Comparing the ‘year-to-April’ data across years, 2022’s high yield issuance looks more like the post-financial crisis period than most years in between.

Data from CreditSights has found euro high yield bond issuance has fallen to the lowest levels seen since 2011, with E0.3 billion issued, compared to 11.8 billion in 2021 and 1 billion in April 2020, a month after the market suffered a massive liquidity shock.

The analyst firm observed that the costs of issuance are likely too high for issuers, with the ‘yield to worst’ ratio for new bonds sitting more than 70% higher than for existing ‘B’ rated bonds, and 100% higher for ‘BB’ rated bonds. Concerns around pricing for a Miller Homes issuance, with a reported ‘underwhelming performance’ in secondary markets will also have worried issuers.

Overall European fixed rate fell below the level issued in December 2021 with Euro investment grade issuance (€23.5 billion) dropping below levels last seen in July 2021, of which 53% was from ‘A’ rated businesses, making up €12.4 billion. Financial firms put in a good turn, with €15.9 billion or 68% of IG issuance.

Only one fixed rate high yield bond was issued, an AT1 bond put out by Banco BPM, which was not index eligible, meaning no index-eligible HY bonds have been issued since February 2022.

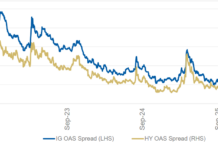

This clearly presents a potential problem in HY liquidity, as investors – and therefore market makers – become increasingly reluctant to carry the risk of taking on HY into a portfolio or on risk. We have seen bid ask spreads expanding over the year to date and with limited visibility on primary market pricing, Euro HY funds could face a liquidity squeeze if there is a big directional move either way.

©Markets Media Europe 2025