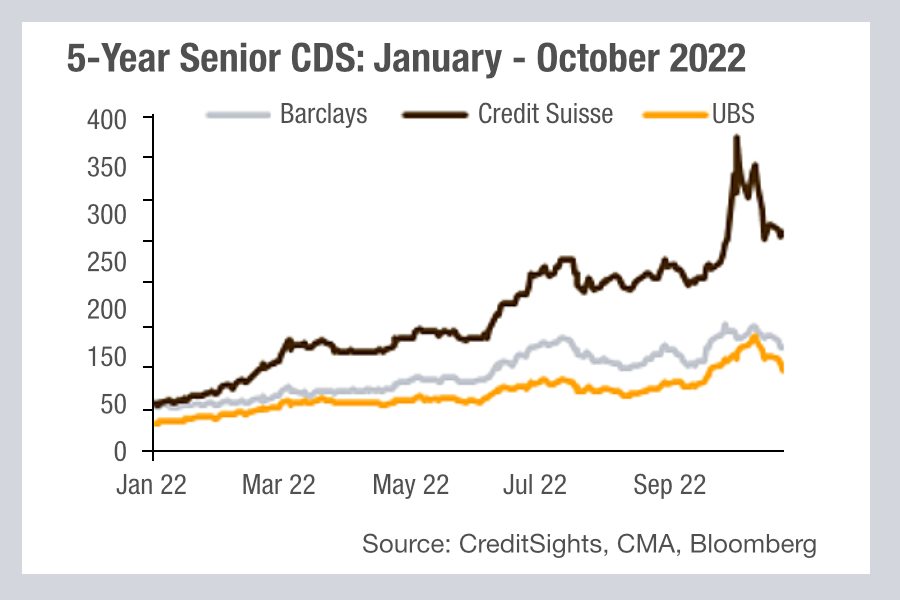

Looking at data provided by CreditSights, we can see the extent of lenders’ concern about Credit Suisse this year. The cost of insuring Credit Suisse’s debt may not strike one as an issue for traders, as much as portfolio managers seeking to hedge their exposure to the Swiss bank’s debt.

However, the divergence from its peers is also signalling another metric – that of confidence.

In the firm’s Q3 results announcement the bank alluded to investor reaction to “negative press and social media coverage based on incorrect rumours” which led to a major loss of deposit and assets under management.

Although outflows stabilised, in secondary markets the bank’s trading counterparties are also conscious of the bank’s position.

When a bank becomes a concern, even if far from danger of default, there are other considerations that need to be made. This includes its ability to support trading in less liquid asset classes which require the use of balance sheet, and the impact that reduced investor flows from private clients might have on its typical liquidity profile.

While one investor might have confidence, what matters more is the liquidity flow that the bank is provided with by its totality of buy-side clients.

The market has seen banks pulling away from liquidity provision when they are in a stable position, in order to limit risk exposure. A firm that is struggling with withdrawals and lower trading activity may have even less capacity. For traders, it will be important to assess how Credit Suisse pulls itself out of this vicious circle.

©Markets Media Europe 2025