The success of automated trading in bond markets is both persistent and consistent, says Andrew Cameron, director of trade automation at MarketAxess.

Automation technologies are omnipresent in the electronics we all carry, from smartphones to PCs to watches. MarketAxess has developed a suite of automated execution tools to support the move from voice to electronic trading. Starting in 2018, MarketAxess launched Auto-X which reduces time needed to make trading decisions, costs of trading all while increasing efficiency.

The DESK spoke with Andrew Cameron, director of trade automation at MarketAxess and a veteran of buy-side technology development about the goals and achievement already clocked up by these tools.

What effect have you seen automation tools having on trading desks’ capabilities?

Our data shows that clients who have adopted automation into their trading toolkits have grown capacity at faster rates than clients who have not adopted any automation, especially through times of volatility, where our clients have counted on our automation technologies to manage risks, establish guardrails, streamline processes, remain compliant, and improve execution quality. Clients who are adopting some degree of automation are scaling more efficiently compared to those who have not adopted automation into their trading toolkits. Enquiries from client to one or more dealers get an algo response 57% of the time for orders of >US$5 million and that increases as the order size is reduced to 95% for orders <US$1 million.

How did that hold up during choppy market conditions over recent years?

During three recent periods of volatility – March 2020 during the onset of the Covid pandemic, March 2022 during the Russian invasion of Ukraine, and March 2023 during the collapse of Silicon Valley Bank and Credit Suisse – automation on the MarketAxess platform sustained new levels of adoption and trade volume on Auto-X. The average percentage of Auto-X orders getting algo responses during the banking crisis was 89.8%. Not only has the number of active clients increased, but usage rates have also increased for high grade, and on a global scale.

What does a highly automated trading model look like?

As clients have become more familiar and comfortable with automation, rates of ‘no touch’ order submission have gone up. During Covid, the average no touch rate stood at 7%, and during the recent banking crisis, the average no touch rate increased to 36% showing that clients are willing to do more work up front to set trade parameters, reducing clicks and ultimately becoming more efficient within the platform. Hit rates have also increased for high grade bonds. Think of hit rates like the performance metric of Auto-X. More clients are meeting their criteria and can execute successfully via their unique set of parameters – where we now offer up to 30 customised variables. The Auto-X hit rate during the Ukraine crisis was 94%, and 93% this during the SVB and CS collapses.

Have risk management measure adapted to handle automated trading?

If those parameters set by the client aren’t met – for example if a trade doesn’t match the pre-set size, level, side, etc – MarketAxess has set up certain guardrails, called ‘overrides’, so that clients always have the option to step in and manually manage an order. During volatile periods, overrides are essential because they allow users the option to move forward with a trade, despite not meeting the designated criteria. At the height of Covid, which was an extremely volatile period, override rates hovered at 50%, which matched expectations in what was the first true market shock in the fixed income automation era. More recently, clients have garnered more control and comfort and during the SVB/CS collapses, override rates sat at 21%, showing that during extreme volatility, users can remain in control of their executions. Many clients consider Auto-X RFQ an extension of list trading, with its capabilities able to provide optimal execution results.

What has been the uptake of these tools and how rapidly is that changing?

What has been the uptake of these tools and how rapidly is that changing?

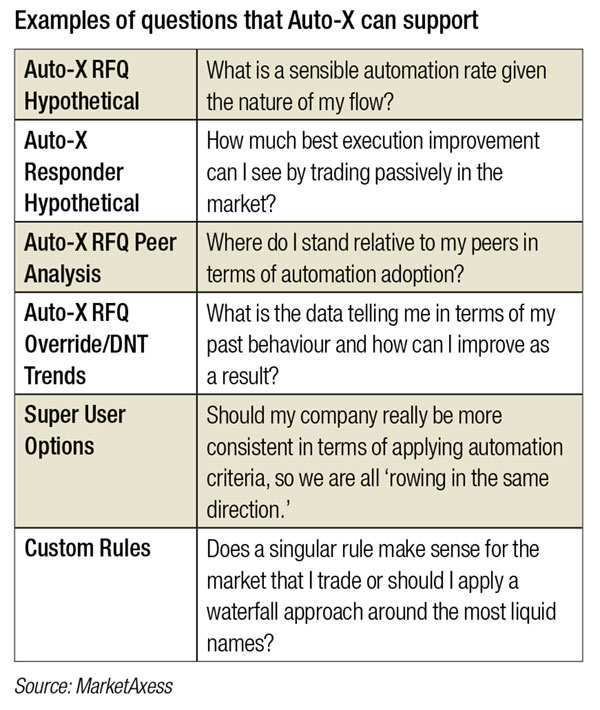

From the beginning of the Covid pandemic to this year’s banking crisis, active users grew from 75 127 and the value traded more than doubled from US$6.8 billion to US$14.3 billion. As with most new and cutting-edge technologies, the earliest adopters see the greatest gains. As our clients turn to automation and become more comfortable with these protocols, we are expanding our toolkit to include more specific trade execution options and answer specific questions around trade strategy.

Is there a quantifiable way to assess performance in 2023?

Nearly every measurable Auto-X RFQ instance in the first quarter of 2023 has been a record – from average daily volume to the rate of no touch. Nearly four million trades and US$718 billion in volume has been executed since its introduction to the market, and more than 780 active traders across 198 clients have used Auto-X. We are on-track for yet another record year in our automation suite of products, and the number of traders using the product is growing along with it. For these traders, automation is becoming an extension of the traders’ desk and an integral part of the trading process. The clear and present need for automation is here.

What are the next steps in the automation journey?

Our automation trading suite will continue to evolve to meet the growing needs of our users. The MarketAxess team is learning along with our clients as they increasingly get more comfortable with our offerings. Our data shows that both buy- and sell-side clients are using our automation products at a similar rate and they’re all equally accepting of trading more risk during volatility.

©Markets Media Europe 2023

©Markets Media Europe 2025