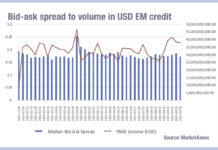

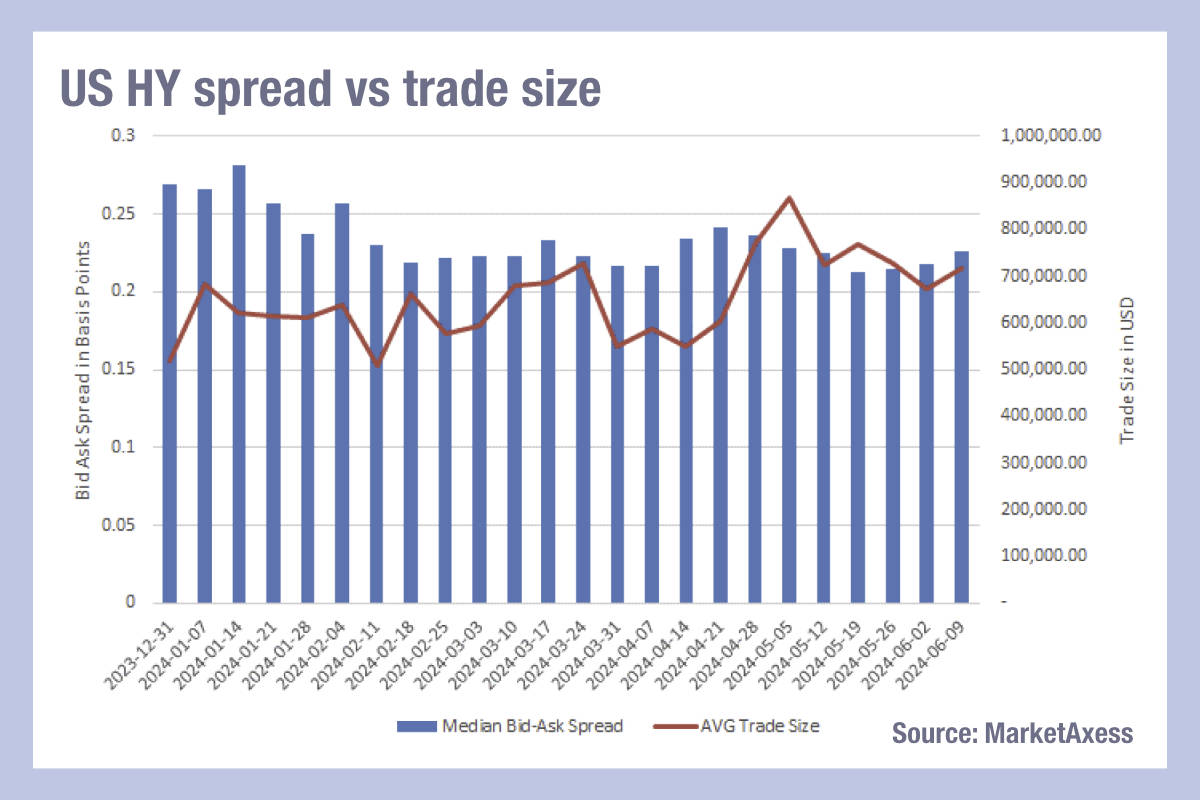

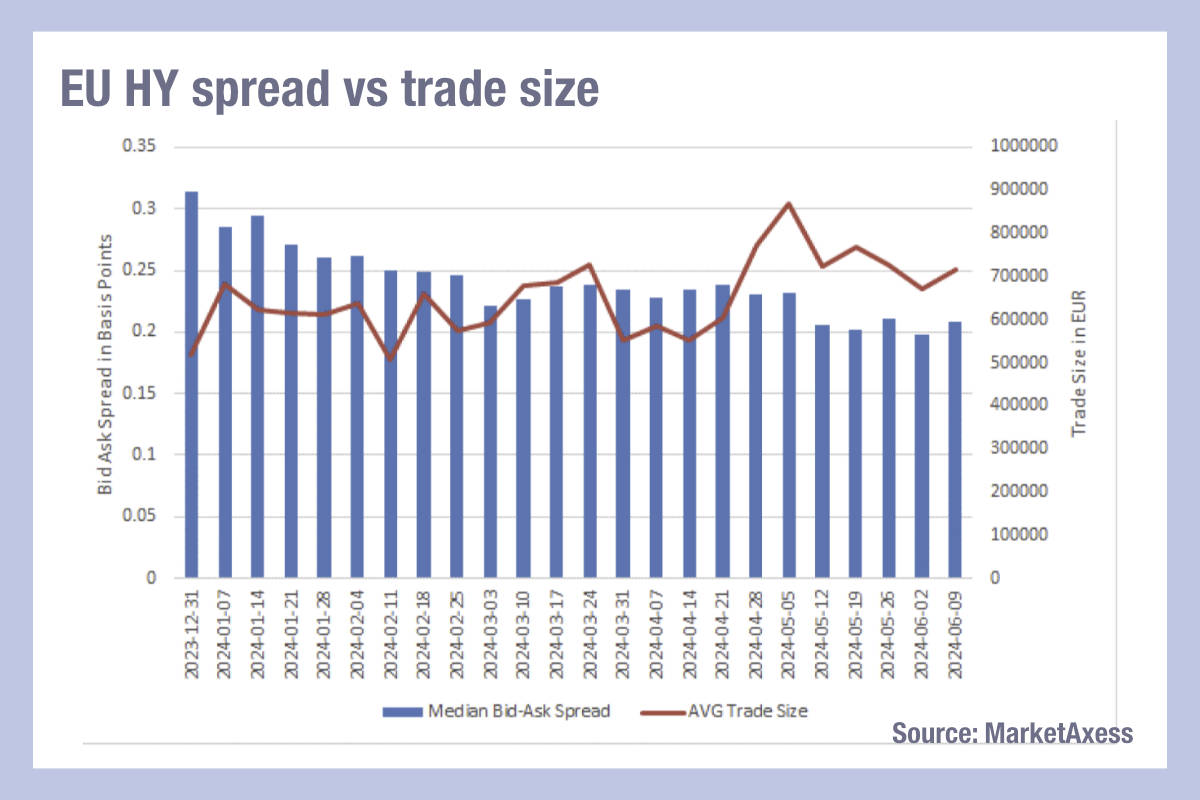

Two weeks ago we noted that high yield markets have seen trade sizes increase since the start of the year, running counter to the trend in investment grade debt, the larger part of corporate bond markets, which has seen trade sizes fall.

To be clear, anecdotally we hear that liquidity is largely improving, but engaging in high yield markets is typically more challenging, as dealers are less keen on making prices for less liquid, high risk debt in smaller sizes.

The good news on high yield is that although trade sizes are rising, we can see from data supplied by MarketAxess TraX and its CP+ pricing tool, bid-ask spreads are falling, in a pattern that suggests a positive correlation between the two.

Although electronic trading is often characterised by low value, high volume trading, the correlation seen in the data adds credence to the idea that portfolio or block trades are enabling a lower cost of trading for HY bonds

PT lets dealers price these lower liquidity bonds alongside more liquid bonds and therefore reduce the cost of trading. Blocks allow a set of bonds to be traded with minimal market impact – and are often better priced though non-comp trading.

Which of these methods is most prevalent currently is hard to determine, but given the notable rise of portfolio trading in US market, where at points it broke the 10% mark at the end of April, correlating with the largest spike in HY trades.

©Markets Media Europe 2024

©Markets Media Europe 2025