Inclusion in one major index could see Indian markets boost investment and liquidity, with more in January 2025.

Inclusion in one major index could see Indian markets boost investment and liquidity, with more in January 2025.

Following the victory of the BJP in India’s general election in April, the country’s bond markets are also set for a victory, with JP Morgan Asset Management announcing in September 2023 that Indian Government Bonds (IGBs) would be included in its Government Bond Index-Emerging Markets (GBI-EM) from June 2024.

In March 2024 Bloomberg then announced the inclusion of India Fully Accessible Route (FAR) bonds in the Bloomberg Emerging Market (EM) Local Currency Government Index and related indices, to be phased in over a ten-month period, starting 31 January 2025.

“The inclusion of India government bonds in the JP Morgan Index was announced in September last year and will commence in June 2024, at 1% monthly increment to a weightage of 10%,” says Cathy Gibson, global head of trading at Ninety One, an asset manager with £126 billion in assets under management. “There have been more than US$8 billion of inflows since the announcement via Freely Accessible Route (FAR). FAR is the pathway which has been set up to allow for foreign investors in the region and to open India for inclusion in the index.”

Inclusion of Indian debt on the FTSE Emerging Markets Government Bond Index (EMGBI) has been deferred. The country was added to the watch list of the index in March 2021, following and despite FTSE Russell finding improvement to market operations, with progress in the accessibility of the government bond market since its previous review, the firm found the country’s increased regulatory reporting, inflexible settlement cycle length, tax clearance process and lack of documentary requirements to fulfil the Foreign Portfolio Investor registration were all still an issue.

“FTSE Russell intends to continue its valuable dialogue with the Reserve Bank of India and welcomes feedback from an expanding cohort of international investors entering

the Indian government bond market on the practicalities of their investment experience,” the company concluded.

Buy-side traders also noted that their engagement in India’s market would not change overnight, but was more likely to evolve as bonds increased in accessibility and liquidity profile.

Buy-side traders also noted that their engagement in India’s market would not change overnight, but was more likely to evolve as bonds increased in accessibility and liquidity profile.

“We mainly use supranationals to gain exposure currently, and we won’t immediately trade out of any positions due to the trading costs; we’re likely to let those positions roll out,” noted one. “It is not a market structural shift like China’s opening of [electronic trading system] BondConnect.”

Positive sentiment

Bond traders are nevertheless expecting a further boost to liquidity, lower spreads on bonds and boosted debt engagement more generally as the effects of indexing are felt from September onwards.

“Over the 10 months of inclusion, it is estimated that there will be between US$20-30 billion of inflows,” says Gibson. “This is a significant inflow and will gradually bring down yields on local currency government bonds and be supportive of the rupee. In time, this will have a knock-on impact for corporates as borrowing levels are linked. India is a large market and there is no indication that the local market will not be able to absorb the flow, given government debt of $3 trillion.”

There are mixed feelings about the value proposition from some investors. Morgan Stanley analysts, Min Dai and Gek Teng Khoo, noted in Q1 that on a trip to London, investors often told them, “I love the story in India but I hate the asset price.”

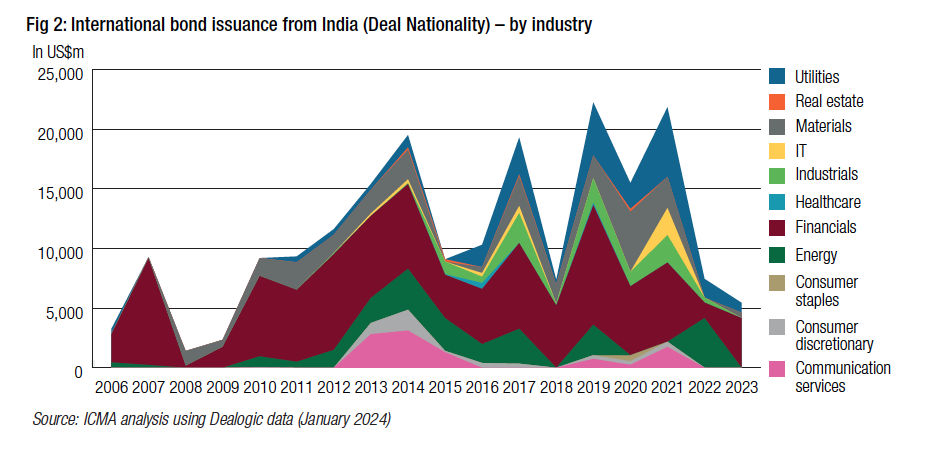

A 2024 report by the International Capital Markets Association (ICMA), authored by Alex Tsang, Mushtaq Kapasi and Andy Hill, noted that prior to 2011 banks and a small number of corporate issuers from India tapped the international bond markets but, in that year, SOEs and quasi-government entities began using international bond markets to raise funds. “Issuance volume of international bonds from Indian issuers reached almost US$20 billion in 2017, then the volume dropped significantly in 2018 to about US$7 billion driven largely by domestic market credit events,” wrote Tsang, Kapasi and Hill. “However, issuance activities rebounded significantly in the following year with issuance volume reaching a recent high of US$22 billion since 2006 and remained above US$15 billion for two more years. Issuance volume subsequently declined to a 14-year low at about US$5 billion in 2023.”

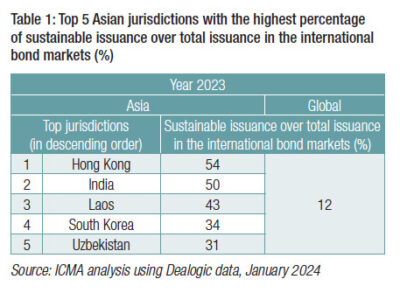

As the cost of hedging dollar issuance into rupees was higher than domestic borrowing, the value of using internal markets was limited. “Financial institutions were the dominant Indian issuers of international bonds and contributed 76% of total issuance volume in 2023,” noted the ICMA team. “This was in contrast with 2022, in which energy companies accounted for more than half of total issuance volume, followed by financial companies which contributed about 18% of total issuance volume.” With 50% of issuance in India classified as sustainable, the second highest in the region, ICMA found the determining factors for issuing domestically or internationally were funding costs, currency-matching in terms of the use of proceeds and profile-building purposes.

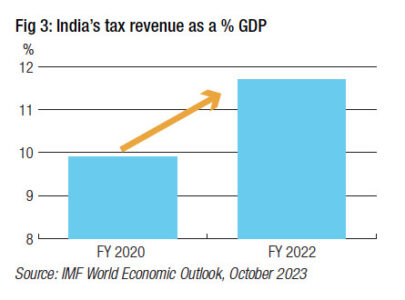

“With rising tax revenues, the government has been able to support green investments and amplify its focus on investment in information technology hardware,” wrote the Franklin Templeton Emerging Markets Equity team, in March 2024. “Looking ahead, a reduced dependence on fossil fuel for power generation and a focus on value-added manufacturing for export could result in a currency account surplus, putting appreciating pressure on the INR/USD exchange rate. While import costs would be reduced in this scenario, if India successfully executes its supply side policies, in particular education reform, we believe the country should be able to compete internationally and not rely on a weaker exchange rate.”

“With rising tax revenues, the government has been able to support green investments and amplify its focus on investment in information technology hardware,” wrote the Franklin Templeton Emerging Markets Equity team, in March 2024. “Looking ahead, a reduced dependence on fossil fuel for power generation and a focus on value-added manufacturing for export could result in a currency account surplus, putting appreciating pressure on the INR/USD exchange rate. While import costs would be reduced in this scenario, if India successfully executes its supply side policies, in particular education reform, we believe the country should be able to compete internationally and not rely on a weaker exchange rate.”

Overcoming disappointment

Despite the setback with FTSE Russell, the inclusion of Indian debt in other indices is expected to drive up investor appetite, with Morgan Stanley’s analysis showing that in government securities, investors are embracing the upcoming index inclusion.

“This is seen in the US$9 billion of inflows to G-Secs since last September,” write Min Dai and Gek Teng Khoo, “Most investors would like to own G-Secs as a core position upon inclusion and have 20-30% of their positions in supranational issuances.”

ICMA analysis suggests that if the US sees lower US yields, more Asian corporates could return to the international market from China, India and Korea.

“Furthermore, it is hoped that international investors who were burned in recent years by the heightened volatility will slowly return to the market, particularly as increased supply helps to take some of the tightness out of the secondary market, so offering better value,” write Tsang, Kapasi and Hill.

Franklin Templeton observed that without changes in policy following the BJP victory, Prime Minister Modi has a mandate for change which should be broadly positive for investors. Executing his economic priorities will be the greatest risk, for example as a result of an appreciating exchange rate. “In our view, any future exchange rate appreciation is likely to be gradual, so policymakers can liberalise the capital account in stages to manage the upside,” the firm writes.

©Markets Media Europe 2024

©Markets Media Europe 2025