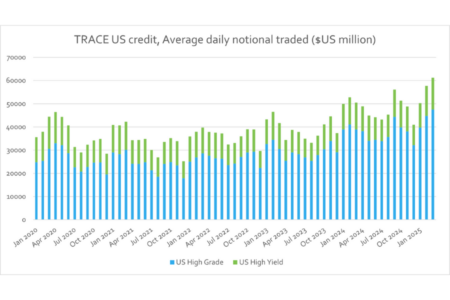

The corporate bond market was already at record levels before the US tariffs came into force, FINRA data shows.

US credit trading volumes reached record highs in March, with combined average daily volumes of investment grade (IG) and high yield (HY) up 23% year-on-year (YoY) to US$59 billion. This also represented a 7% jump from February’s US$55 billion – which was already a record for the market.

A single-day record of US$89.7 billion was set just eight days into April.

Average trade sizes increased over March as more traders adopted a block approach, up 14% YoY to US$426,000, according to Coalition Greenwich

E-trading ticked up YoY too, the group’s report stated, by 3% in IG to 50% of the market and by 2% to 32% of the market in HY. Overall, trading venues handled close to US$29 billion a day, setting another record and representing a 28% YoY increase.

©Markets Media Europe 2025