Analysis of Tradeweb data has show the level of surprise at potential central bank rate cuts over the past week in the interest rate swap (IRS) market, by assessing the level of expected rate cut changes, and reflecting a major source of volatility at the start of the week.

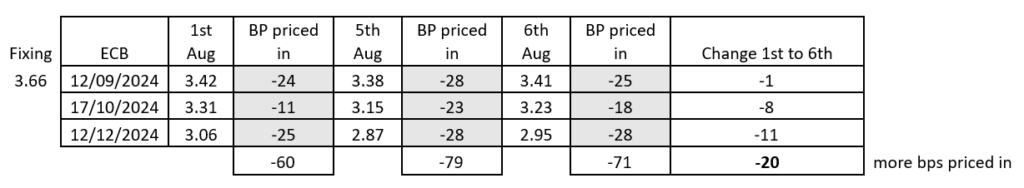

When Fed and the MPC make a rate change or hold on a meeting date, that is effective from that day until the next meeting. ECB swaps are different from the UK and US swaps, because they have an observation window, with the rate being effective for an observation window that starts five days after the meeting, or the Wednesday following the meeting.

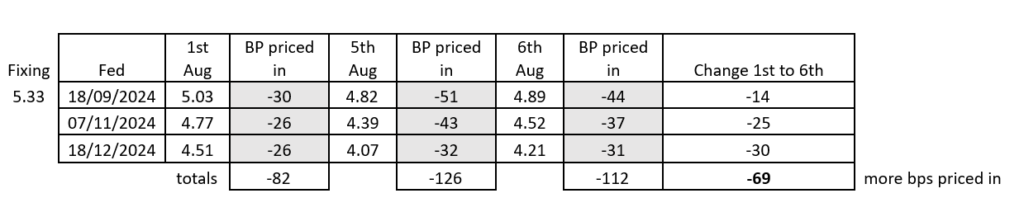

Looking at the overnight borrowing rates in the US at the start of the week, on 1 August 2024, the first Federal Reserve meeting date for 18 September was priced at 5.03.

To trade an interest rate swap against the relative overnight option-adjusted spread (OAS), traders apply the Fed Funds rate in the US, the Sterling Overnight Index Average (SONIA) in the UK and the Euro Short-Term Rate (ESTR) for the ECB, from the one meeting to the subsequent meeting.

Looking at the prices on 1 August, when the Fed Funds effective rate (the ‘fixing’) was 5.33, the rate of 5.03 indicates traders’ expectation of a 25 basis point cut the Fed Funds rate for between 18 September to 7 November. Looking ahead to the December meeting, a full 82 basis points of cuts were expected.

Concern grew at the end of that week that the Fed would need to cut rates more rapidly than expected.

If we fast forward to the 6 August, the closing price for the 18 September was 4.89, a 44 basis point difference from the fixing of 5.33, suggesting traders expected there to be a good chance that The Fed would cut by 50 basis points in that meeting.

By the 7 November meeting, the change in pricing is an additional 25 basis points and another 30 bps for the 18 December meeting, with pricing at 4.21.

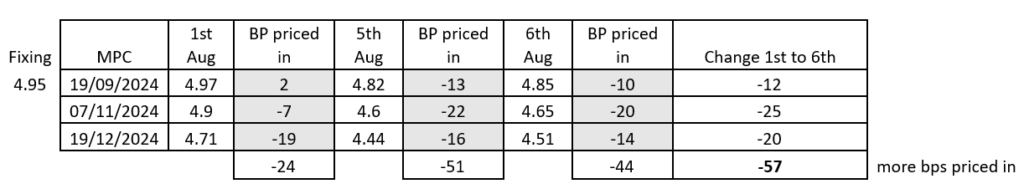

The UK swaps market has seen an additional 57 basis points priced in between 1 and 6 August, while the European swap traders added another 11 bps in the same period.

To summarise between Thursday 1 and Tuesday 6 August, swaps traders in the US expected nearly three quarters of a percentage point i.e. almost 75 basis points more cuts, a massive change in expectations in just four working days.

©Markets Media Europe 2023

©Markets Media Europe 2025