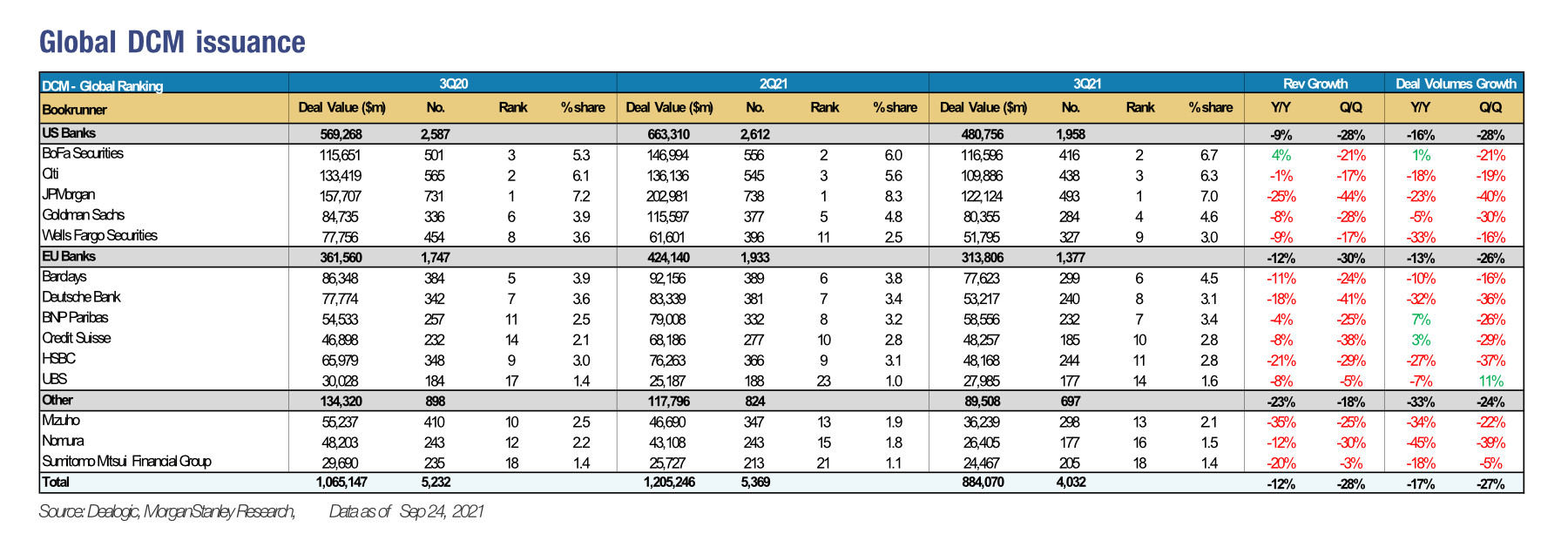

In the bond issuance markets, there have been a few subtle changes in the top five most successful banks for syndication, and less subtle change further out, according to data from Morgan Stanley and Dealogic.

JP Morgan has kept its Number 1 rank for global debt capital markets issuance, with a deal value of US$122 billion for 493 deals in Q3 2021. Yet Bank of America Securities has increased its own position from Number 3 to 2 between Q3 2020 and Q3 2021, pushing Citi out of the contender position in the top five. Morgan Stanley has fallen from 4 to 5 As Goldman Sachs has increased its own level from Number 6 to 4. That has edged out Barclays to 6th position.

All the while BNP Paribas, who did half the value of deals in Q3 2021 to JP Morgan by value and less than half by number has increased its position from 11 in Q3 2020 to Number 7 in Q3 2021. Credit Suisse has also moved into the Top 10 in that period, while HSBC was pushed out to Number 11.

Primary markets is not only key to the supply of liquidity for traders, and to capital for borrowers, it delivers a vital revenue stream for the banks themselves. Engagement in primary markets has been a major driver of revenues and typically predicates a market making position in an issued security as the bank knows where to find inventory.

The relatively fixed positions of the big banks in the top five create confidence amongst traders in their capabilities and services. But tracking the banks which are moving significantly in the right direction also provides guidance on who might have inventory at a time when access to liquidity is tight.

©Markets Media Europe 2025