E-trading levels are remaining steady in the US Treasury market, hovering at 58% of notional volume in February.

Ratios have returned to pre-election levels, Coalition Greenwich reported, with the market share of platform providers and protocol types holding strong. As in January, request-for-quote (RFQ) claimed 24% of e-trading volumes.

Coalition Greenwich noted that streaming is an increasingly popular mechanism for rates market participants. Although ‘pure’ streaming may only account for an estimated 9% of volumes, the method often ties into other strategies, it explained.

“Walling off streaming volumes from other execution methods is increasingly complex, as RFQs can result in executing via a stream with a better price than the RFQ respondents and aggregated streams that are consumed by liquidity takers as a central limit order book,” it said.

Voice trading continues to be a crucial part of the market, particularly for off-the-runs and large trades. Smaller firms are also significant contributors to volumes here. Coalition Greenwich expects high volumes to remain, but predicts higher automation adoption to reduce manual entry and improve efficiency in the space.

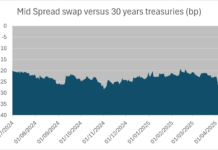

Overall volumes were up over the month, while volatility fell by a double-digit percentage. Bond issuance was up 7% on last January amid monetary and fiscal policy adjustments in the Trump administration.

©Markets Media Europe 2025