Research by The DESK has found that buy-side traders have adopted a range of primary market tools to help them increase their efficiency at processing new bond issues. While competition is typically seen as a force for good in driving innovation, many traders are concerned that there can be no increased efficiency if there are too many ways of connecting to dealers managing new issues.

The problem is considerable, because most buy-side traders see little value in occupying their time as a conduit for order and pricing information. ‘How’ to trade is not a question, there is simply a back and forth between multiple syndicate banks providing varying levels of information to multiple portfolio managers, who need the patchwork of data that has been created to be standardised, and filled-in where gaps exist. Trader perform that important role, but it does not make best use of their talents.

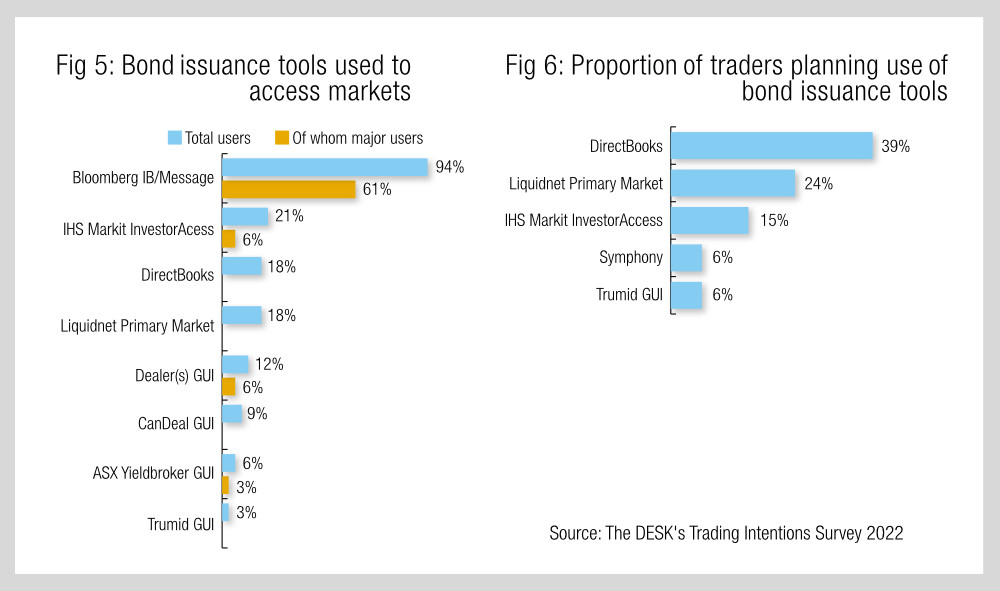

IHS Markit’s longstanding InvestorAccess system has seen solid adoption. Now DirectBooks and Liquidnet are expanding their market share. The existing winner is Bloomberg, as the unstructured communication that currently flows between buy and sells ide is most easily conducted via chat and IB messenger, as well as email and phone.

Either standardised information or interoperability would help to support the use of multiple tools, as potentially would desktop aggregation platforms like OpenFin and Finsemble. DirectBooks has voiced support for interoperability in principle but not affirmative steps to date. IHS Markit and Liquidnet have said they are actively discussing interoperability although not with any named partners.

Looking at The DESK’s experience in researching platform use, the current position is far from bad. When the third generation of electronic bond platforms were launched in 2014-15, many were keenly being adopted. However they did not all live up to their potential and traders have little time to devote to hypotheticals – mainly because so much time is spent managing new issues.

It seems likely that there will be a shakeout of the existing platforms in the near future if function does not follow expected form. Consequently, the number of providers may be reduced, becoming more manageable. For the sake of The DESK’s readers, we hope that offers some relief.

©Markets Media Europe 2025