Howard Cohen, Head of Leveraged Loans at MarketAxess.

Since early April, the leveraged loan market has trended in one direction. Risk assets have continued to sell off this week, as Fed Chair Powell was firm in his commitment to get inflation under control, even to the extent that there may be some pain involved. Along with increased volatility, bid offer has widened materially creating more friction around trading.

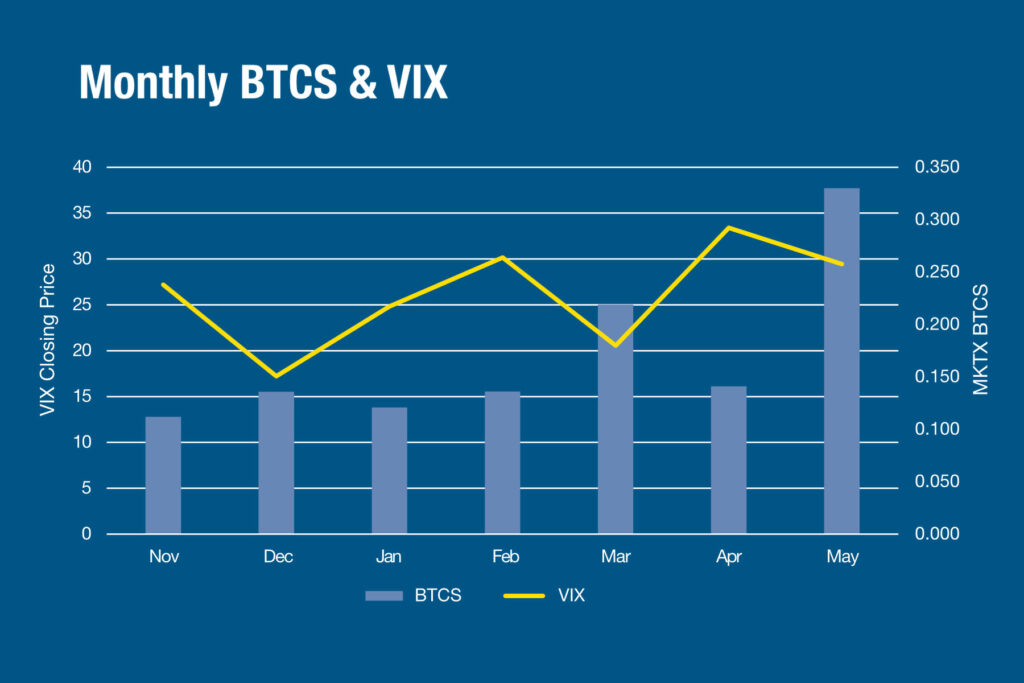

The increased cost of trading has encouraged investors to source liquidity from multiple dealers and lean into trading loans electronically. May is a top 3 leveraged loan volume month on the MarketAxess platform. The Best to Cover Savings (BTCS), a measure of clients’ savings observable in electronic trading, more than doubled to 33 cents from 14 cents in April. As the dealer community pulls back on taking risk, the notional ticket size for electronic trades continues to grow month over month

While electronic trading of loans is not for every trade, our list trading functionality offers a more streamlined process to execute multiple line items efficiently. Other benefits of moving from antiquated methods to trading loans electronically on MarketAxess include transparency and order management connectivity. Additionally, the recent volatility coupled with the material BTCS also continues to drive new client adoption in the loan space.

Visit our product webpage to learn more.

©Markets Media Europe 2025