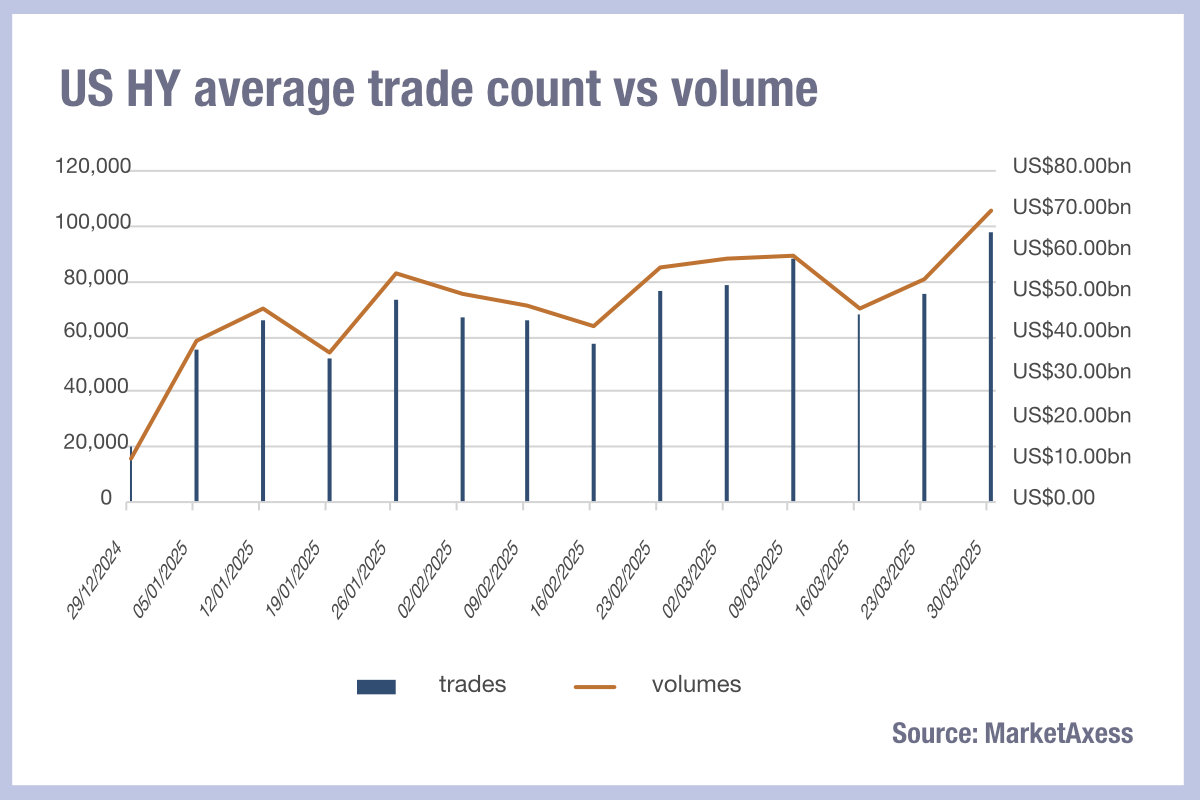

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’ tariffs.

Activity trended up drastically in mid March, MarketAxess data shows, with trade counts and volumes rising in tandem. The particular spike last week reflects last week’s ‘Liberation Day’ tariff uproar and subsequent sell-off in the US, however so-called ‘junk bond’ trading volumes have been rising fairly consistently over the year.

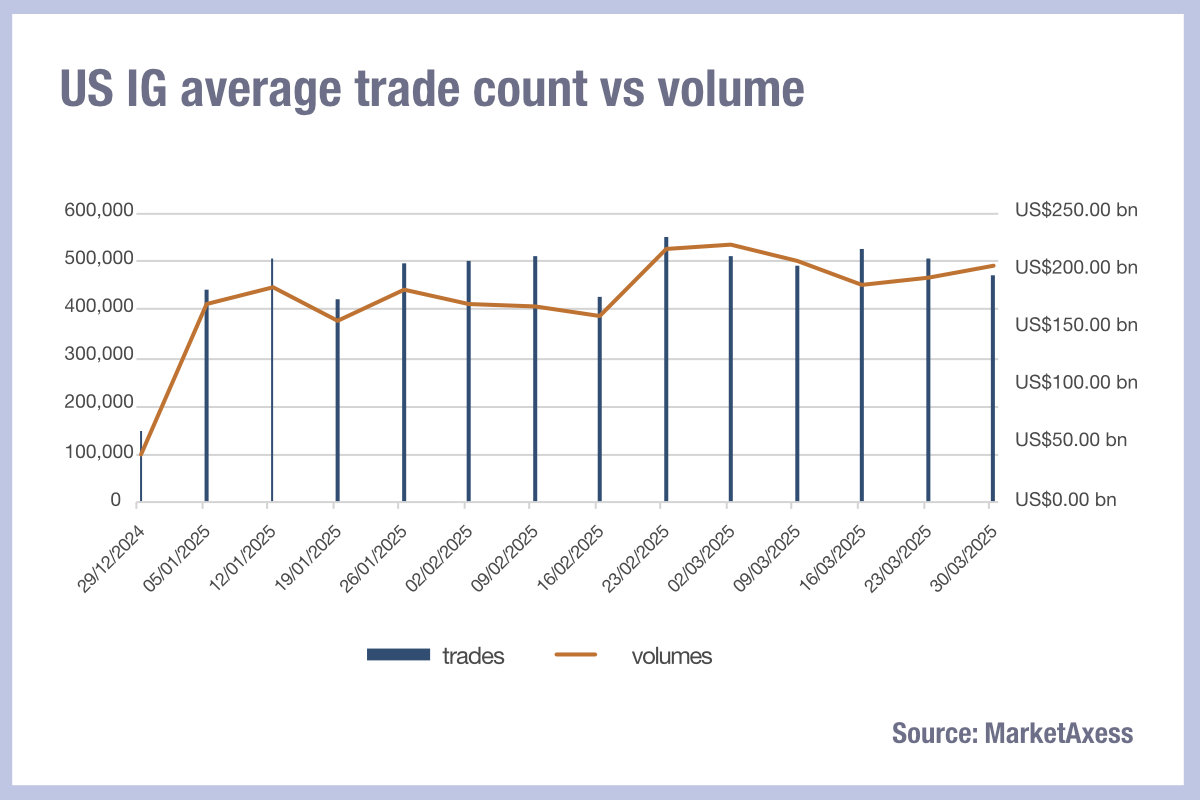

In US investment grade (IG) trading, volumes ticked up over March but remained below the highs recorded in mid-February. High trade counts over the month imply strong e-trading engagement, but figures have not reached the levels of small-ticket trades made in late January and early February. This suggests that market participants are beginning to lean more into block and dealer-led trading.

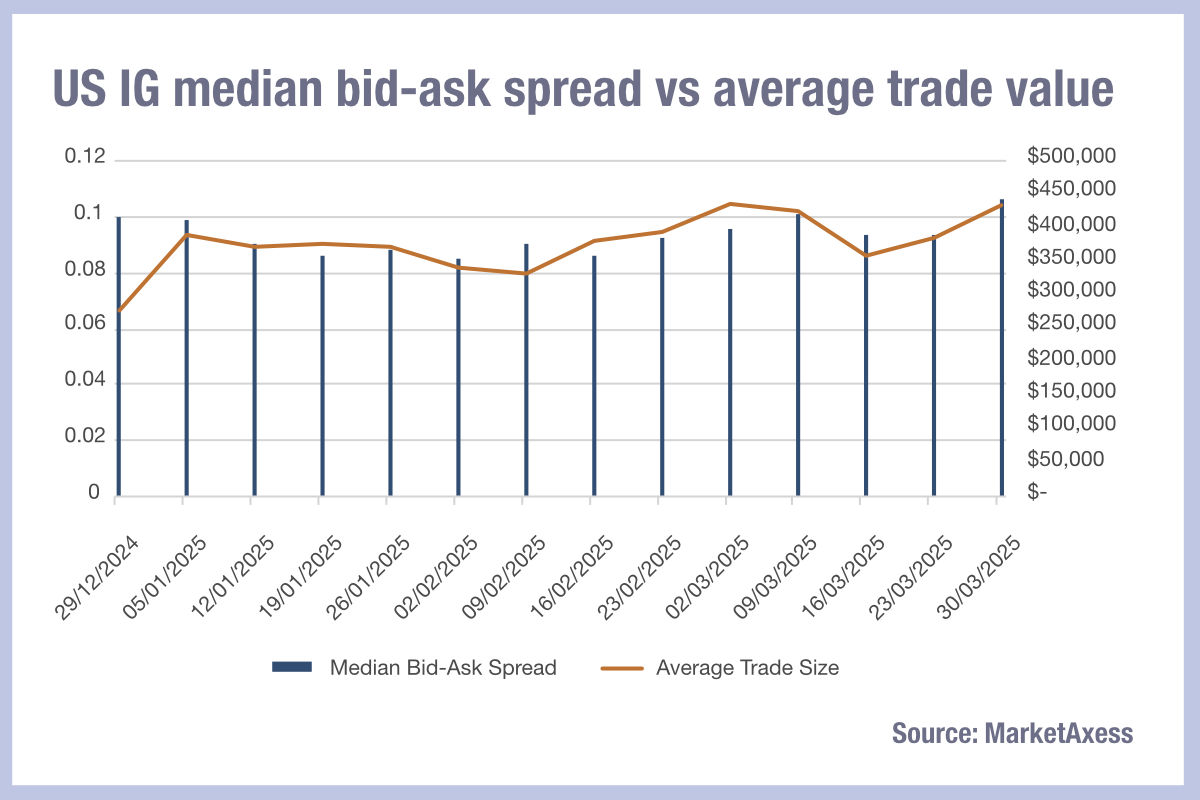

That said, average trade sizes have been increasing in IG bonds – and to a lesser extent in HY bonds. However, bid-ask spreads have also increased over the last week as liquidity prices rise amid global uncertainty.

Europe

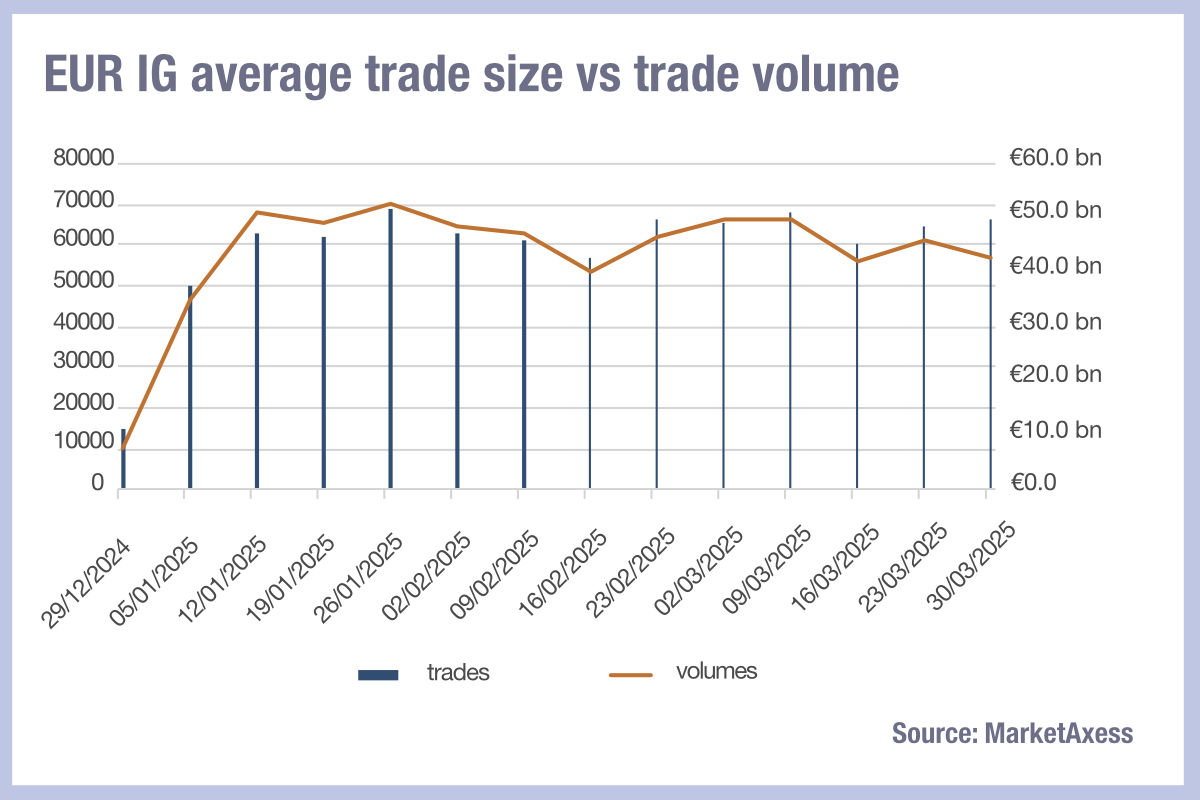

By contrast, activity in European bond trading remained fairly stable. Volumes in European IG bonds fell slightly over the month, while HY began to return to year-to-date highs seen in the final week of February. A high number of trades compared to volumes in both indicate growing electronic trading in the markets, particularly IG, with a larger number of small tickets being traded.

The average EUR IG trade size declined steadily in March, while bid-ask spreads picked up at the end of the month.

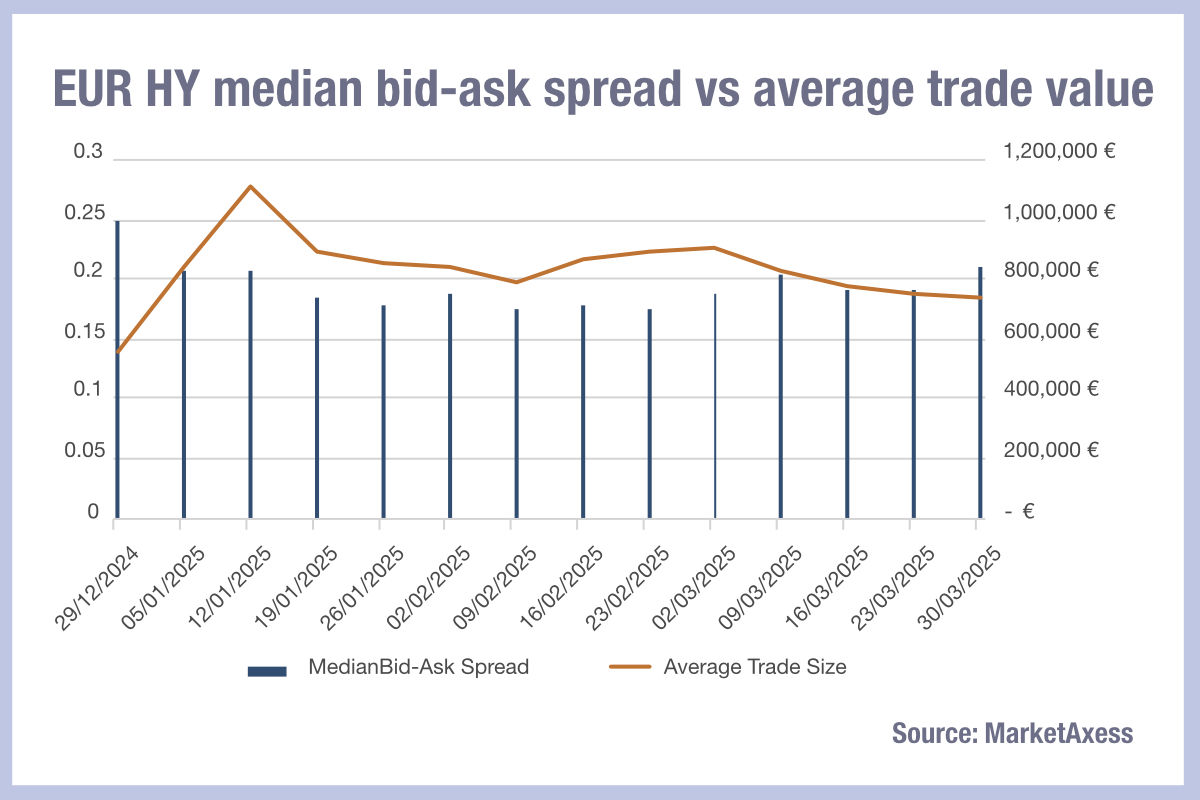

European high yield saw a steeper change, with the average trade size following a similar downward pattern and bid-ask spreads rising by the end of the month, indicating the increasing cost of liquidity in the market.

The concentration of activity in the US credit market is to be expected, given tariff announcements, as traders seek safer-haven investments. Comparable stability in Europe implies that market panic has not made it across the Atlantic – for now, at least.

©Markets Media Europe 2025