Who is kicking up a fuss about US government bonds?

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux in the US Treasury market’ has outlined the challenges banks face when intermediating the US Treasury market.

Did Coalition Greenwich talk about this recently?

Kevin McPartland of Coalition Greenwich noted that when the US got downgraded by Fitch recently, it sparked huge volumes of trading activity, which were on a par with then record volumes following the 2011 downgrade by S&P; however, he observed that the size of US debt outstanding has doubled in the intervening period, which meant they were dwarfed relative to outstanding notional.

What does Duffie say?

Since 2007, he notes that the total size of primary dealer balance sheets per dollar of US Treasuries outstanding “has shrunk by a factor of nearly four”, which combined with the above statement starts to paint an ‘interesting’ picture…

So the supermarket checkout is now a cornershop counter, but its backroom stock is the size of a megastore?

Yeah pretty much.

So what does mean in real terms for the market?

There is a real risk that intermediation breaks down – so trading cannot happen in the size it needs to as firms try and move risk – which Duffie flags as potentially resulting in losses of market efficiency, higher costs for financing US deficits, potential losses of financial stability, and a reduced save-haven services to investors.

Sounds bad. Any reason to think it might happen?

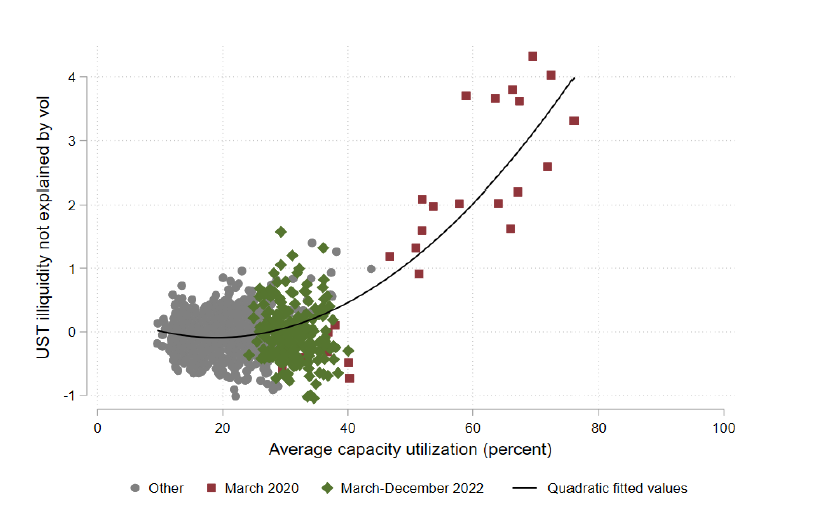

Already did! March 2020, when he says directional selling form customers meant dealer bond inventories hit 10 times normal sizes because they couldn’t shift the bonds they were having to buy, and bid-ask spreads for dealer-to-client (D2C) trading increased by 10 times, while the interdealer (D2D) market shut up shop.

Could that happen again?

It might even get worse. He’s spotted that dealer capacity (Fig 1) has an outsized effect on illiquidity when there is a crisis i.e. a lot of directional selling. He also notes that says that the quantity of Treasury securities that could need trading in a crisis in a crisis is growing far more rapidly than the size of dealer balance sheets, for example, the US Congressional Budget Office projecting total Treasury security debt will rise from 98% of US gross domestic product (GDP) in 2023 to 177% of GDP in 2052, far above the previous peak of 106% of GDP in 1946. Yet between 2010 to 2022, the ratio of total primary-dealer assets to GDP fell by 18.5%.

So everything is going the wrong way?

Yes!

What can we do?

He advocates asset purchasing programmes, central clearing which would reduce settlement commitments, and all-to-all trading which he notes “could significantly increase the intermediation capacity of the market.”

©Markets Media Europe 2023

©Markets Media Europe 2025