The annual letter to clients from Tradeweb’s CEO and chair, Lee Olesky, and president and CEO-elect, Billy Hult, has been published, noting the tough conditions clients have faced, noting “If we’ve learned one thing over the last few years of once-in-a-lifetime events occurring with some regularity, it’s that bold pronouncements about what the future will look like are almost certain to be upended by something no one saw coming.”

The letter in full is produced below:

‘Dear Client,

If 2020 and 2021 were tests of our resilience and resolve, this past year was a masterclass in macroeconomic and geopolitical one-upmanship. Financial markets weathered the storm of an ongoing global pandemic, supply chain disruption and massive geopolitical unrest, while rising inflation and rapid-fire interest rate increases and a persistent threat of recession tested the resilience of our markets.

With global consumer prices up 10.7%[1] so far this year and the 10-year U.S. Treasury yield nearly 200 basis points (bps) higher than it was in January – not to mention the historic moves we saw in UK Gilts during September and October – 2022 has not disappointed when it comes to keeping market participants on their toes.

We’ve had a unique vantage point throughout this journey at Tradeweb. Across virtually every asset class we cover, from government bonds to munis to corporates to mortgage-backed securities to equities, we’ve seen historic milestones and fascinating responses from the markets to maintain efficient access to liquidity in challenging environments.

Following are some of the most important developments we’ve tracked over the past year, which we think are critical turning points that will help shape the future of how markets respond to tests down the road.

Inflation Rears Its Head

The biggest macro story of the year, of course, was inflation. What started on used car lots quickly bled into housing and commodities markets and virtually everything else. By June, US mortgage rates were rising at a historic pace, the US Consumer Price Index (CPI) was at a 40-year high, the Eurozone was hitting its highest inflation rate since the creation of the euro in 1999, and the UK inflation rate was the highest since 1997, when the National Statistics series began tracking CPI in its current format.

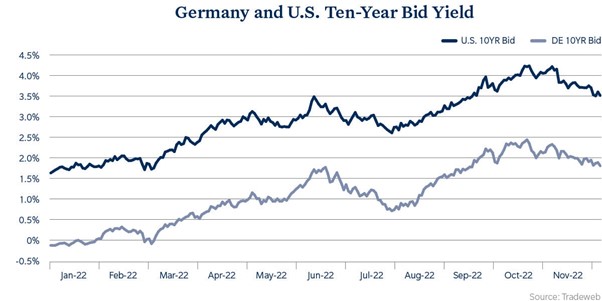

Accordingly, central banks around the world responded with swift changes in monetary policy, moving quickly from the record low interest rates of the pandemic era to a steady march of rate increases at the most rapid pace since the 1980s. The far-reaching impact of these moves has been impossible to miss in our rates markets, where yields on the 10-year US Treasury and German Bund each climbed more than 250bps between January and October of this year. On the longer end of the curve, the 30-year US Treasury bond issued in November of 2021 saw its price fall 30% over the last 12 months, all against a backdrop of continued strong supply. In the UK, we saw some of the wildest moves of all, with Gilt yields rising more than 350bps between January and October, only to swing sharply lower throughout the period of upheaval surrounding Prime Minister Liz Truss’ election and abrupt resignation.

By the summer, yield curves had inverted in the US, with shorter-dated 2-year and 3-year US Treasuries rising higher than the benchmark 10-year yield, sending the clearest signal yet that the markets were starting to grow increasingly concerned about inflation and the growing threat of a possible recession. By November, the 2-year/10-year curve had inverted in at least eight countries, including Germany, Russia, Brazil, the UK, Mexico, South Korea, Canada and the U.S.

Markets Adapt To Fast-Moving Fundamentals With Inflation-Linked Securities

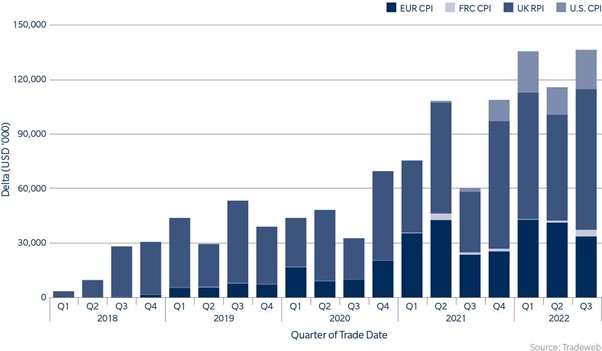

Of course, wherever there is volatility, there is evolutionary change. At Tradeweb, one of the first ways we saw market participants adapt to this new reality was a dramatic rise in activity in inflation-linked securities, such as Treasury Inflation-Protected Securities (TIPS) and inflation swaps. In Q3, TIPS trading by institutional clients on the Tradeweb platform increased 19% as compared to the same period last year, and, in Q3 alone, we saw roughly $136.5 million of delta in inflation swaps trade on our platform. Through the first three quarters of 2022, average daily volume in inflation swaps was up 63.6% over the same period last year as a broad mix of clients, including liability-driven investors, asset managers, bank desks and hedge funds, embraced the asset class as an efficient way to hedge inflation risk.

Perhaps even more interesting than the institutional market’s embrace of inflation-linked securities is the manner in which market participants have been trading these instruments as volatility continued to rise. Historically, periods of market stress have been accompanied by a relative slow-down in response times between dealers and customers as some may have disabled auto-quote tools and started manually sweating the details of every trade. The opposite happened this time around.

In fact, dealer response times of under one-second increased to around 70% across all TIPS activity on the Tradeweb platform in the summer of 2022, up from roughly 50% in mid-2021, suggesting that even more dealers than normal may have been auto-quoting inflation-linked securities trades. Likewise, on the customer side, the percentage of TIPS trades executed via Tradeweb’s Automated Intelligent Execution (AiEX) tool topped 20%, which is roughly double the level of automated TIPS trading we saw in 2020. The trend offered a clear signal that institutions are increasingly leveraging electronic trading, and that they are relying on the latest automation tools to stay as nimble as possible when markets get volatile.

The Rise Of Retail Fixed Income

This blurring of lines between traditional, legacy processes and behaviors was a recurring theme throughout the year. Across several asset classes, investors of all types, who had developed a stronger embrace of electronic markets and a stomach for persistent uncertainty, continued to find creative ways to access liquidity. One of the most interesting flash points for this trend was the big moves by retail fixed income investors, who continued to grab a bigger piece of the municipal bond market pie this year versus their institutional counterparts.

With municipal bond prices down roughly 9% through the first half of 2022, institutional asset managers were standing face-to-face with a liquidity crunch. That is until retirees and their wealth managers showed up to take advantage of the rising yields that accompanied these plummeting prices. Through the summer of 2022, financial advisors accessing Tradeweb’s municipal bond platform on behalf of their retail clients were buying up munis at a rate of roughly 4-to-1 versus institutional investors, illustrating just how significant the trend toward retail fixed income has become across the broader municipal bond market. An influx of new innovations and advanced data science methods further spurred this trend, as retail participants in the muni bond market increasingly turned to electronic trading innovations such as Tradeweb Municipal Ai-Price to optimize their trading experience through enhanced price discovery and transparency.

Historically, those two classes of investors would never cross paths, but – thanks, in part, to advances in electronic trading that have given retail wealth managers a direct conduit to institutional liquidity through Tradeweb Direct – retiree investors have come to wield big buying power in the institutional municipal bond markets.

Toward A Portfolio-Centric View Of Risk

A similar set of evolutionary adaptations is continuing to reveal itself in our corporate credit and ETF markets, where investors have begun to change the way they think about moving risk. With the ICE Bank of America Index of investment grade corporate bonds down roughly 20% so far this year, the bond market is having one of its most challenging years in recent history. Despite this macro trend, we continued to see strong engagement on our global credit platform and our fixed income ETF platforms throughout the year.

Digging deeper into the behaviour of market participants in both asset classes, we see that these trends are being driven by a fundamental reframing of risk transfer. Driven in large part by the soaring popularity of ETFs—a market that has now crossed over $10 trillion (tn) in assets under management—and the availability of portfolio trading tools that make it possible to move large baskets of bonds in a single trade, market participants have started to think less about trading specific bonds and more about packaged trades that fit a specific risk profile.

In a continuation of a trend that’s been building for several years, we’re finding that the liquidity of the ETF, combined with workflow enhancements and electronic trading solutions, are helping institutional market participants move larger volumes of risk more efficiently. As a result, ETF trading volumes on electronic RFQ platforms have continued to climb and clients have begun to apply the advantages electronic trading provided in linking different markets together.

In fact, global institutional ETF volumes on Tradeweb surpassed a record $1tn year-to-date (YTD) and by late November Tradeweb had surpassed $250bn in notional trades in US institutional fixed income ETFs compared to $110bn for the full year 2021.

Through November of this year, the number of portfolio trades executed on the Tradeweb global credit platform had grown 20% year-over-year. This capability, combined with features like Tradeweb AiEX and all-to-all trading, which allow buy- and sell-side firms to connect more efficiently, are making it possible to keep markets moving in any market condition.

Looking Ahead To 2023

If we’ve learned one thing over the last few years of once-in-a-lifetime events occurring with some regularity, it’s that bold pronouncements about what the future will look like are almost certain to be upended by something no one saw coming. Right now, as longer-dated US Treasury yields have inverted further below those on shorter-dated bonds than at any point in recent history, half of investors and analysts think it’s a sure signal of recession, while the other half think it means we’re headed for a soft landing. We’ll leave it to our clients to pick which side of that bet they’re going to take.

What we can accurately forecast, however, is that continued advances in electronic trading, increased transparency into real-time pricing and market sentiment, and the breaking down of silos between markets and asset classes will give market participants more flexibility than ever when it comes to accessing liquidity in tough market environments.

In addition to the big trends we’ve seen this year in rates, credit, ETF and retail markets, we’re also seeing some very interesting activity in markets that have been slower to embrace electronic trading, like emerging markets and repo. In emerging markets, for example, over $1.5tn in interest rate swaps volume was executed on the Tradeweb platform YTD through the third quarter. That’s up from just $470bn for all of 2020, as investors continue to hunt for new sources of liquidity and wider availability of real-time electronic trading data makes it easier to access these markets. In repo, a sizeable market which we believe demonstrates an opportunity for increased electronification, we are experiencing a steady rise in activity on the Tradeweb platform, with average daily repo volume for the first three quarters up 13% as compared to the prior year period.

Likewise, systematic workflow enhancements, such as electronic request-for-quote (RFQ), Tradeweb’s AiEX tool, portfolio trading and other innovations, will continue to improve the speed and efficiency with which investors can transfer risk, regardless of what the markets throw at them. Ultimately, what we see when we peer into the next chapter is a convergence of several trends that have been taking shape for decades finally reaching a tipping point. As the world has shifted to a digital-first mindset for virtually every interaction, electronic trading – and the automation, analytics and execution tools that come with it – have become more widely used. Accordingly, market participants are now able to take advantage of connectivity between markets that never existed, surface liquidity in instruments that were once difficult to move and venture into markets that were once out-of-reach. That evolution is not only a noteworthy turning point for market structure, it is also a fitting milestone in the history of Tradeweb.

As we look back on some of the most important developments that shaped our markets in 2022, we can confidently say that regardless of where you see macro markets going over the next year, we’re sure to see more surprises that come out of left field, head-scratching market moves and unanticipated events in the foreseeable future. While no one can realistically prepare for all of them, with the right tools and mindset we can be ready for any of them.

Having overseen Tradeweb’s growth together for so many years, we are very proud of what we’ve accomplished with our clients, employees and partners. As we each head into new roles on January 1 (CEO for Billy, Chairman for Lee), we reflect back on just how far Tradeweb has come as an organization. One persistent theme has been that challenging periods in markets often yield our strongest dialogue with clients, and certainly that has been the case in 2022. We will continue to collaborate with you every step of the way to deliver solutions that help your business and move our industry forward.

Thank you for your continued partnership and trust, and best wishes for a healthy and happy New Year!

Sincerely,

Lee Olesky Billy Hult ‘

©Markets Media Europe 2025