How automated can low touch get?

Gherardo Lenti Capoduri, Head of Market Hub, Banca IMI speaks to The DESK.

Gherardo Lenti Capoduri, Head of Market Hub, Banca IMI speaks to The DESK.

How are trading algos being applied in fixed income today?

The fixed income market is evolving at a faster rate than ever before, which has resulted in increasing cost pressures, competition and a raft of new entrants.

To reduce costs, minimise execution time and improve efficiency, operational control and best execution, fixed income trading is experiencing greater adoption of trade automation in the full trade lifecycle, both in-house or outsourced solutions.

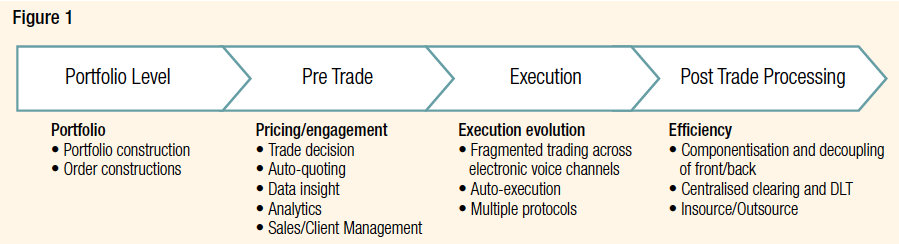

Traditional vendors and new fintech firms are developing solutions to bring greater efficiencies to all the operative process and to avoid redundancy and complexity (see Figure 1).

Advanced automated technology and the structure of execution management systems (EMSs) are often borrowed directly from equities and are not fit for purpose in the complex world of fixed income markets, which are more fragmented, less transparent and less liquid. Even if equity trading provides a useful starting point, we are still in the early stages of introducing algorithmic pricing to fixed income. The results are different for rates and credit:

• Rates Trading: Substantial investments have been made by electronic platforms and market participants as they strive to simplify lower touch trading and leverage auto-quoting, for both market and quote workflows. Rates trading automation had an earlier start than credit market automation, and market liquidity, low latency tools, benchmarks, reference and theoretical prices and market data are already available to support the creation and development of algorithmic models;

• Credit Trading: The evolution of automation of the US credit space and the robust liquidity that comes in from exchange traded fund (ETF) market making activity and program trading have together supported a robust trading flow in small size tickets in the European credit side, a cultural change and a strong push to automation. Today, in the credit trading space, the top priority in adopting automation is risk management, which faces a challenge as trading floors continue to evolve and client engagement is a priority. The industry is working to create intelligent tools to support trading idea generation, to identify portfolio risks, hedge them more quickly and more profitably, and support clients in portfolio allocation. To realise this potential, market participants need data-sets of pre-trade and post-trade information and analytics which are available, consistent, comprehensive and standardised.

What does a more automated service look like to your clients, and what are the benefits they see?

Automation allows buy-side traders to execute low-risk orders using pre-defined rules, which creates the capacity for their traders to focus on higher-value priorities and to use their skill-set to improve alpha on the high-touch deals, avoiding some of the low-touch flow. Complementing human traders with automation will be the future challenge. As a result of process automation, financial institutions will sustain less costs for trading execution, making it possible to offer the same service to buy-side investors at a lower price.

Are there specific preparations that buy-side desks need to make, to utilise your algos and price streaming / trading?

Auto-quoting requires a low-touch model of engagement and a strong decision-tree for execution, supported by a long-term plan which must give traders greater confidence and control, enabling them to apply more complex logic to fully realise the benefits of their automation strategies, also in a highly complex environment.

Algorithmic execution criteria are critical: the automation strategy should reflect the specific fixed income product being traded, because the number of traded instruments by International Securities Identification Number (ISIN) is huge. Firms also need to implement risk mitigation policies, primarily through robust internal processes, strong internal supervision/governance regimes and training. They must also put monitoring tools in place and allocate human resources training to handle complexity.

How are your buy-side clients bringing high and low touch trading together?

It’s key that buy-side firms put in place policies to balance fixed income execution between high- and low-touch trading, and to build the human capabilities on the desk so traders can conduct more complex trades while automation handles the simpler ones. To meet this goal, buy-side traders need to quickly capture, normalise and consolidate a centralised integrated repository of information and analyse data. The future trading desk is high-touch / low-touch, with quants and data at the forefront to offer a better outcome for our clients. Following that decision, the buy side needs to evolve its current execution model: first, by prioritising the principal trading model for high-touch business; second, by complementing it with an agency smart order router model for low-touch business, to avoid fragmentation of liquidity across disparate types of venues and liquidity providers.

Will this impact the ability to measure execution quality?

Greater automation will likely require that traders have a greater understanding of how it works and put in place a continuous monitoring of the execution quality to identify unexpected outcomes and adjust models and tools accordingly, to avoid the risk of sacrificing best execution for operational efficiency. It will be crucial to understand and test the algo rules criteria used to determine which trades should be automated, to minimise risks. Reporting and analysis on a post-trade basis is necessary to continuously improve the automation process. TCA, which is now more embraced in equity and forex trading, can play a pivotal role in the future for fixed income: best execution needs to be viewed as a process, where TCA provides objective and quantifiable data that helps testing how cost-effective execution is being achieved despite challenges of liquidity fragmentation, different levels of trading automation and price transparency.

How could the use of algos impact fixed income trading in the future?

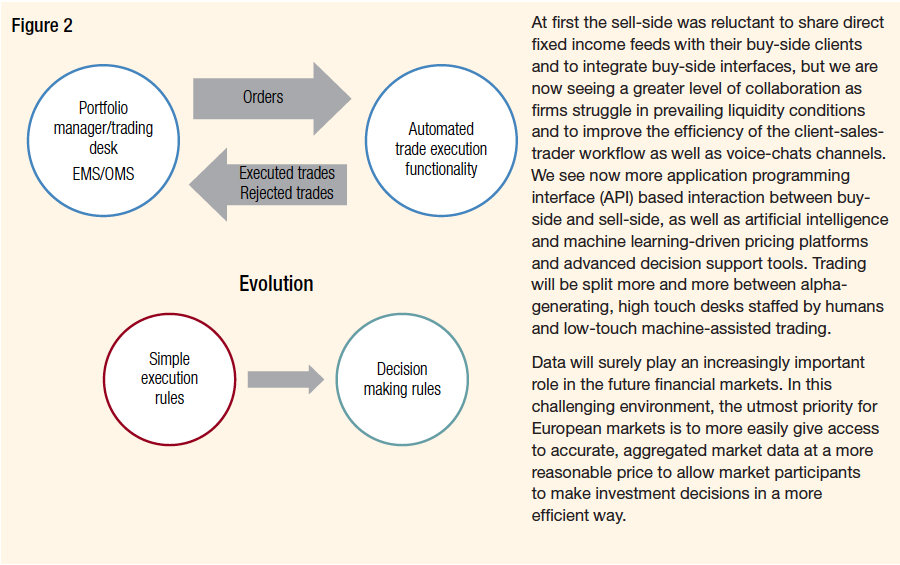

The process of creating automation, new trading protocols, and greater efficiency is inexorable. We expect to see increasing focus on data insight, analytics and connectivity tools. Key to successful implementation is to develop a symbiotic relationship between the human culture and new technologies as well as having a robust control environment (see Figure 2).

©The DESK 2019

©Markets Media Europe 2025