We often hear ‘nothing really changes’ in relation to capital markets so it is good to have an insight into real progress, courtesy of MarketAxess’s TraX data, which looks at data across multiple markets.

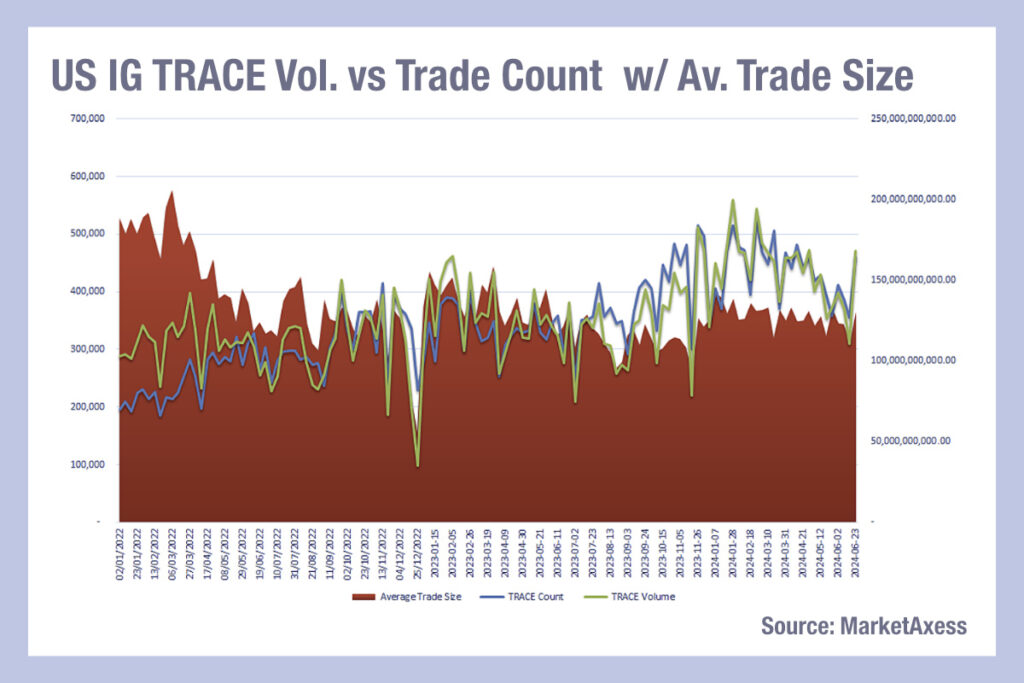

In the left corner, weighing in at 500,000 tickets is the average trade size for US investment grade trading at the start of 2022.

With a weekly TRACE count of 200,000 tickets and a weekly volume of approximately US$100 billion, this slugger seems to be built for delivering big orders efficiently.

But wait! In the right corner, weighing in at just 350,000 tickets is the average trade size for US investment grade trading, two and a half years later – this champ is punching around US$150 billion a week, via a whopping 500,000 tickets.

Lighter weight, faster, harder, this is what a diet of electronification can do to a market in just over 24 months.

It is good to see that things really do change, and for the better, even over relatively short periods of time. Traders anecdotally report far greater dealer and market maker hit rates over time, making the case for a very positive evolution of the market.

©Markets Media Europe 2025