144A and Regulation S (Reg S) securities have distinct regulatory backgrounds and key differences. Liquidity measures such as Bid-Ask spread and post-issuance volumes in bonds across these offerings can vary widely for otherwise identical bonds. By Grant Lowensohn.

Highlights

• Liquidity measures such as Bid-Ask spread in 144A and Regulation S (Reg S) bonds across markets can vary widely for otherwise identical bonds.

• Reg S and Rule 144A securities have distinct regulatory backgrounds and key differences.

• Issuers wanting to maximize buy-side engagement may want to consider the likely liquidity profile of a bond.

Reg S and Rule 144A offerings

• Rule 144A and Reg S provide safe harbors from registration of securities under the U.S. Securities Act of 1933.

• Rule 144A permits resales of unregistered securities in the U.S. to “Qualified Institutional Buyers” or QIBs. An issuer utilizes an initial purchaser who purchases the securities from the issuer and resells them to QIBs in transactions that comply with Rule 144A. QIBs may freely re-sell securities offered and sold under Rule 144A to other QIBs in the U.S. under • Rule 144A or offshore under Reg S, subject to certain conditions.

Regulation S allows, under certain conditions, for the offering, sale, and re-sale of securities to in offshore transactions without any directed selling efforts in the U.S.

• A security can be offered and sold simultaneously under both 144A and Reg S, which would open trading both to foreign investors and US-based QIBs.

A marked difference in historical liquidity profiles of Reg S and Rule 144A bonds may have an effect on investor appetite and access. Both rules above alleviate some disclosures typically required for registration, so this may lead to cheaper and quicker access to capital.

Matching offerings across registrations

If a security is issued under both Rule 144A and Reg S, holders can exchange between the two types of bonds. For the following analysis, 144A and RegS bonds were considered “matched” when each bond had the same issuer, maturity, coupon, and issue date.

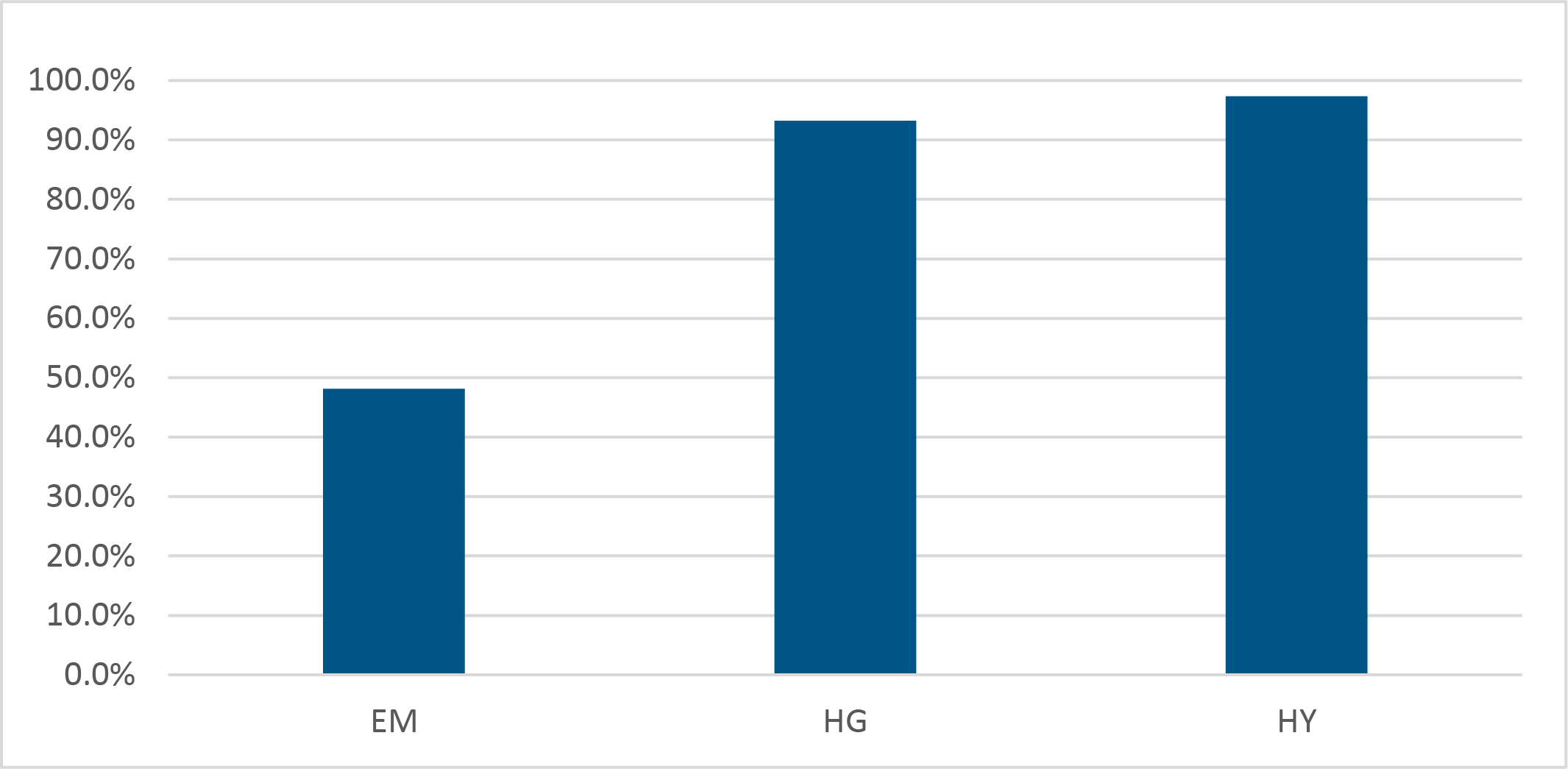

In nearly every scenario, the presence of a 144A bond will portend a corresponding Reg S counterpart. However, the inverse is not always true. The chart below shows the share of RegS issuance that has a matching 144A bond, as a percentage of total amount outstanding. 48% of Reg S bonds classified as an emerging markets bond had a corresponding 144A bond that appeared on TRACE, whereas more than 90% of high grade and high yield bonds were matched as a percentage of amount outstanding. This illustrates that for EM issues, Reg S-only issuance is a very common practice. For all other cases, a significant amount of overlap exists.

Match Rate as % of Amount Outstanding (Reg S)

Liquidity analysis

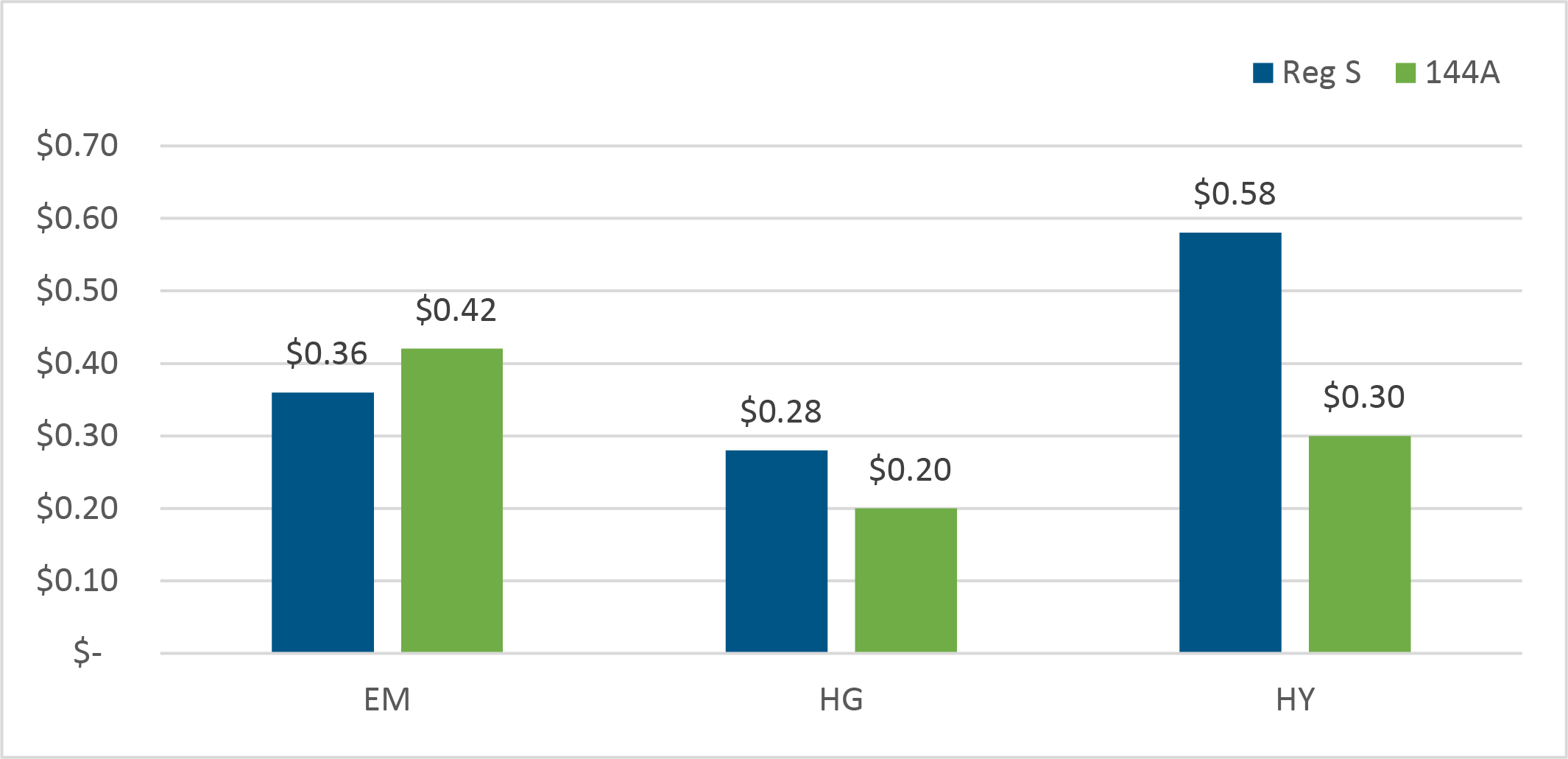

Bid-asks spreads can be used as a proxy for liquidity or the value of a security. We can therefore compare the difference in Bid-Ask spreads across Rule 144A and Reg S bonds from the Composite+™ (CP+™) pricing algorithm (shown below). Going across the selected markets, CP+ Bid-Ask spread is noticeably higher for Reg S bonds in the High-Yield and High-Grade markets, with a difference of $0.28 and $0.08 respectively, but the inverse is true when looking at Emerging Markets, with 144A bonds having a larger CP+ Bid-Ask spread by $0.06.

Median CP+ Bid-Ask Spread

Entry and exit liquidity

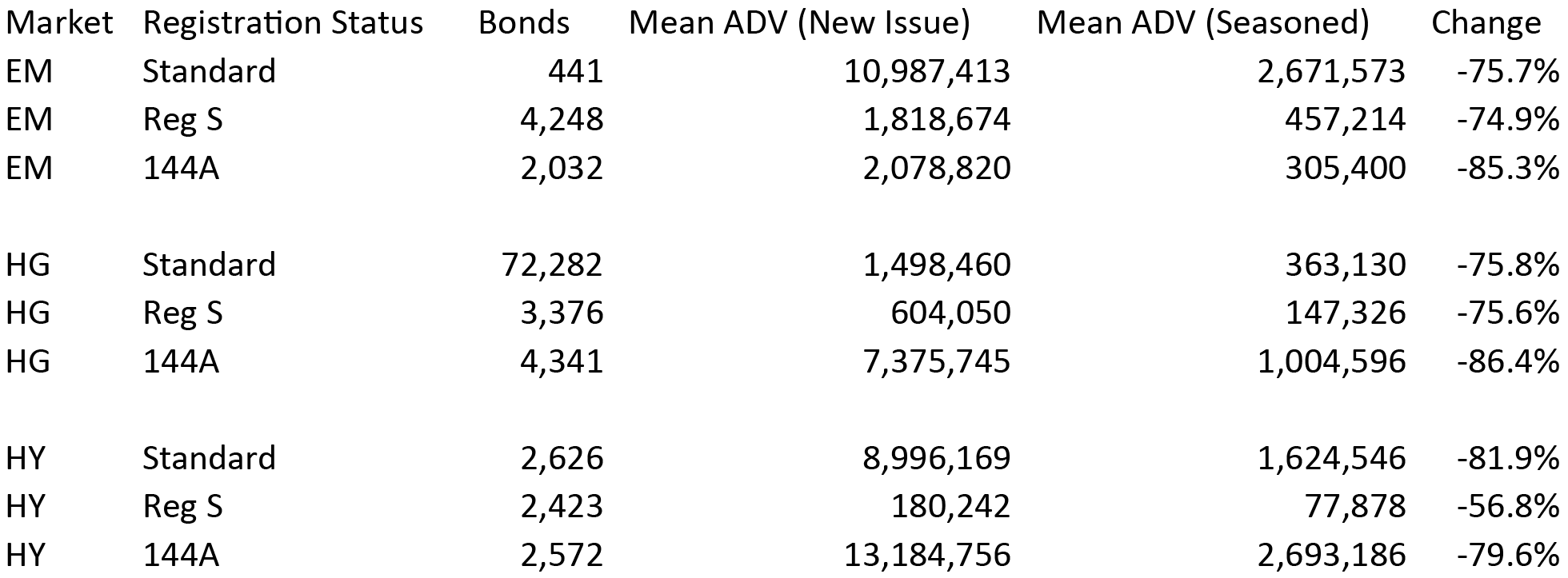

Liquidity can also be assessed based on trading volumes. A key point for traders and issuers to consider with these bonds is on- vs off-the-run liquidity. Put simply, is there sufficient liquidity to exit a position in the future that is taken today? The potential to move into and out of positions can affect the level of market making activity that is supported by dealers. It may also affect investors comfort in acquiring bonds, especially during volatile periods. The below chart compares TRACE volumes in the first 50 trading days after issue date vs the rest of a bond’s life, by market and bond type. As expected, there is some level of decay in all cases. We can see that volumes fall most sharply for 144A offerings in HG and EM. This perhaps suggests a “buy and hold” philosophy for some investors in these securities and indicates that liquidity at a future point in time may be harder to come by. For HY, Reg S bonds actually appear to sustain volumes more consistently than standard issues.

Footnotes

The overarching universe for the above is every 144A/Reg S bond that has appeared on TRACE between start of 2020 and end of 2022.

For questions or follow-up, email our data scientists:

©Markets Media Europe 2025