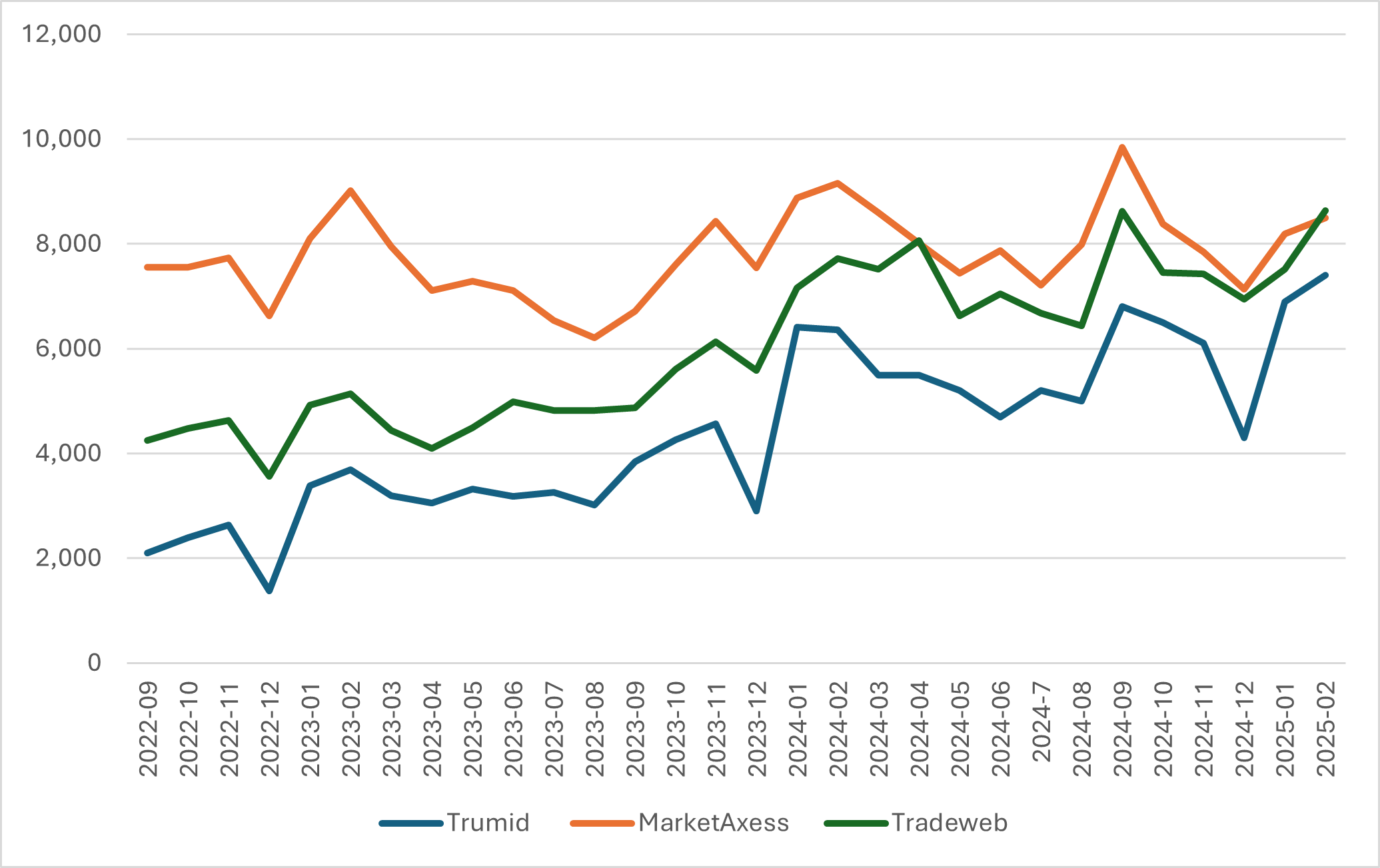

Multi-asset market operator, Tradeweb, has recorded average daily volume (ADV) of US$8.6 billion in US credit during February, surpassing rivals MarketAxess (US$8.5 billion) and Trumid (US$7.4 billion), and marking the second time since April 2024 that it has had the highest market share.

Tradeweb recorded an average daily volume (ADV) of US$8.6 billion in fully electronic US credit for February 2025, up 11.8% compared to the previous year. The company reported significant gains in US investment grade and high yield TRACE segments . Growth was driven by the increasing adoption of its request-for-quote (RFQ) and portfolio trading protocols. Tradeweb’s municipal bond ADV reached US$408 million, representing a growth of 26.9% year-on-year, notably outpacing the broader municipal market increase of approximately 9%.

MarketAxess, historically the dominant player in electronic credit trading, reported total credit ADV of US$15.5 billion, showing a modest increase of 2% year-on-year. According to Morgan Stanley research, Its market share in US investment-grade (IG) credit dropped to 17%, down 250 basis points year-over-year, reflecting continued market share erosion to competitors. Market share in US high-yield credit also fell to 11.1%, the lowest since December 2019. Nevertheless, the firm experienced robust growth in other credit segments, with emerging markets ADV increasing by 13% year-on-year to US$4.1 billion, Eurobonds rising by 16% to US$2.3 billion, and municipals surging 41% to US$614 million.

Despite recent market share challenges, MarketAxess remains optimistic, highlighting enhancements to its portfolio trading solutions and recent protocol innovations.

Chris Concannon, CEO of MarketAxess, noted: “We believe these new capabilities should help drive higher levels of market share in U.S. credit in the coming quarters”.

Trumid reported record ADV for February, reaching US$7.4 billion, up 17% year-over-year, with continued performance across its request for quote (RFQ_ and high yield trading segments. Trumid’s RFQ volumes tripled year-over-year, driven by increased adoption of its automated trading solutions, including the AutoPilot RFQ service, which reported an 81% “no-touch” execution rate. Trumid portfolio trading (PT) participation increased by 50% year-over-year, underscoring the firm’s successful client acquisition and retention efforts.

Michael Cyprys, equity analyst at Morgan Stanley, commented: “While MarketAxess experienced some softness in market share, their recent strategic initiatives like the high touch block trading solution and dealer Mid-X protocol may position them well for recovery. Tradeweb continues to benefit significantly from growing client adoption of automation and portfolio trading, consistently expanding its credit market presence”.

©Markets Media Europe 2025