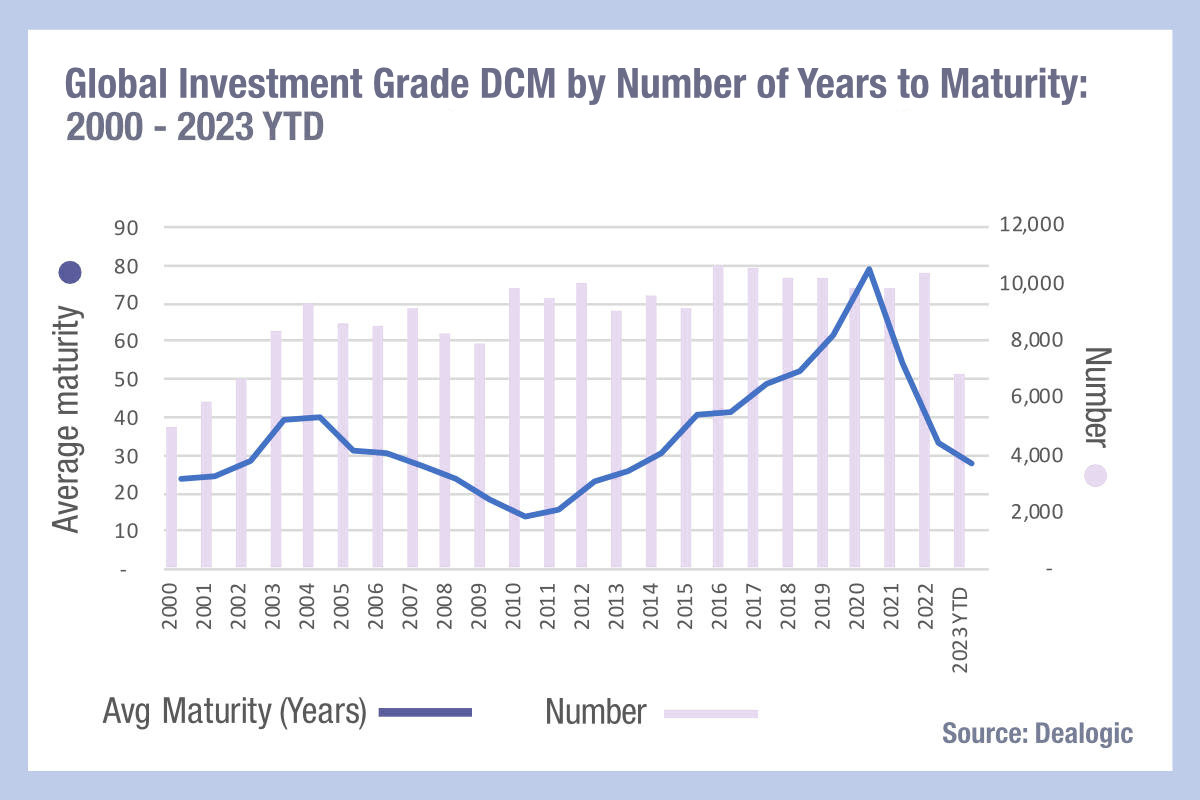

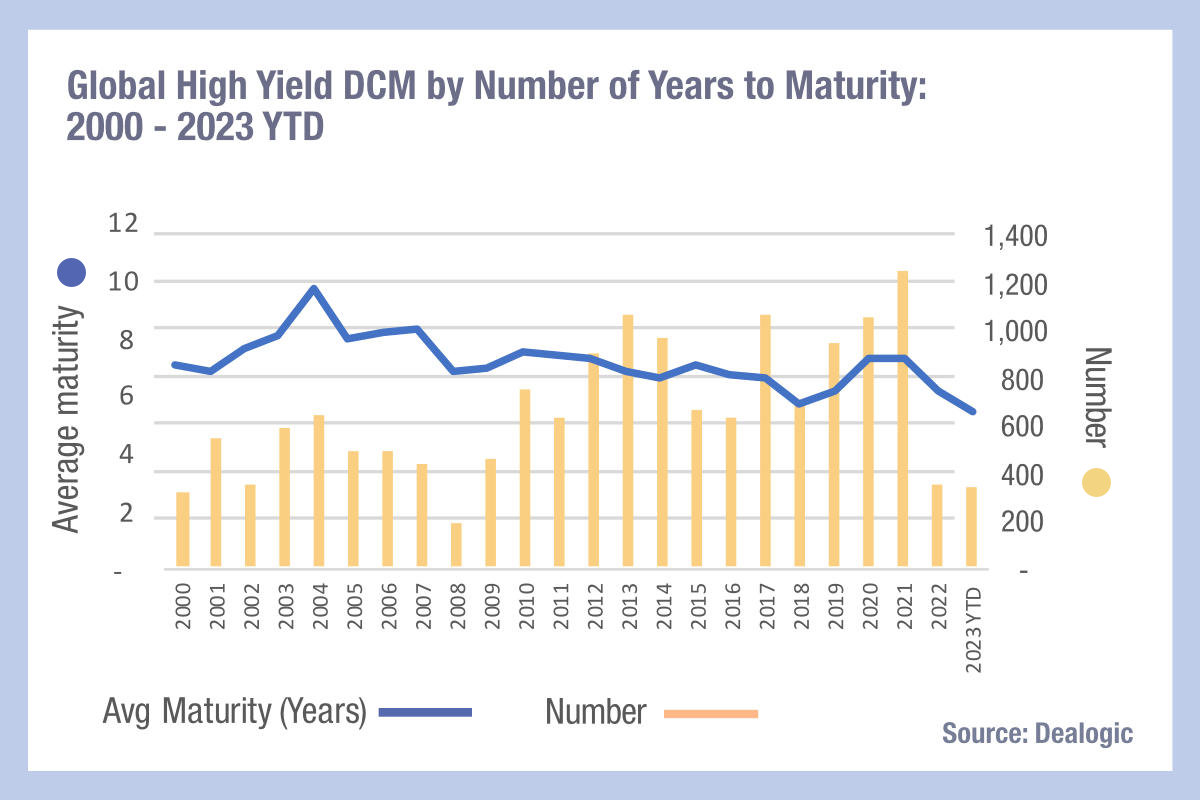

Data from Dealogic shows that the average maturity for newly issued bonds has been falling in 2023 relative to recent years, with the current level representing a 23-low for high yield and a 10-year low for investment grade.

Looking at such a big picture may lack nuance. The base rates for new issues are very different globally and one would expect higher rates to drive the issuance of shorter tenor bonds. Yet we also know that electronic trading tends to favour two types of tickets; those of a smaller size and those with shorter-dated bonds.

The current interest rate picture, and uncertainty around future changes, reduces the likelihood of directionality in the market outside of any event, as the combined needs for hedging and differently opinionated portfolio managers push and pull at positions. We have seen that trade count is increasing in certain markets, indicating more tickets if not more notional is being traded, and ticket sizes are gradually decreasing.

Net-net this indicates that the latter half of 2023 is ripe for the growth of electronic trading, driven by the accessibility of trading smaller sized tickets, of shorter duration bonds. Very exciting times could be in store for electronic bond trading.

©Markets Media Europe 2023

©Markets Media Europe 2025