The bid-ask spreads in credit trading across the Europe and US have fallen dramatically in the first three weeks of 2024, relative to the same period in 2023, without a notable change in trade sizes.

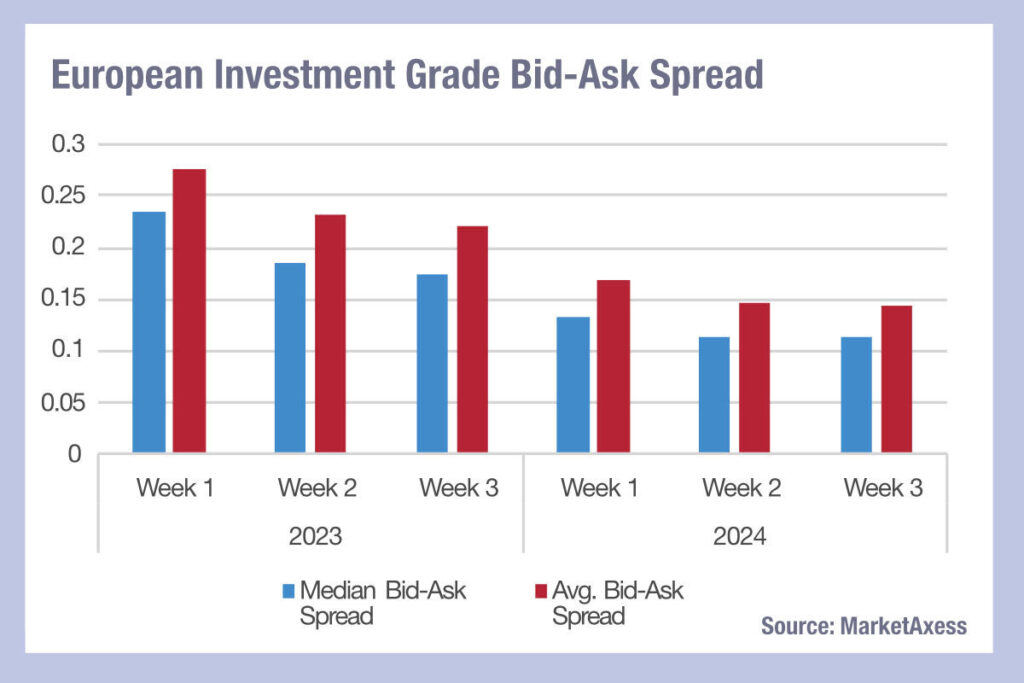

Measured in price from MarketAxess’s CP+ pricing service, these indicate that the median bid-ask spreads were 43% lower in Week 1 year-on-year (YoY), 40% lower in Week 2 and 36% lower in Week 3.

Measured in price from MarketAxess’s CP+ pricing service, these indicate that the median bid-ask spreads were 43% lower in Week 1 year-on-year (YoY), 40% lower in Week 2 and 36% lower in Week 3.

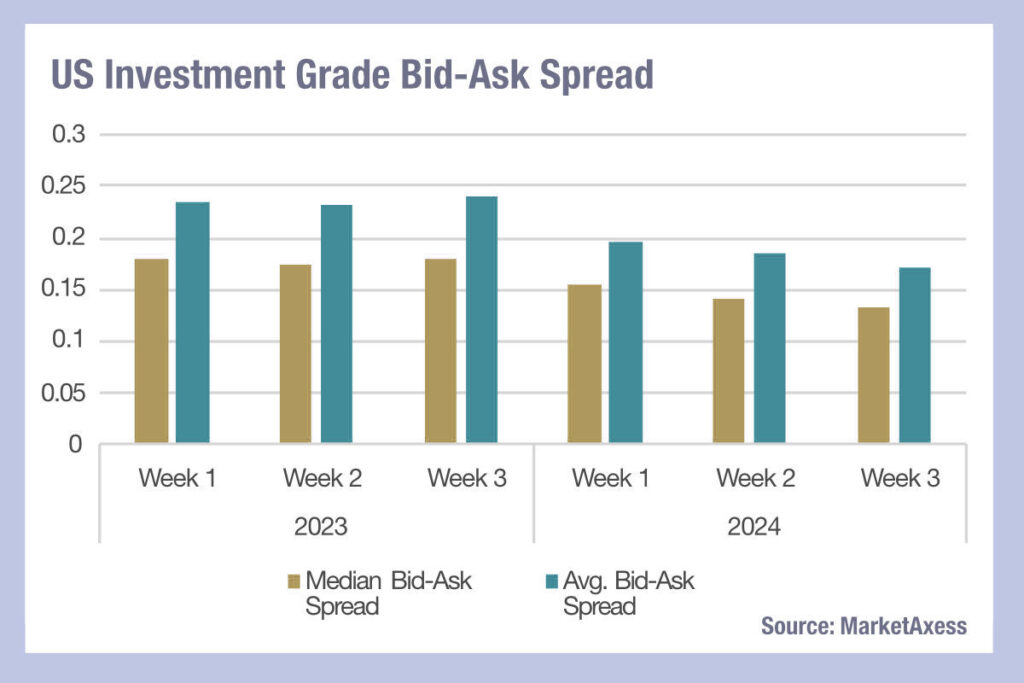

In US investment grade credit the drop was 15% in Week 1, 20% in Week 2 and 27% in Week 3. The differences between the two are interesting. European credit markets overtook US markets last year for the proportion of trading conducted electronically, with Barclays research estimating it to be over 50% of IG trading, against 40%+ in US markets based on Coalition Greenwich research.

In US investment grade credit the drop was 15% in Week 1, 20% in Week 2 and 27% in Week 3. The differences between the two are interesting. European credit markets overtook US markets last year for the proportion of trading conducted electronically, with Barclays research estimating it to be over 50% of IG trading, against 40%+ in US markets based on Coalition Greenwich research.

We also see that the average trade size in the US is smaller than in Europe, with IG trades ranging between €550k and €700k, according to data from MarketAxess’s Trax which aggregates data from across multiple markets, while US IG average trade size sits between US$350k to US$395k according to TRACE data published by FINRA in the US. Neither investment grade nor high yield trade sizes have changed significantly since the first three weeks of 2023.

Curiously, European high yield trade sizes are on a par with European investment grade trades over this three week period in 2024, while US markets have IG trades of around 2/3rds the size of HY trades. That suggests the electronification of European markets may be driving down liquidity costs based on a dynamic that is not trade size dependent.

Buy-side traders may find this is an element of their own trading that warrants further investigation via analysis of market data sources, including either via transaction cost or execution quality analysis. Where bid-ask spreads have fallen so far over the year, without a relative fall in trade sizes, clearly something is working in the favour of the buy-side desk.

©Markets Media Europe 2024