Michael Richter, an executive director at S&P Global Market Intelligence, and head of the Transaction Cost Analysis (TCA) business for EMEA explains the key role pre-trade analysis can play in fixed income.

Why is pre-trade data so important for over the counter (OTC) markets?

The microstructure of the fixed income market, or any OTC asset class for that matter, doesn’t lend itself kindly to providing insights from a trading analytics standpoint. The limited level of information available in the market presents a general challenge. As a result, giving traders and investment managers the tools to predict their expected execution costs is extremely valuable.

The ability to perform pre-trade analytics on fixed income instruments can save clients and investors millions of dollars a year, dramatically improving the performance of fixed income portfolios and actively managed funds. Fixed income pre-trade analysis ultimately allows traders to gain insight, which can then drive trading decisions, on how a particular bond is to be executed. This in turn feeds into the whole best execution process, which from a regulatory standpoint is vital.

Has it become more crucial as markets have become more volatile?

Absolutely. With increased volatility, there is less of an understanding on where an execution can take place. Pre-trade analysis will take away some of the uncertainty regarding where a particular bond can be executed. Using Artificial Intelligence (AI), a pre-trade model must enable the user to look at the market at any given time and evaluate liquidity, momentum, volatility and spreads, as well as taking into account how that particular bond performed historically in similarly volatile conditions.

How does S&P Global’s fixed income pre-trade offering differ from current competitors?

At S&P we are placed at the forefront of being able to offer AI technology for pre-trade analytics for fixed income instruments. We have the ability to provide essential insight and analysis for single entities through to full portfolio pre-execution analysis, irrespective of the market environment. Contributor-based in-house data, through our own peer data, helps fuel our pre-trade cost models, and cutting-edge machine learning technology provides users with essential analytics tools to stay ahead of the curve.

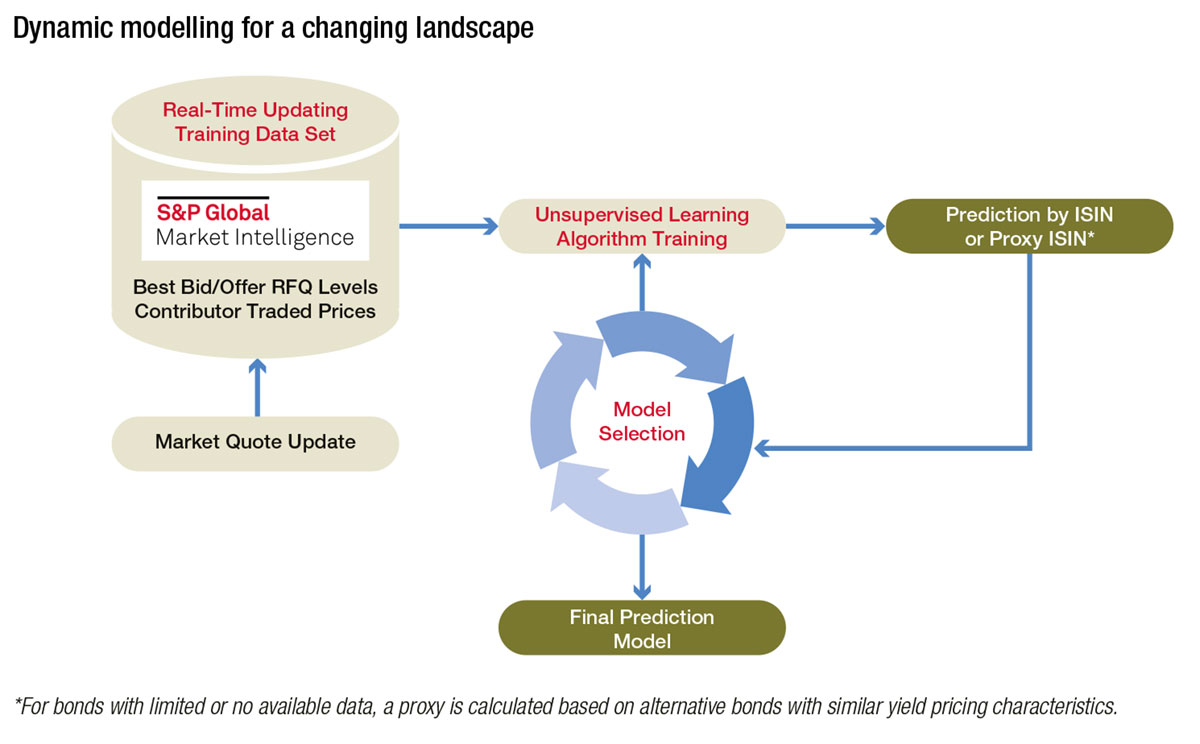

Our fixed income pre-trade model leverages AI and utilises a learning process which identifies changing market dynamics in order to select the best model to estimate execution pricing and slippage, providing the predictions and criteria for optimal execution with respect to single traded entities through to complex baskets, based on real-time market dynamics.

Changing market characteristics, and other drivers, mean adaptation is essential in any predictive model, whether estimation is required from a relative or independent perspective. Removing constraints and supervision allows the full capabilities of artificial intelligence to self-calibrate, without the need for endless parameter optimisation and targeting.

Our fixed income pre-trade offering’s single goal, throughout its selection process, is to achieve a model that minimises predictive error in real-time. Any number of inputs – independent variables – can be used in the calculation process, their significance determined internally, and the optimal predictor achieved.

What do end users need and how can asset managers, trading desks and funds benefit from its capabilities?

The aim of S&P Global’s fixed income pre-trade offering is to provide essential and valuable tools to improve transaction cost estimation and execution potential by means of understanding the dynamics behind efficient execution in changing markets.

On this basis, a pre-trade offering in the fixed income world can be extremely powerful for asset managers and trading desks where there is constant pressure to reduce costs. We have also seen a focus on post-trade data to assist with this. Couple this focus with inserting a pre-trade model into the trading workflow and the user gets more visibility and clarity on the execution in the lead up to the trade. The feedback loop between the pre- and the post-trade is critical for users to be able to maximise the benefits of TCA.

What specific needs and advanced capabilities do proprietary and alpha-seeking trading desks require and how does that differ from other market participants?

When it comes to proprietary or alpha-seeking desks, the benefits of an adaptive learning model do not end at transaction cost analysis prediction, because the generic build of the S&P model enables the end-user to select inputs and outputs for any complex baskets to achieve a variety of essential pre-trade analytics, including a representation of current market state. Identifying inherent dimensionality characteristics will undoubtedly improve returns and provide insight in changing market dynamics ahead of the curve.

This article was first published in Best Execution Magazine (Spring 2023)

To subscribe click on the image below:

©Markets Media Europe 2025