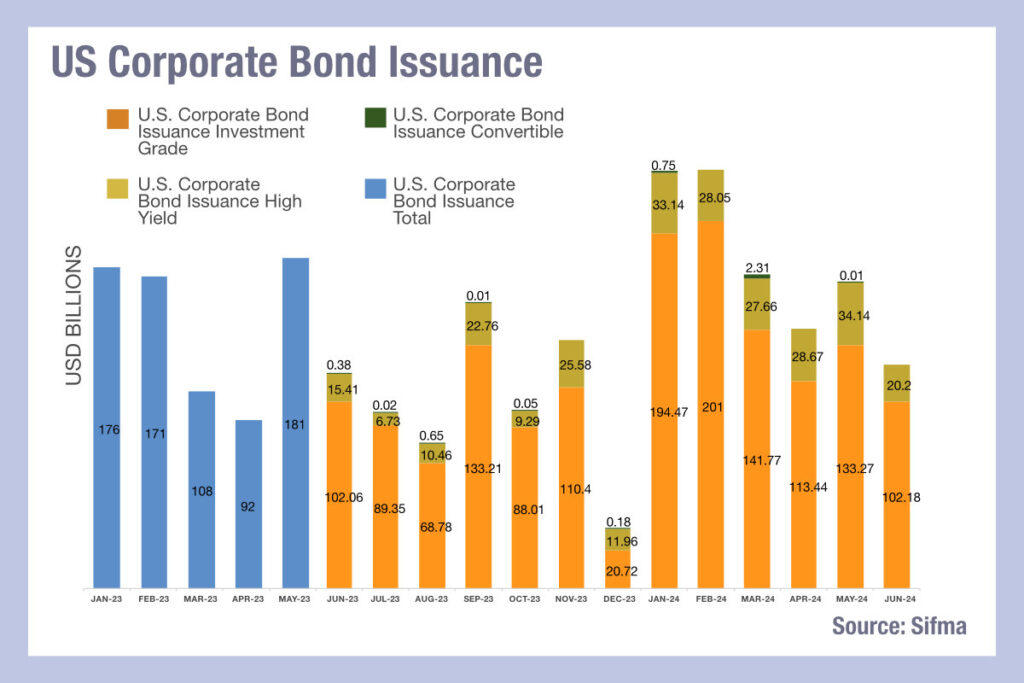

June 2024 has seen US corporate bond issuance levels only slightly higher than those seen in June 2023, after record levels at the start of the year, according to data from the Securities and Financial Markets Authority (SIFMA).

With summer subduing activity and ongoing interest rate uncertainty, not least thanks to a neck-and-neck election on the cards, reading the market today is hard.

However, it seems clear that amongst issuers, confidence in the debt markets as a source of financing if high. There are few signs of saturation and while rates are higher than before, they are still not straining corporate finances – yet.

The big question being raised by many in the investment community is inflation – what if it does not fall as expected?

Political risk is greatest when populations and politicians seek revolution over evolution, and polarisation of political discussion in many markets is certainly leaning towards that potentially volatile state. This can trigger anything from trade wars to actual wars, alongside magical thinking economics all of which, beyond terrible social consequences, can create major economic disruption.

The ability of central banks to manage public spending though rate hikes is also not guaranteed, as inflation can prove resilient when wages have been held down for a long period in line with low inflation, and political pressure to limit spending declines during election years.

Coming back to issuance, it seems likely that the levels we have seen at the current rate of inflation will only continue if rates are maintained or fall, giving a considerable debt burden to corporates, but balanced with likely continued spending and economic activity.

That will weigh on the trading operations of asset managers and dealers, who are driven to distraction by managing high volumes of messaging back and forth during the bond issuance process. It may also accelerate adoption of platforms that can increase the efficiency of the primary market activity, and support overall secondary volume as trading of debt typically occurs around the data of issuance.

If rates rise and the cost of debt issuance increases it seems possible that issuance may increase to some extent but there will inevitably be a ceiling where cashflow makes refinancing untenable for an increasing number of companies, and further borrowing is limited.

A tail off over summer may provide a respite to support revenue growth and build further resilience into corporate debt, but as a witness to crises in the past it is clear one should not assume common sense will be applied to a market wide activity. If borrowing adds short term competitiveness, everyone is forced to borrow to compete, and increasing take risks.

©Markets Media Europe 2024