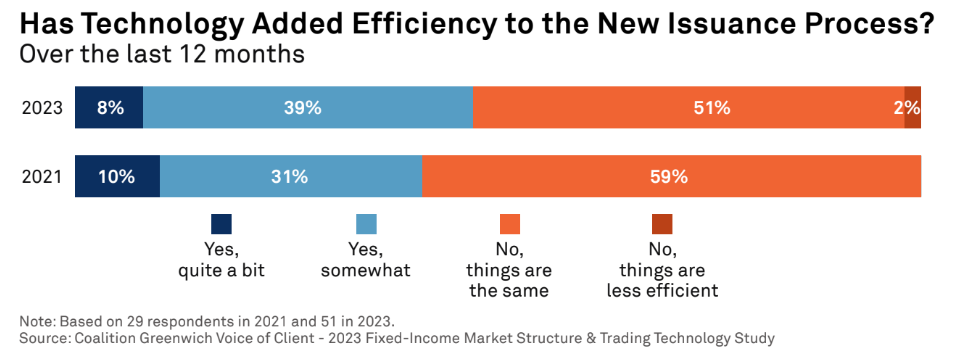

While nearly half (47%) of corporate bond investors feel that technology has made the new issue process more efficient, the mechanics of distributing newly issued bonds remain far less electronic and automated.

That’s according to Coalition Greenwich report The Corporate Bond New Issuance Process: A Buy-Side View, which analysed data on investor trading habits, dealer relationships, technology usage, and other market structure-related questions.

Kevin McPartland, head of research at Coalition Greenwich, said: “The buy side continues to want more from their new issuance management platforms, including OMS integration, access to a broad list of dealers and improved reference data, among other factors.”

Q1 2024 saw the biggest for corporate bond issuance ever, with US$625 billion in debt hitting the market.

While much of this issuance was driven by existing debt coming due in 2025, and by macro factors such as the pandemic, central bank policy, investor demand, and other cyclical trends, the report found that the distribution of the debt has been facilitated by a tremendous move forward in bond market technology.

Competition among technology providers is the primary driver of innovation in the corporate bond market. While there are seven trading venues competing for corporate bond volume, the buy-side’s new issuance management process is dominated by only three: Bloomberg, DirectBooks and S&P (formerly Ipreo). While a single solution that brings together an entire market would help to drive efficiency, the benefits of competition outweigh the single-solution approach, the report suggested.

“The presence of a smaller and more focused DirectBooks competing with the scale and reach of Bloomberg and S&P has created a competitive landscape that will bring end users quicker innovations at lower prices than would otherwise be possible,” McPartland added.

Portfolio trading tools, execution protocols focused on newly issued bonds, better real-time bond pricing, and workflow automation have seen the corporate bond market digest US$200 billion of new bonds per month while trading nearly US$50 billion per day in the secondary market.

Raising the bar

The analysis of market structure changes over the past decade also suggests that recency bias plays a role. According to the report, in 2021, the buy side was primarily focused on order management system (OMS) integration and the ability to express interest/send instructions related to a new deal. The importance of other aspects, such as access to deal documents and trading venue integration, received considerably fewer votes. Two years later, the list of ‘important’ aspects has grown.

“There are several reasons that investors might question the efficiency gains of recent innovation. For example, much of this market is still managed by spreadsheets shared via email and chat,” McPartland adds. “Our analysis of market structure changes over the past decade suggests that when processes get better, trading desks are very quick to raise the bar—meaning today’s inefficient is yesterday’s efficient.”

©Markets Media Europe 2024

©Markets Media Europe 2025