The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich. A Barclays report using Propellant technology found that in April 2023, 50% of EUR investment grade (IG) and 41% of EUR high yield (HY) volumes were executed electronically, up from 41% and 37% in November 2022. Analyst firm Coalition Greenwich has tracked US corporate bond market activity and most recently found that electronic IG trading accounted for only 43% of activity, and for HY it was 31% The difference between the markets is curious in some respects.

The US is often the first market in which electronic trading protocols are deployed, giving it a longer lead time to develop e-trading volumes. The US market is also more homogenous making it simpler for a bank to deploy an electronic trading platform which supports multiple clients with a standardised interface. However, speaking with traders and market operators, there are also some key structural elements of European credit markets that do explain the acceleration of electronic trading.

The first aspect is the number of counterparties available. Buy-side traders note that European markets have a wider range of sell-side firms engaged in bond issuance than US markets. As those firms are then making markets in bonds, there is a greater dispersion of liquidity providers which increases competition. That reduces the pressure to trade with larger banks on a relationship basis, and encourages trading in competition (In comp) as opposed to picking a single counterparty to trade with (non-comp).

Secondly, some traders note that the allocation of bonds in primary markets has been segregated from secondary trading more effectively in European markets through the application of ‘best execution’ rules to fixed income, which have encouraged traders to apply a quantifiable measure of trading quality and a separation of buy-side trading and investment decision making through regulatory obligations in Europe. This point is less clearly supportive as credit trading is not paid for by commission, as it is in equities, and so the costs of trading have been less easily separated from investment performance.

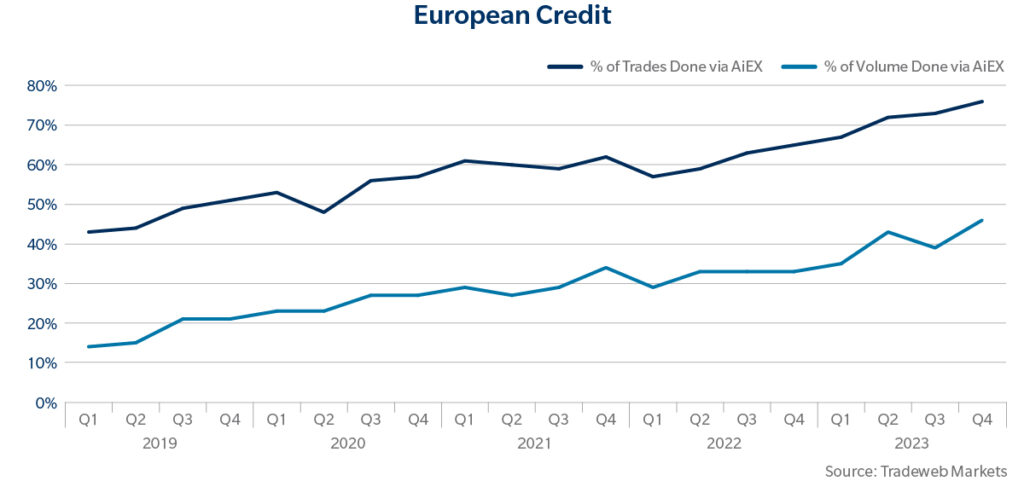

A third driver is the level of electronic engagement that has been generated via the use of new e-trading protocols. James Dale, co-head of international developed markets at Tradeweb, says, “Portfolio trading is becoming increasingly institutionalised, and we now have 20 dealers providing liquidity for European credit portfolios. There has been a build-up of engagement and technology investment across the sell-side to drive the trading of portfolios. This has resulted in more competition between those dealers, which has meant that clients are the ultimate winners, because they are getting better quality of execution.” Mike Roffey, head of credit Europe at Tradeweb, says, “In Europe and the UK, we see a lot more clients who are multi-asset, whereas in the US, these tend to be more buy-side credit only funds and traders.

Traders have become more familiar with different ways of trading and dealer selection tools, and are keen to adopt different types of execution protocols to achieve their trading objectives. Multi-asset firms are trading a variety of asset classes in the same packages via lists or portfolio trades. The automation of trading which has been supported by both electronic trading venues and technological developments on the sell side is allowing faster pricing of trades.

“Auto quoting abilities that dealers have in place now mean there is more systematic market-making happening, and that gives clients a better experience,” says Dale. “That’s something we continue to see into month-end, which is a large amount of portfolio trading. Buy-side clients are achieving high quality and certainty of execution across a wide variety of bonds. That in turn drives more e-trading activity.” Perhaps counterintuitively, the lack of a consolidated tape could also be a driver towards greater electronification in Europe, as some data providers see buy-side firms using a greater amount of pre-trade data in their selection process than in the US.

“In Europe and the UK, quite a number of asset managers are very selective in their dealer choice,” says Roffey. “We spend a lot of time on our pre-trade content; the axes, indicative prices and firm prices that have been posted through to the platform. That allows clients to be better informed very early on in the actual execution process. Unlike the US where there isn’t as much pre-trade data outside of TRACE.

So US clients are generally going to a wider audience than in Europe, where you don’t need to go to a wider dealer group to achieve best execution. You can keep it small, because you know three, four or five dealers have a genuine interest to trade on that side of the market you are looking to trade, and then expand mid-flight on the enquiry if you need to.”

©Markets Media Europe 2024

©Markets Media Europe 2025