An ominous sign in Europe’s secondary markets for dealers, as volumes remain in the doldrums.

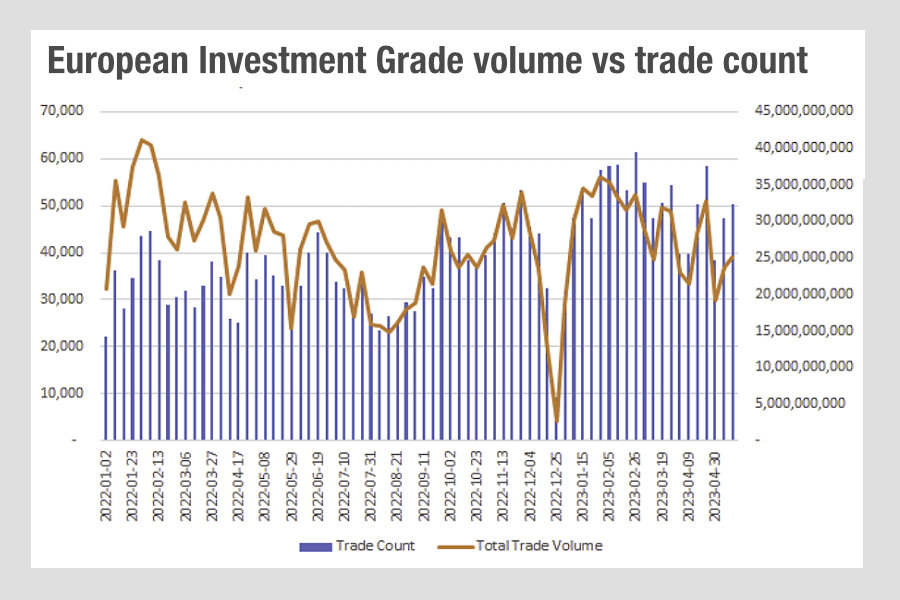

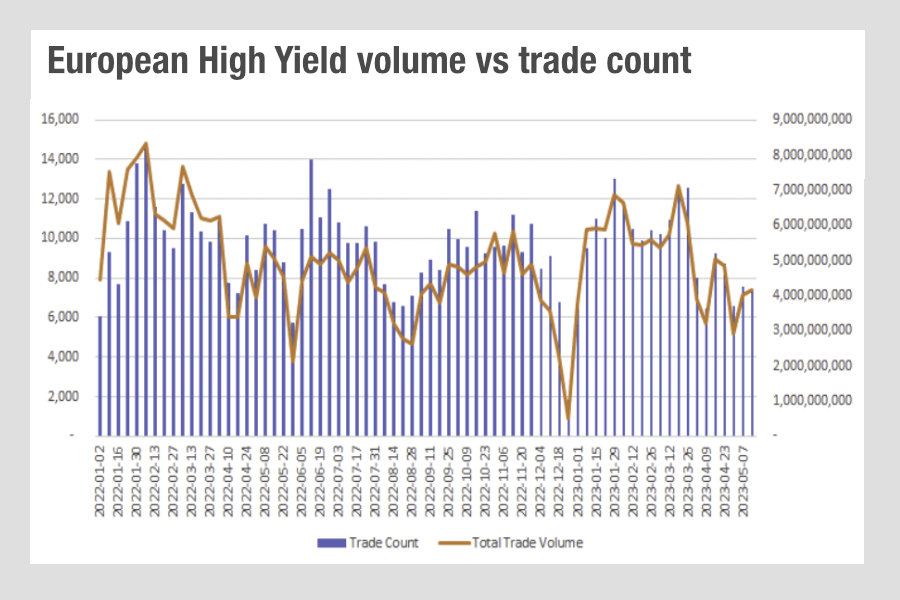

Anecdotally, buy-side firms report volumes are up to 20% down with liquidity having been challenging. Looking at data from MarketAxess Trax, which tracks trading across multiple markets and counterparties, that is harder to clearly distinguish. Across investment grade (IG) and high yield (HY) net notional volumes in April and May to date have been higher than in 2022. Nevertheless, with trade counts up relative to volume we can see that larger trades are becoming fewer and that suggests a greater number of trades are being pushed out at the bottom of the liquidity waterfall i.e. as odd lots to clear out dealers’ holdings, rather than as blocks intended to provide natural liquidity to other market participants.

We know that the exchange-traded-fund (ETF) market makers are mopping up liquidity providing in these smaller sizes. We are also seeing bid-ask spreads falling. This may indicate lower liquidity costs for buy-side traders, but the implications for the sell side are clear; trading does not look very profitable.

Sell-side desks will need to be incredibly efficient to make money in this market. One French bank has had a knock-out quarter delivering old-fashioned risk taking to make itself a buy-side favourite and winning a good return, while others have had a tougher 2023. Dealers will need to consider how they engage with trading venues, with clients directly and in market making operationally in order to step up to client demands, while making a decent return.

©Markets Media Europe 2023

©Markets Media Europe 2025