Tradeweb has launched an enhanced functionality for request-for-quote (RFQ) trading in US credit markets. RFQ Edge deploys Tradeweb’s advanced portfolio trading analytics to its RFQ protocol to deliver a more powerful list trading experience for US credit and ETF traders.

RFQ Edge allows clients access to real-time trading data and analytics, customised charting functionality and dealer performance breakdowns. RFQ Edge leverages Tradeweb innovations such as Tradeweb Ai-Price, which provides real-time prices for nearly 30,000 corporate bonds, to more accurately identify and compare which bonds to trade.

Iseult Conlin, head of US institutional credit at Tradeweb, said, “This new functionality is a first for the industry and represents the next frontier of credit trading. We’ve taken what we learned from our widely successful electronic portfolio trading tool and introduced a new level of analytics for RFQ that has never been available. Clients can now leverage predictive analytics and data to unveil deeper insights at the list level, providing them with an unparalleled level of precision throughout every point of the RFQ trading process.”

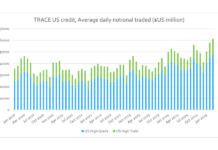

In Q1 2024, Tradeweb reported record quarterly average daily volume (ADV) in fully electronic US institutional grade credit.

©Markets Media Europe 2024

©Markets Media Europe 2025