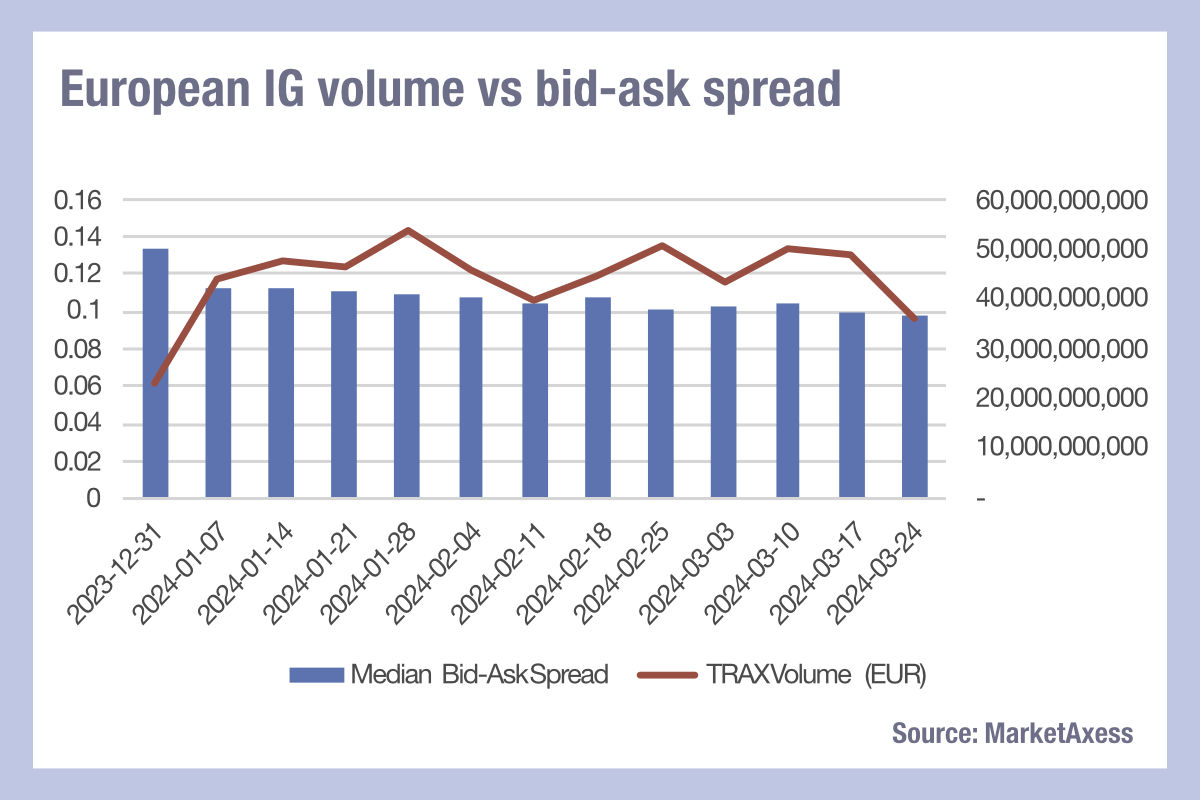

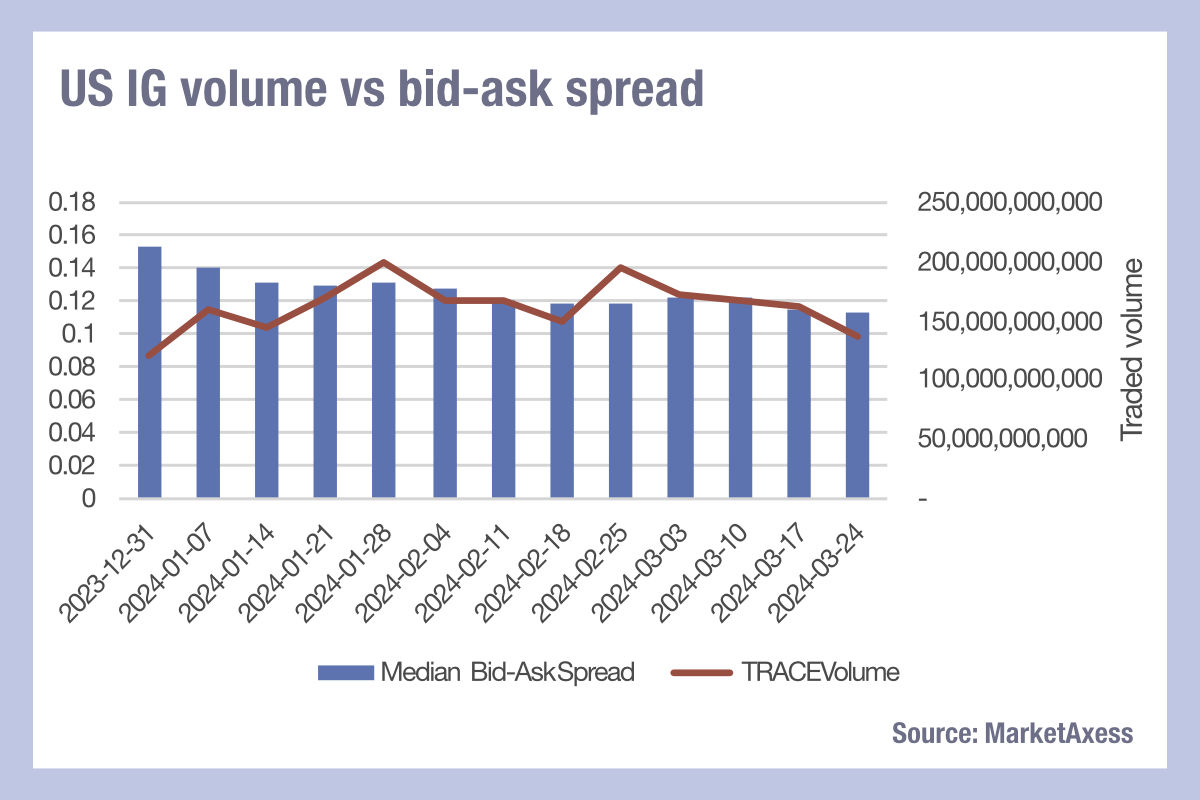

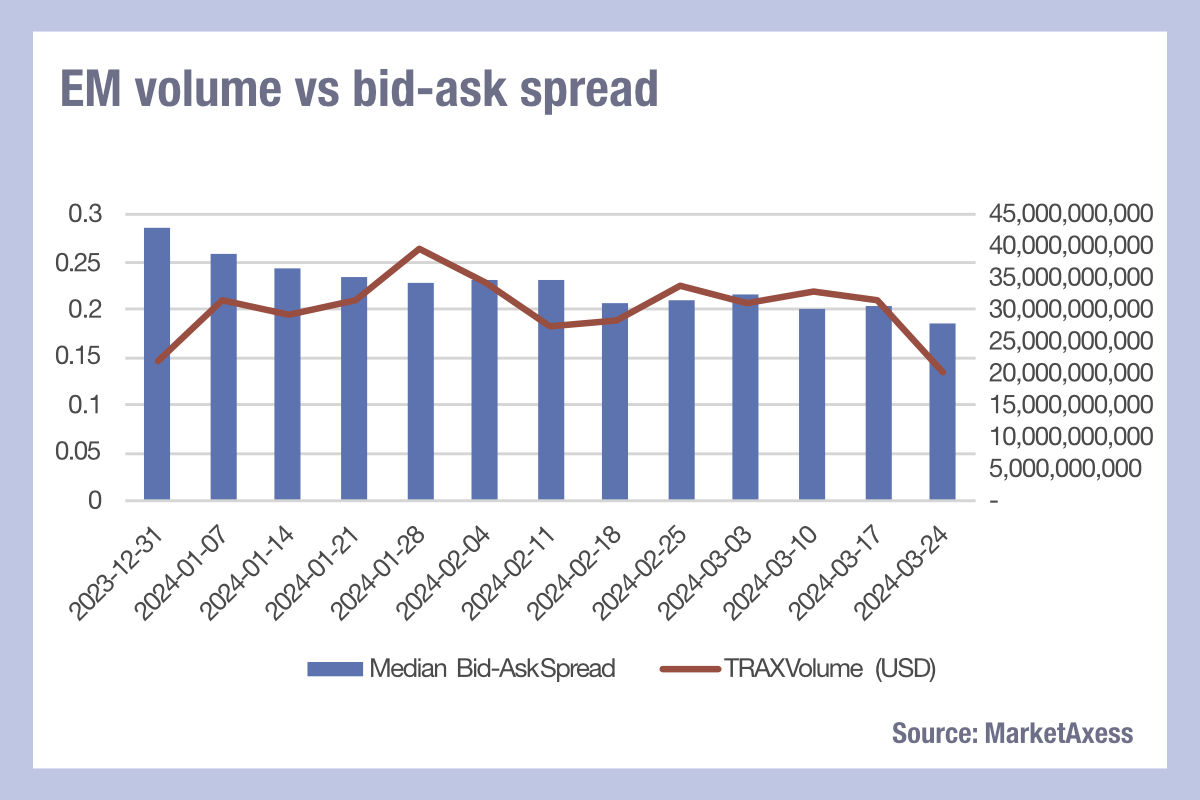

A broad decline of trading volumes across European & US corporate bond and emerging market debt trading coincided with end of the first quarter of the year, according to data from MarketAxess’s TraX, which follows activity in multiple fixed income markets.

In part, this decline reflects the two short weeks resulting from the Easter and Passover holidays. It also follows a period of high activity, with electronic trading platforms reporting many record highs in Q1, and record primary market activity, with huge numbers of bonds being issued.

At the same time, the bid-ask spread across most bond markets has continued to fall. This suggests that the cost of liquidity has fallen for buy-side traders despite an apparent decline in activity, based on trade count and volume.

Several reasons may exist for this. Firstly, electronic trading is driving down the cost of liquidity by increasing the support for low cost, automated trading. Secondly, dealers have seen revenues in fixed income trading rise, allowing them to better support risk trading using their balance sheets. It may be that this has been sustained despite declining volumes due to the holiday period. If so, we might expect spreads to widen if volumes continue to stay low.

Finally, positive inflows into bond funds may be allowing dealers some support by giving a predictable direction in trading, and securing their capacity to offload bonds where needed, supporting effective market making.

©Markets Media Europe 2024

©Markets Media Europe 2025