Faced with the prospect of climbing rates, some investors will be looking to switch out of lower coupon bonds to capture higher returns. However, investors need to consider the impact that trading costs may be having upon their portfolios as these are typically not evenly distributed between different types of bonds.

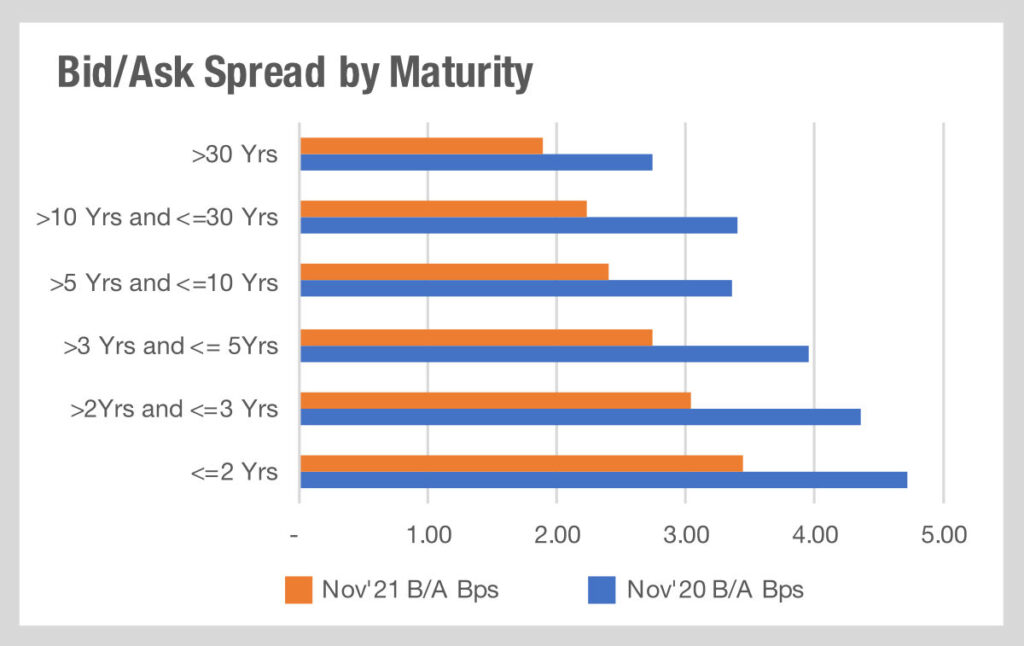

The first difference is in tenors. Analysis of trading costs, based on MarketAxess data, shows that longer-dated bonds have a wider bid-ask spread than shorter dated bonds. Consequently a portfolio manager seeking to manoeuvre during a sell-off, for example, will find that they are hit much harder by the costs of trading if they are holding 10-year bonds (see above) than sub 2-year bonds, with a difference of US$0.32c between them

When trading a million dollars of a bond, US$0.32c per hundred equates to US$3200 per million. At just US$0.04c to trade the short end, there is a considerably lower cost for trading shorter dated fixed income securities.

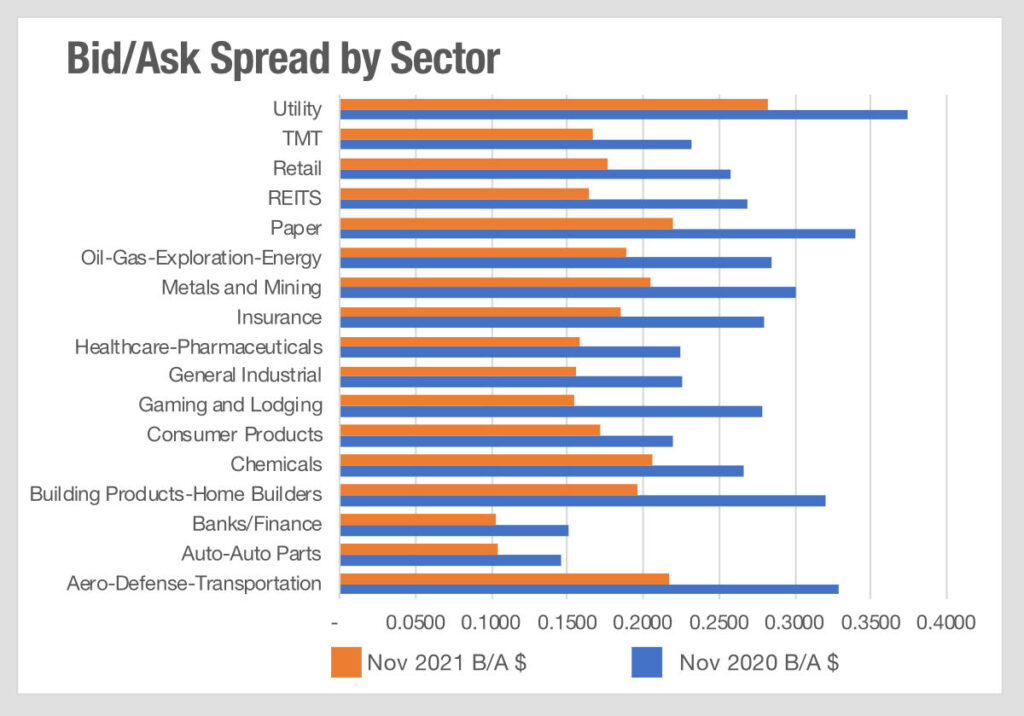

There are also notable differences between sectors (as below), with banks and finance trading at US$0.10c per hundred and utilities hitting US$0.28c by comparison.

For trading desks with the resource to support specialists down to the sector level, this level of information may be easy to access, but with buy-side desks increasingly facing resource constraints, this can show the value of data to support the decision making process for traders, and the level of support they can feed back to portfolio managers.

On desks that are driving multi-asset traders to handle fixed income as a whole, there are real benefits to decision support tools and analytics which may help assess how significant turnover in a specific portfolio might be by adding to cost.

©Markets Media Europe 2025