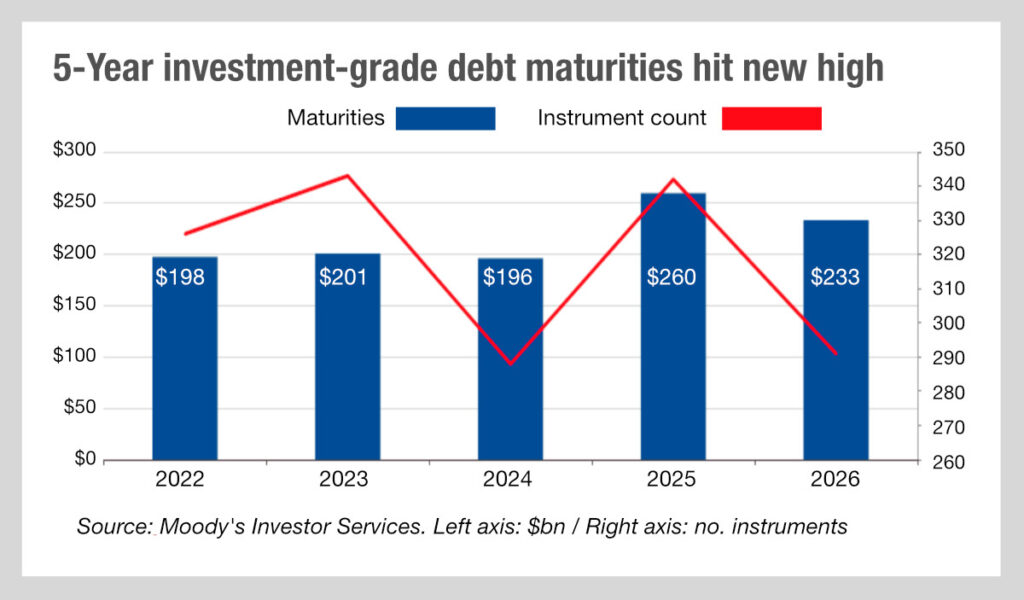

According to data from Moody’s Investor Services, the US investment-grade companies should have few problems refunding their debt in 2022, which is useful given US$1 trillion of investment-grade notes are due between 2022-2026. That is approximately 2% higher than last year and sets a record.

Analysts at the ratings agency expect that firms with an investment grade rating will be able to refinance their upcoming maturities, thanks to the low cost of debt issuance and ongoing appetite for more debt from investors. Any concerns about the economic climate and the increase in debt levels are offset by these factors – by their analysis.

While newly issued bonds had been taking longer tenors typically, there has been a widening of term premia, as investors probably respond to the expected rates hikes, offering a higher rate of interest. That may lead to shorter tenor debt in 2022 as a consequence.

This suggests that the rate of new issues that traders will have to deal with is likely to rise in 2022, and in 2023, with an expected drop off in 2024.

In the US market, many sell-side and buy-side trading desks are backing DirectBooks as the platform to support automation of the new issuance process. There are keen expectations of new functionality in the new platform, and it looks like it will be needed.

There may also be the need for greater resourcing on buy-side desks. With central bank rates increasing, the return on credit will stop looking so flat, and the investment opportunities will increase. To support effective communication between portfolio managers and investment traders, either bodies or new kit will be needed to increase the capacity for trading higher volumes.

©Markets Media Europe 2025