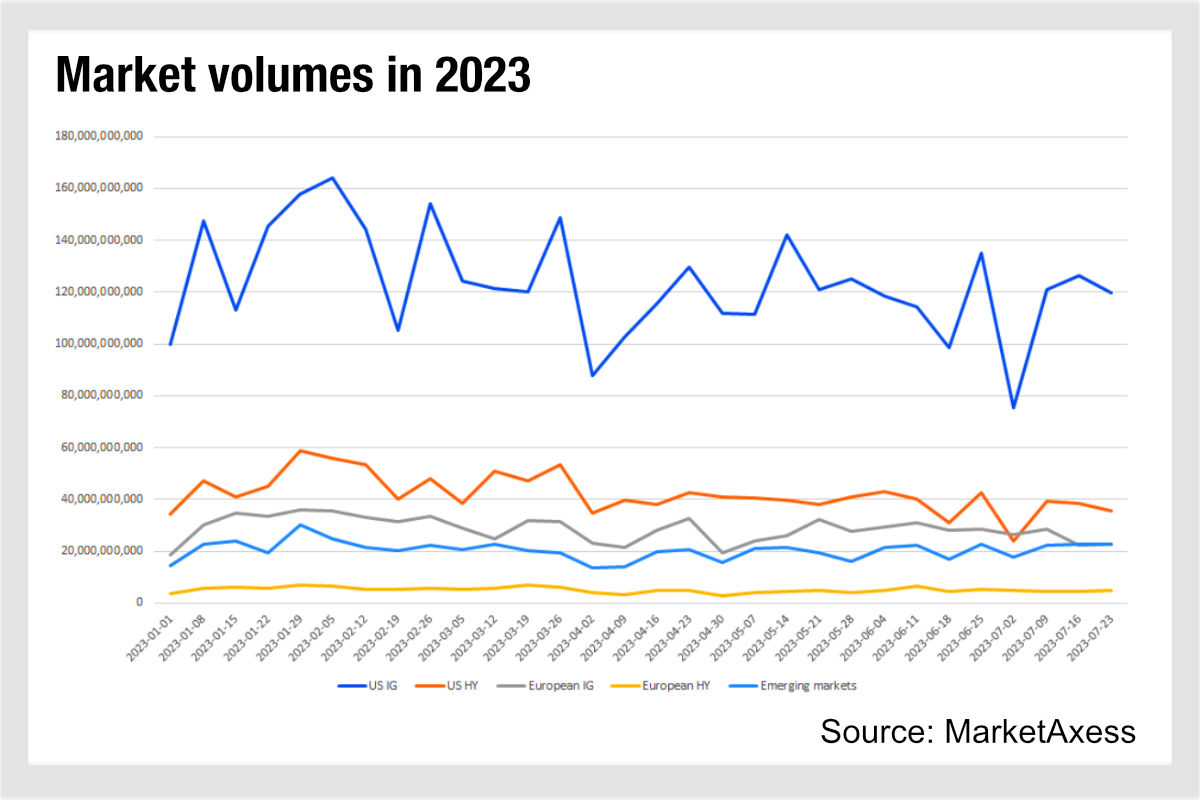

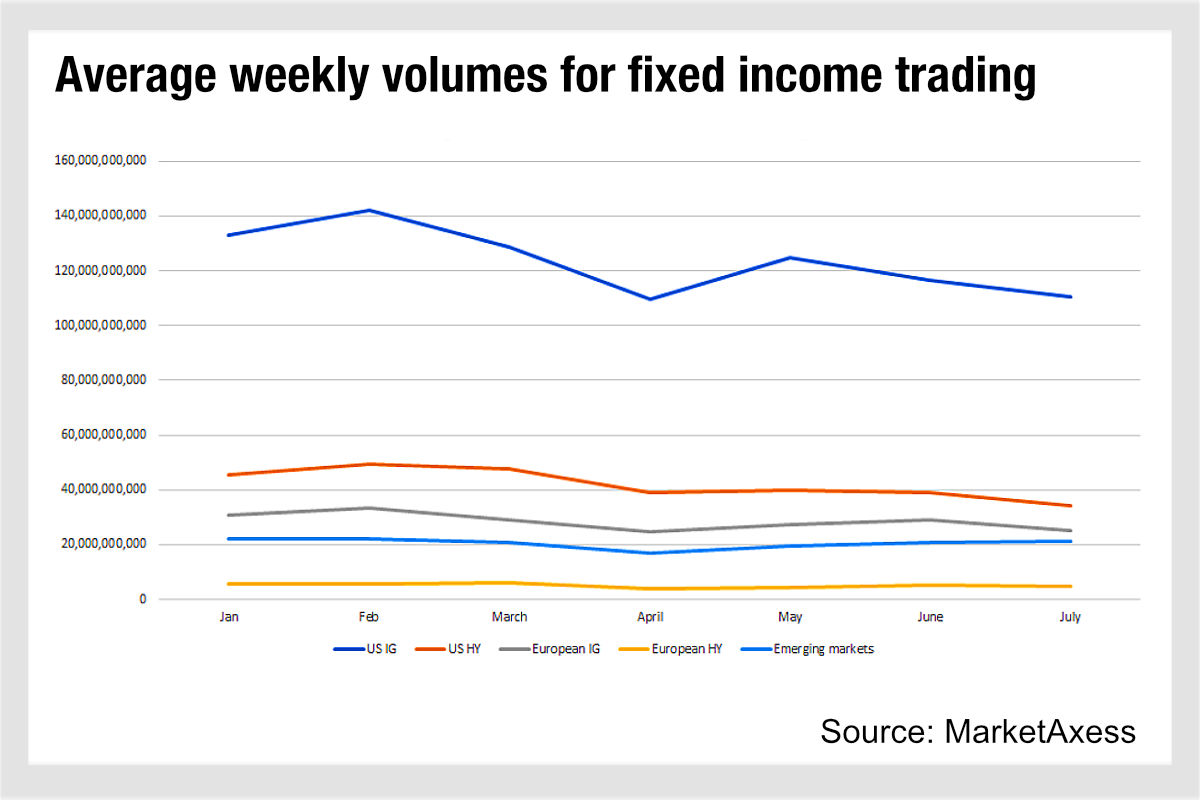

Trading volumes in fixed income markets typically start the year high and gradually fall, matching issuance and refinancing patterns along with investment allocation decisions.

However, that is not true across the board. Looking at data from MarketAxess Trax, which tracks trading across multiple markets and counterparties, we can see that by late July, US investment grade bond trading has fallen nearly 17% since the start of the year, from an average weekly volume of US$132 billion in January to US$110 billion by July.

US high yield (HY) has fallen harder, hitting a lull in early April and flattening out, then starting to tumble a little in June. Having started at a weekly average volume of US$45 billion in January it fell nearly 25% in July to US$34 billion and peaked in February at US$49 billion.

In Europe, investment grade and high yield credit both saw declines of 18% and 19% respectively between January and July, much in line with US credit. However, emerging market bond trading has declined just 3.5%, barely a drop compared with developed market trading. This may well reflect the high spread on EM bonds to other markets, with central banks having pushed rates higher and faster in Latin America, for example, than in the US and Europe.

Consequently, with inflation not being so rampant in EM countries as in many developed markets, hard currency bonds can be found with double-figure returns, while low single-figure inflation makes the risk of a recession far lower than in the UK, for example.

At the same time, emerging markets with distressed debt such as Pakistan and Sri Lanka have seen far better performance this year than last, driving up investor interest.

©Markets Media Europe 2023

©Markets Media Europe 2025