In a Christmassy spirited theme, The DESK considers how the advantages of electronic liquidity provision can support credit markets – and how the reception of liquidity is affected.

When banks stepped back from providing liquidity in bond markets, weighed down by the cost of holding inventory, it left a vacuum. Electronic liquidity providers were able to step in, using one of two models to provide price making without having to hold inventory.

One is to use high speed data feeds from central limit order books (CLOBs) or direct feeds, to identify arbitrage opportunities between bids and offers across cash and futures markets, and then to trade in and out of positions nearly simultaneously, using high-frequency trading (HFT). In fixed income this only really works for US Treasury interdealer markets, which are majority traded on CLOBs and direct feeds. HFT is not viable in a market where prices are too infrequent to support rapid price formation, such as credit.

An alternative model is to provide constant pricing on bonds which are part of an index that is tracked by an exchange traded fund (ETF). As ETFs trade on CLOBs their pricing can be used as a proxy to assess the price of their components on a more continuous basis, and as baskets of these securities can be converted into ETFs and trade on, risk can rapidly be moved off electronic liquidity providers’ (ELPs) books.

This latter model has created better liquidity provision in the credit space, starting at the smaller end of the market, but buy-side traders do have concerns about the way that liquidity is provided by non-banks, and how that can affect both pricing and depth of market.

Impact of electronic trading

In their paper “There’s still a role for voice”, Zornitsa Todorova and Andrea Diaz Lafuente of Barclays’ Thematic Macro Research team, found that electronic trading generally has some major advantages for market participants.

“Controlling for market trends and a wide array of bond attributes, we find that relative to the standard voice protocol, electronic trading reduces transaction costs on average by 20% to 40%,” they wrote.

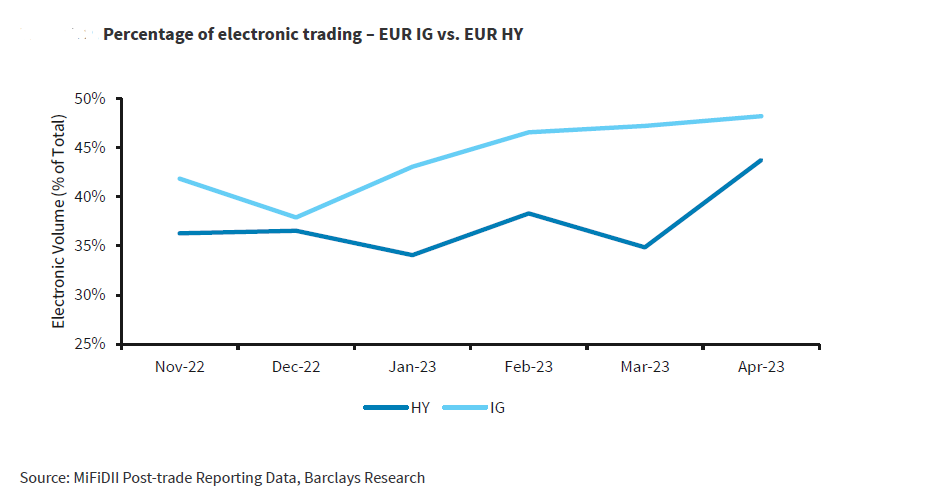

The same paper found that in April 2023, 50% of EUR investment grade (IG) and 41% of EUR high yield (HY) volumes were executed electronically, up from 41% and 37% respectively as recently as November 2022.

Analyst firm, Coalition Greenwich, recently largely found that US credit markets see 44% e-trading in IG and around 30% in HY as of November 2023.

Engagement by electronic market makers is equally hard to gauge today due to the limited nature of disclosure in credit markets, and the dispersed market structure.

One indicator of ELP participation is the level of ETF activity in a market, although that can also reflect the challenges that investors face in illiquid markets. The recent study by Coalition Greenwich found that IG ETF trading volume grew in line with the bond market in October.

“IG bonds are more liquid in general and IG ETFs are conversely less heavily traded than HY ETFs, so increased market volatility translated to increased IG bond e-trading,” the report said. “We see this in the percentage of TRACE activity executed via ATSs as well, where IG ATS volume grew from 7.3% to 7.6% month over month, while HY dropped from 5.3% to 4.6%. In contrast, HY ETF volume was up relative to bond market volume, while HY bond e-trading was flat month over month and down four percentage points year over year. This suggests that given the relatively less-liquid nature of most HY names compared to their IG cousins, market participants are looking to ETFs for exposure in times of higher volatility, rather than the bonds themselves.”

Concern around ELP and HFT support

Where market makers are employing HFT or ELP strategies, one concern from buy-side traders is the depth of liquidity they offer. The perception of bank liquidity is that a bank can absorb losses or make a price on behalf of a client in a tough market, knowing that they can get a bid-ask spread wide enough to cover losses or lean on the relationship at a later date.

The concern is that firms delivering liquidity predicated on immediate risk offsetting may only provide liquidity at a shallow depth, and may remove liquidity rapidly, in certain conditions.

A sudden withdrawal of liquidity has been cited as a trigger in several flash events, in which prices either spike or plummet over a very short period and then return to near previous levels, like a rapid momentum event. These have always been tied to markets which have listed futures on an exchange, historically the CME, but it may be possible that ETF markets could also see similar events.

However, ELPs tend to follow momentum and try and jump in front of it, which can be problematic buy-side traders report, as that can potentially exaggerate movements. As a result in a heavily directional market the impact could be severe.

Nevertheless, the overall perspective on electronic liquidity provision is a positive one; the market abhors a vacuum, and HFT / ELP firms tend to fill one.

Price and good fill to all traders.

©Markets Media Europe 2023

©Markets Media Europe 2025