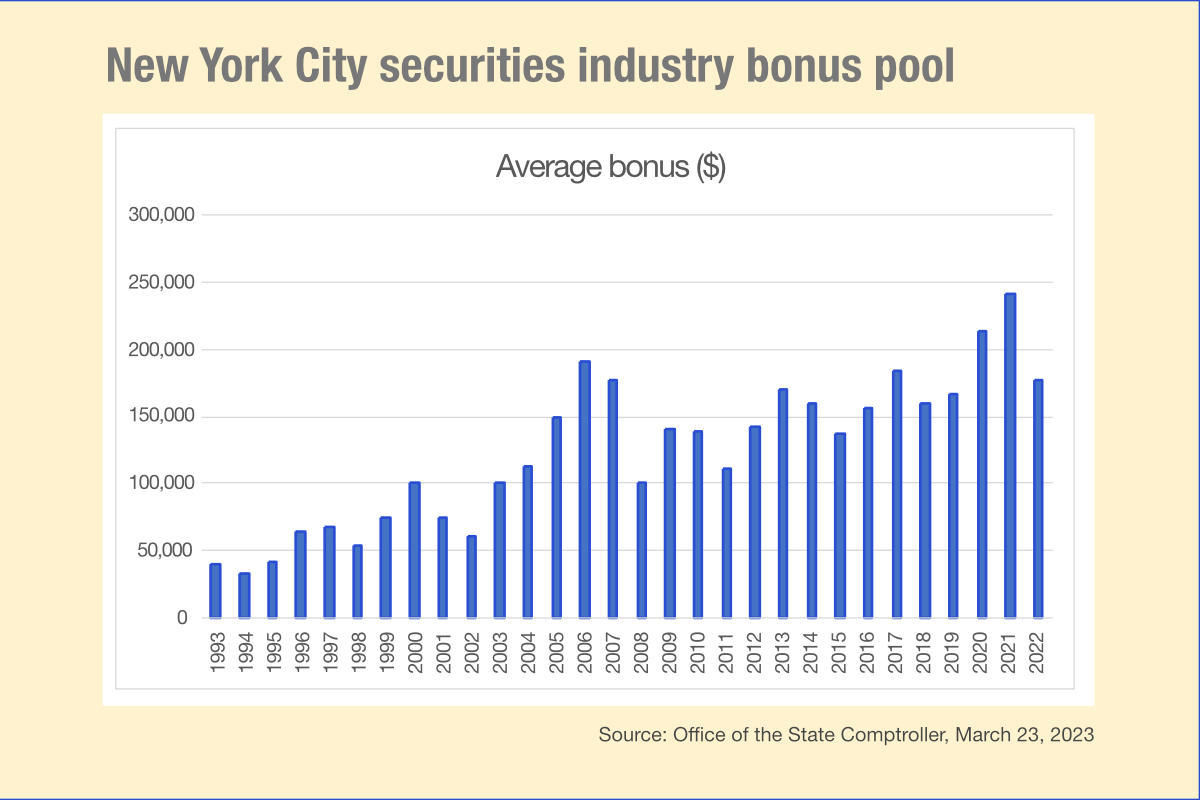

Wall Street’s 2022 average bonus paid to securities employees dropped to $176,700, a 26% decline from the previous year’s $240,400, according to New York State Comptroller Thomas P. DiNapoli’s annual estimate.

Rising interest rates and fear of a recession led to significantly less profits on Wall Street after a record year in 2021. As a result, bonuses returned to pre-pandemic levels, which will mean a decline in related income tax revenue, as anticipated by New York state and the city.

“Wall Street’s cash bonuses were expected to fall as several factors weighed on the securities’ industry profitability in 2022,” DiNapoli said. “A 26% decline brings the average bonus closer to what financial employees received prior to the pandemic. While lower bonuses affect income tax revenues for the state and city, our economic recovery does not depend solely on Wall Street. Employment in leisure and hospitality, retail, restaurants and construction must continue to improve for the city and state to fully recover.”

The $33.7 billion bonus pool for 2022 was 21% lower than the previous year’s record of $42.7 billion — the largest drop since the Great Recession. The fall to pre-pandemic levels mostly reverses the pool’s dramatic growth of 25% in 2020 and 15% in 2021. In 2022, Wall Street’s pretax profits fell 56% from the previous year due to deep declines in investment-banking fees, which were driven by the Federal Reserve’s interest-rate hikes, inflation, and Russia’s invasion of Ukraine.

Wall Street bonuses have a significant impact on tax revenue in the state and city budgets. DiNapoli estimates that the securities industry accounted for approximately $22.9 billion in state tax revenue, or 22% of the state’s tax collections, for State Fiscal Year (SFY) 2021-22, and $5.4 billion in city tax revenue, 8% of total tax collections for City Fiscal Year (CFY) 2022.

In 2021, bonuses drove income tax gains of $282 million for the state and $128 million for the city compared to the prior year. DiNapoli projects the 2022 bonuses in New York City’s securities industry will generate $457 million less in state income tax revenue and $208 million less for the city when compared to the previous year. However, the state and city anticipated these significant declines, minimizing a fiscal shock to their budgets in the short-term. The Governor’s proposed budget assumed bonuses in the broader finance and insurance sector would decrease by 25.2% in SFY 2022-23, while the CFY 2023 financial plan assumed a decrease of 35.6% for the securities industry.

The securities industry also has a significant impact on the city’s employment and overall economy. In 2022, the sector employed about 190,800 people, the highest level in more than two decades. DiNapoli estimates that 1 in 11 jobs in the city is either directly or indirectly associated with the securities industry. While the city remains the capital of the U.S. securities industry, its share of jobs has been declining over time as large firms have left the city. Sector employment in 2022 was 5.1% lower than in 2000, which represented the peak for securities employment in the city.

More securities employees are back in the office, which contributes to increased spending in the city and subway ridership. Financial services firms reported 59% of employees were in the office on a given day in January 2023, compared to 52% for all firms in the city, according to the Partnership for New York City’s survey. Additionally, 43% of securities employees ride the subway, a higher rate than the citywide average for workers. DiNapoli estimates Wall Street was responsible for 16% of all economic activity in the city in 2021, and thus the financial sector’s ability to generate revenue and turn profit is critically important to New York.

Methodology

DiNapoli’s office releases an annual estimate of bonuses paid during the traditional December through March bonus season to securities industry employees who work in New York City. Bonuses paid by firms to their employees located outside of New York City, whether in domestic or international locations, are not included. The Comptroller’s 2022 estimate is based on personal income tax withholding trends and includes cash bonuses paid for work performed in 2022 and bonuses deferred from prior years that have been cashed in. The estimate does not include stock options or other forms of deferred compensation for which taxes have not been withheld.

©Markets Media Europe 2023

©Markets Media Europe 2025