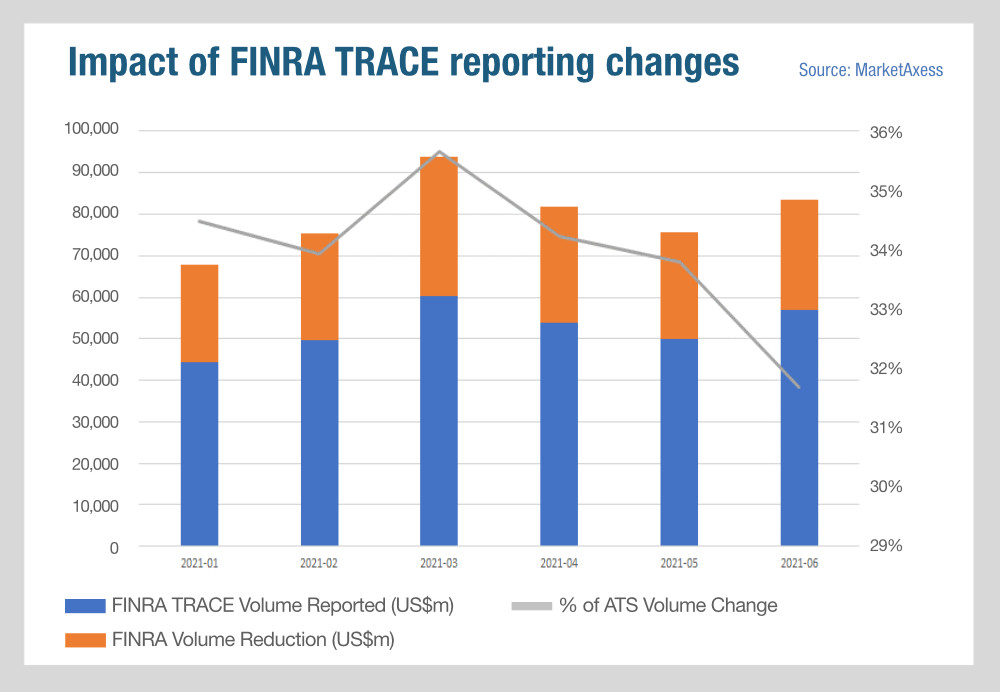

An adjustment to bond trade reporting to TRACE, the US post-trade reporting tape for fixed income, has cut the volume of trades arranged via alternative trading systems (ATSs) by an average 36% since 2017.

Since 26 July 2021, secondary market volumes being reported to TRACE are being adjusted to remove double counting of certain trades.

“Specifically, volumes will be computed similarly to the Weekly Treasury Aggregates, in which only one report for an ATS trade is included,” FINRA noted. FINRA implemented this as part of a wider a set of changes to reports from 26 July 2021 onwards. In addition to volumes of asset classes, it is now categorised based on how trades were conducted, as interdealer, dealer-to-customer or ATS transactions.

Although platforms are not given full clarity from FINRA, which manages the TRACE system, on the underlying trade-by-trade assessment that is made for TRACE reports, they have been provided with the overall reduction that has resulted from the change.

The effect on volumes is interesting to note. Looking back at monthly volumes from January 2017, the average monthly total trade count falls by 4%. By volume, the drop in average monthly activity is 2%. However, looking specifically at the reported ATS volumes, by collapsing the double printing for certain venues and trades to a single print, the monthly trade count has fallen by an average 20% since January 2017 or 36% by volume.

The impact of this change will depend on the extent to which firms were already able to account for this double counting in their assessment of individual ATSs and TRACE data as a source for market liquidity and price information.

TRACE has always had its quirks and the inclusion of double counting is a clear issue. FINRA’s move will be welcomed by traders, but it also emphasises some of the challenges that exist in representing the bond market. This could further support the use of multiple commercial solutions by portfolio management and trading desks to get a more nuanced picture of trading activity, in order to iron out any wrinkles found that are specific to an individual source.

©Markets Media Europe 2025