By Gara Afonso, Marco Cipriani, Catherine Huang, Gabriele La Spada, and Sergio Olivas.

Take-up at the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP) increased from a few billion dollars in January 2021 to around US$2.6 trillion at the end of December 2022. In this post, based on a recent Staff Report, we explain how the supply of US Treasury bills (T-bills) affects the decision of money market mutual funds (MMFs) to invest at the facility. We show that MMFs responded to a reduction in T-bill supply by increasing their take-up at the ON RRP, helping to explain the increased overall take-up.

MMFs’ Demand for US Treasury Securities US MMFs are open-end mutual funds regulated by the Securities and Exchange Commission (SEC) that can only invest in safe and highly liquid money-market instruments denominated in US dollars. Among such instruments, US Treasury securities are especially relevant because of their safety and liquidity. Since MMFs cannot hold securities with a remaining maturity greater than 397 days, T-bills are an especially appealing investment option for them.

MMFs’ demand for Treasury securities, moreover, has grown significantly since October 2016, when the Securities and Exchange Commission (SEC) implemented an important reform of the MMF industry; this reform led to an increase in assets under management of more than US$1 trillion for government MMFs—a type of MMF that can only hold Treasury securities, agency debt, or repurchase agreements collateralized by these assets. Treasury Supply Decreases after the COVID-19 Crisis Subdues In response to the COVID-19 pandemic, the US Treasury expanded its debt issuance, and in particular its issuance of T-bills, which accounted for 83 percent of the newly issued marketable government debt between March and September 2020.

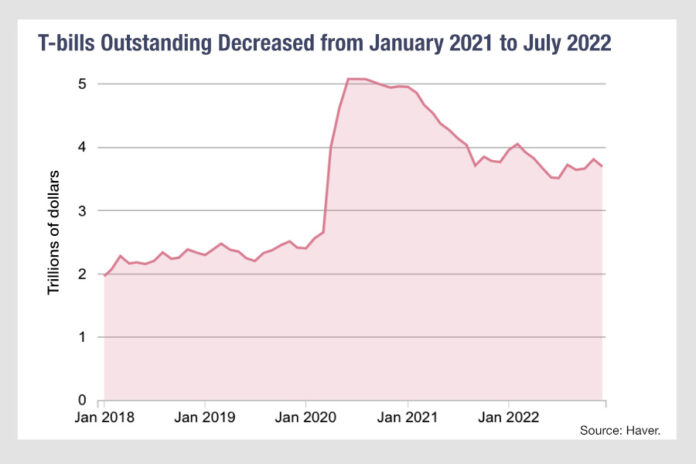

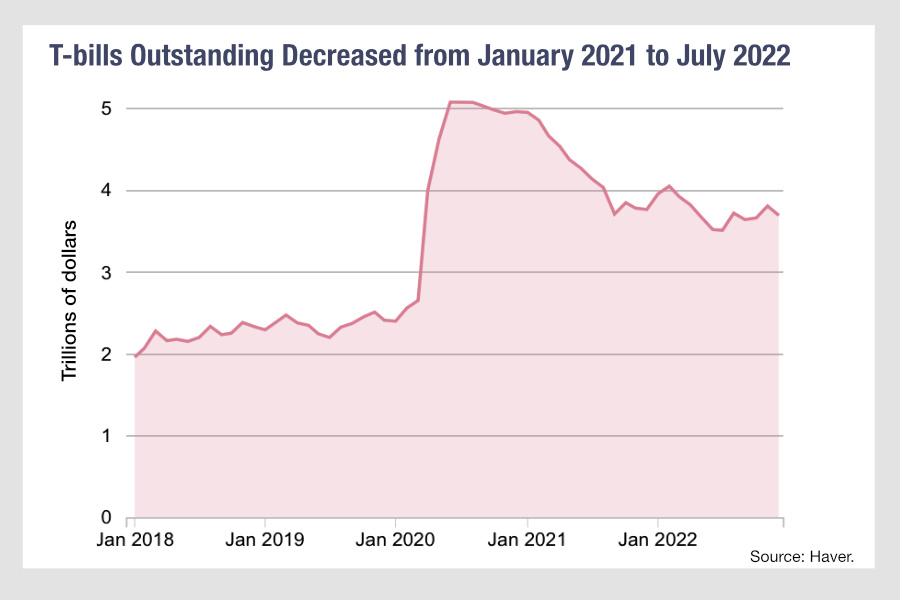

As the chart below shows, T-bills outstanding increased from US$2.66 trillion to US$5.03 trillion during this period. As economic conditions improved, the issuance of T-bills returned to levels closer to historical standards, and T-bills outstanding decreased from US$4.95 trillion to US$3.51 trillion between January 2021 and July 2022. Take-up at the ON RRP Increases as T-Bills Become Scarce One of the drivers of the increase in ON RRP take-up may have been the relative shortage of T-bills, which limited MMFs’ investment options, making investment at the ON RRP an attractive alternative.

As we discussed in a previous post, the MMF industry grew substantially between 2016 and 2020, expanding from US$2.99 trillion in January 2019 to US$4.22 trillion in December 2020, partly as a result of monetary policy tightening; moreover, much of this increase was concentrated in government MMFs, which experienced large inflows during the early stages of the COVID crisis. The resulting increase in the demand for safe assets from MMFs, and especially from government MMFs, may have led MMFs to turn to the ON RRP facility as the supply of available T-bills became scarce.

To identify the effect of T-bill supply on ON RRP take-up, we exploit the differential exposure to variation in T-bill supply across MMFs. Government MMFs are more exposed to shocks in the T-bill supply than prime MMFs, which can also lend to financial and nonfinancial corporations through unsecured debt instruments such as certificates of deposit and commercial paper. As a result, the ON RRP investment of government MMFs should be more sensitive to a decrease in T-bill issuance than that of prime MMFs. To test our conjecture, we run a regression analysis of ON RRP investment on a daily panel of MMFs eligible to invest in the ON RRP, from April 2020 to August 2022, during the expansion and subsequent contraction of T-bill issuance.

Our regressions identify the effect of T-bill issuance on the share of ON RRP investment in government-MMF portfolios relative to prime-MMF portfolios, controlling both for unobserved time-invariant fund characteristics and for time-varying common factors. We find that a decrease in monthly T-bill issuance of US$100 billion leads government MMFs to increase the share of their portfolios invested at the ON RRP by roughly 2.34 percentage points more than prime MMFs. The estimate is highly significant, suggesting a causal relationship between T-bill supply and ON RRP investment. The effect is also economically important: government MMFs eligible to invest at the ON RRP had, on average, US$3.3 trillion in assets under management between April 2020 and August 2022; considering that T-bill issuance declined by almost US$1 trillion during the same period, its effect on the portfolio composition of government MMFs relative to that of prime MMFs corresponds to an additional increase in ON RRP investment of roughly US$750 billion, against a total increase in ON RRP take-up of US$2.2 trillion.

Summing Up A shortage of T-bills reduces MMFs’ investment options, pushing them to increase their investment at the ON RRP facility. This happened in 2021 and 2022, when the Treasury significantly reduced its issuance of bills; the impact of the reduction in T-bill issuance was particularly significant because the size of the MMF industry, and especially government MMFs, had increased substantially between 2015 and 2020, as a result of monetary policy tightening, the SEC reform implemented in October 2016, and the increased demand for safe assets caused by the COVID crisis. In other words, as T-bills became relatively scarce compared to MMFs’ demand for safe assets after 2020, the ON RRP facility became an attractive alternative, absorbing MMFs’ demand for safe, short-term investments.

This post was written by Gara Afonso, Marco Cipriani, Catherine Huang, Gabriele La Spada, and Sergio Olivas, “Treasury Bill Supply and ON RRP Investment,” published on the Federal Reserve Bank of New York, Liberty Street Economics, November 29, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/treasury-bill-supply-and-on-rrp-investment/.

©Markets Media Europe 2023

©Markets Media Europe 2025