US corporate bond activity saw a slight slowdown over March, although remained elevated on a historical basis, Coalition Greenwich’s April Data Spotlight on US credit trading has found.

Secondary market volume, on a notional basis, was up 17% YoY for March. New issuance was down 27% from February 2024 but remained 57% higher than March 2023.

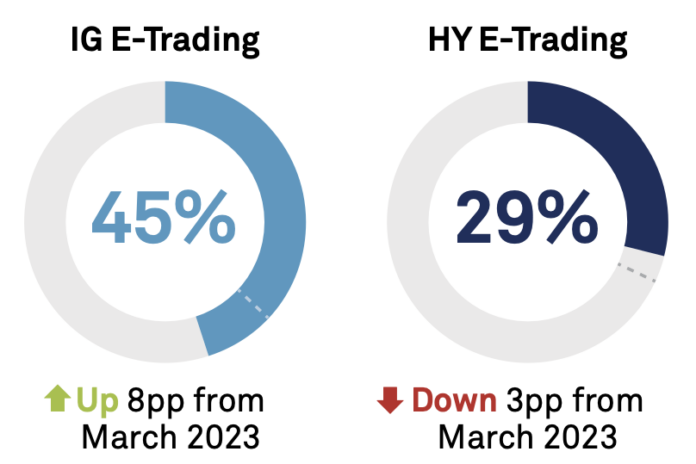

Electronic trading consisted of 44% of total investment grade notional volume traded in the first quarter, compared to a 38% share in Q1 2023.

In contrast, high yield e-trading has continued to hold its 29% of the volume seen in February 2023, with MarketAxess, Tradeweb and now Trumid the main players in the space. The report suggests that this lack of movement could be the result of a market focus on higher-quality credit, and the expectation that rates are set to go down.

Neither investment grade nor high yield e-trading saw changes in volume held between February and March 2024.

According to the Federal Reserve, in Q4 2023, US households held US$5.67 trillion in directly held debt securities (bonds) and US $5.31 trillion in indirectly held debt securities (mostly ETFs and mutual funds). This marks a 90% increase in bond holdings since Q4 2021 and is the first time since 2014 retail investors have held more in bonds than bond funds, which reduced by 1% in the same timeframe.

The report suggests that demand for safe, higher-than-recent-normal yields have contributed to these higher volumes and holdings. While the report is quick to state that investing behaviour tends to be cyclical, with retail investors and financial advisors reallocating investments based on the economic cycle, it adds that recent retail investor impact may be a sign of “true structural change”.

It adds that the work done to make bonds more accessible to retail investors “has made the market better for everyone”.

©Markets Media Europe 2024

©Markets Media Europe 2025