A new paper published by Gjergji Cici of the University of Kansas, with Philipp Schuster and Franziska Weishaupt, of the University of Stuttgart, has outlined the advantages of employing former trading team members as portfolio managers in fixed income funds.

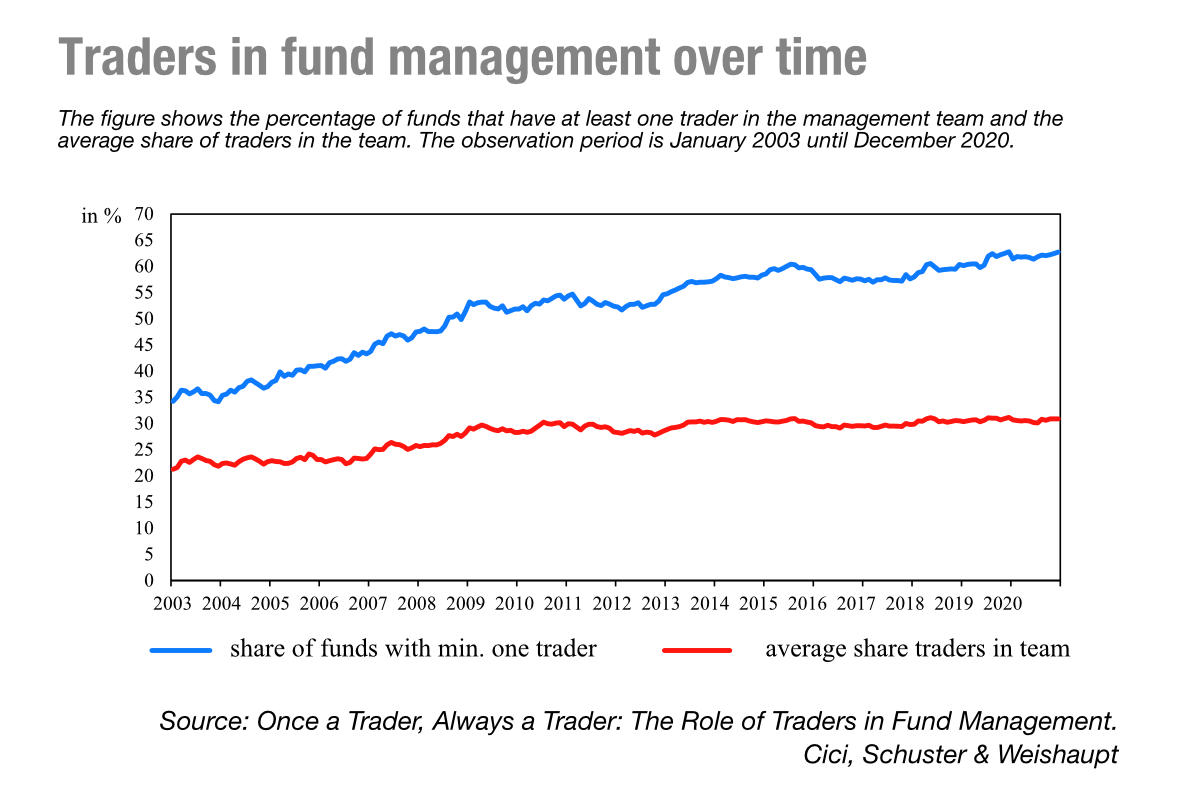

The paper, entitled ‘Once a Trader, Always a Trader: The Role of Traders in Fund Management’ employed manual profiling of corporate bond fund managers to identify those ‘trader managers’ who had followed a trading career path, rather than an analyst career path, into their current job.

“The large fraction of funds that are run by teams of managers makes attribution of fund outcomes to actions of individual managers challenging,” write the authors. “Therefore, we follow two approaches for our comparisons. One approach focuses on single-managed funds. The second approach utilises the entire sample to compare the performance of funds whose management team is dominated by trader managers (trader-dominated funds) against other funds.”

Traders working for traditional investment firms can potentially contribute to alpha, helping end investors by assisting in the structuring and execution of trades in cost-efficient ways. The report also notes that they can contribute beyond transaction cost improvements, providing additional alpha by “identifying and exploiting profitable short-term trading opportunities and providing liquidity.”

The report notes that some fund families such as Pimco have recognised the latter potential contribution of traders and have integrated them in investment teams by giving team members both trading and portfolio management mandates. “These potential contributions notwithstanding, traders are not without their critics, however,” the authors write. “In popular culture, traders are portrayed as dubious personas that operate in a testosterone-fueled environment and take outsized risks, sometimes recklessly.”

“Some evidence from academic research suggests that professional traders exhibit a propensity to take elevated risks and critics have even suggested that professional traders’ risk-taking behaviour contributed to the most recent financial crisis (Adams 2011). In this paper, we use a unique feature from the corporate bond mutual fund sector to study the role of traders in investment management.”

While directly correlating a trader’s contribution to investment management as traders is challenging, for a fund family’s trading desk because of data limitations.

The researchers were able to bypass this limitation by directly looking at bond mutual fund managers and exploiting the fact that their career progression follows two distinct tracks whereby an individual works either as a bond trader or as an analyst before becoming a bond fund manager.

“Thus, many fund families hire former bond traders as fund managers of their corporate bond funds,” the authors write. “This feature allows us to study the performance, portfolio characteristics, and actions of traders when they work as corporate bond mutual fund managers (hereafter, trader managers). Following this approach and comparing this group of fund managers with the more traditional fund managers that did not follow a trading career path, we can shed light on the role of traders in investment management.”

The corporate bond setting – fragmented, more illiquid than equities, and lacking in pre-trade transparency — is ideal for this analysis because trading is far more complex in the corporate bond market than in the equity market. Additionally, recent regulatory changes have led to reduced dealer inventories pushing dealers toward a market matching as opposed to a traditional market making role. “This suggests that traders potentially play a bigger role in the investment management of corporate bond funds,” the authors note.

They hypothesise that, relative to non-trader managers, trader managers benefit from an ability to process and act quickly on new short-lived information that enables them to take advantage of short-term profitable trading opportunities. “We refer to this hypothesised ability as “agile reaction” ability. Such ability could arise because of selection, meaning that individuals with the ability to think and act quickly in fast-changing conditions are more likely to be hired for trading jobs.”

Trader managers may also possess another advantage that complements their hypothesised agile reaction ability – the ability to trade at lower transaction costs because of their trading experience and trading relationships they developed as former traders. “These two advantages, agile reaction and trading cost advantage, are likely to interact in that the ability to generate lower transaction costs would better position trader managers to take advantage of short-term trading opportunities, thus amplifying the gains from their agile reaction ability,” the authors suggest.

To test their theories the researchers focused on single-managed funds as well as those managed by teams of managers. The second approach utilises the entire sample to compare the performance of funds whose management team is dominated by trader managers (trader-dominated funds) against other funds.

To measure the combined return contribution of a trader manager’s interim trading activities due to the manager’s agile reaction ability and the manager’s ability to generate lower trading costs, the authors employed the return gap measure, which is the difference between the reported fund return and the holdings-based return of the fund’s most recently disclosed portfolio.

“We document that trader-dominated funds generate higher return gaps than other funds,” they write. “This result holds for both sets of comparisons that employ either only single-managed funds or all funds.”

However, the return gap difference is almost twice as large for the comparison based on single-managed funds, where the attribution of manager skills to fund outcomes is more precise. Specifically, the monthly return gap difference between trader-dominated funds and other funds is 3.82 bps per month for the comparison based on single-managed funds and 2.34 bps for the comparison based on all funds.

“These differences are statistically significant,” they note. “They are also economically significant given that the return gap for the average sample fund is -0.63 bps,” the authors noted.

In the next group of tests, the researchers confirmed the presence of each hypothesised ability among trader managers, using trades inferred from changes in portfolio holdings for a given fund that we match to actual customer trades in TRACE happening in the same direction and with the same size.

“We use those trades to compute unit transaction costs for each trade, which we then use to compute a value-weighted transaction cost measure per fund and month. We document that trader-dominated funds generate significantly lower transaction costs than other funds. This trading cost difference between the two groups is economically significant, ranging between 25% to 56% of the trading cost of the average sample fund.”

Other tests revealed that trader-dominated funds generate even greater return gaps compared to other funds during periods of market stress, when market illiquidity is more pronounced or when there are large interest rate fluctuations.

“This is consistent with trader managers benefitting even more from processing and acting quickly on short-lived information during periods of market stress, when there are more short-term profitable trading opportunities to exploit,” they write.

The findings are also consistent with trader managers enjoying greater trading costs advantages during periods of market stress when trading costs are typically higher.

“However, the widening of the return gap difference between trader-dominated funds and other funds during illiquid market periods is not accompanied by a similar effect for the transaction cost difference between the two groups, suggesting that during periods of market illiquidity, the agile reaction ability of trader managers plays a more prominent role than the trading cost advantage.”

Notably, both the return gap difference and the trading cost difference of trader-dominated funds vs. other funds become stronger during periods of large interest rate fluctuations. The trading cost advantage of trader managers during such periods is consistent with trader managers paying less for trade immediacy when most bond fund managers must reposition their portfolios in response to large changes in interest rates.

“This advantage is most likely coming from stronger relationships that trader managers have developed with larger dealers that enjoy central positions in dealer networks and charge their customers less for providing trade immediacy,” they write.

It is unclear whether the advantages documented for the trader managers translate into superior performance, the researchers noted.

“We document that over the entire sample period funds dominated by trader managers exhibit similar risk-adjusted returns as other funds. This suggests that, overall, these advantages are not large enough to generate a clear performance advantage for the trader managers. Nonetheless, trader managers can generate better performance during periods of larger fluctuations in interest rates.”

As such, the researchers concluded that the agile reaction ability and trading cost advantage of trader managers translate into performance advantages for these managers but only during periods of high interest rate fluctuations.

Whether the opportunistic trading activities of trader managers correspond to higher risk-taking by these managers, the research considered how trader managers might resemble the typical trader stereotype characterised by a high appetite for risk-taking or they could have been selected simply because of their ability to handle risk better given their aptitude to operate in fast-moving markets. “Therefore, whether trader managers exhibit more or less risk-taking propensity than other managers is an empirical question.”

To assess differences in risk-taking between the two groups of managers, the researchers looked at the reaching-for-yield (RFY) measure i.e., reaching-for-maturity and reaching-for-rating, and compared them between trader-dominated funds and other funds.

“Our results show that, on average, trader-dominated funds do not engage in overall RFY that is different from other funds. However, during periods of high illiquidity in the market or sudden extreme changes in interest rates, trader-dominated funds exhibit a significantly lower RFY compared to other funds, primarily due to trader managers reducing their exposure to lower credit quality bonds.”

Taken together with the evidence of higher return gaps produced by trader managers during such periods, the research suggests an ability by trader managers to benefit from exploiting profitable trading opportunities in periods of market stress while at the same time de-risking their portfolios.

“Interestingly, we find some evidence that trader-dominated funds tilt their portfolios toward bonds with longer maturities, which is consistent with an intent to capture the maturity risk premium. They do so, however, while managing interest rate risk proficiently because they construct bond portfolios with a higher level of convexity than other funds. Overall, these results portray trader managers as cautious risk takers, who do not shy away from exploiting opportunities in periods of market stress, but they do so in a measured way that keeps their portfolio risk in check.”

©Markets Media Europe 2024

©Markets Media Europe 2025