While the effect of an election on the markets is typically subdued on the day itself – more so when the outcome is uncertain – there was a very marked difference in trading activity between European markets and US markets in the run up to the US election today.

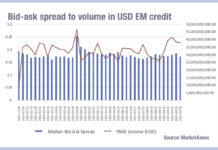

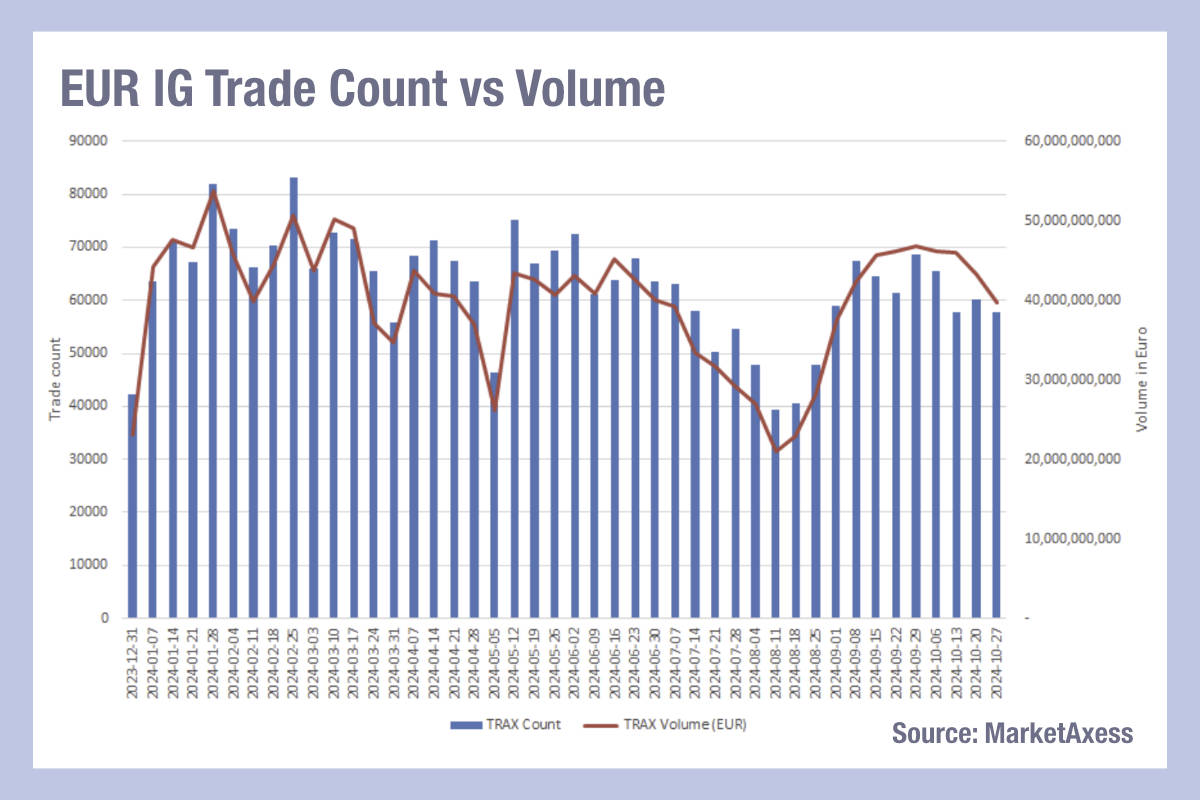

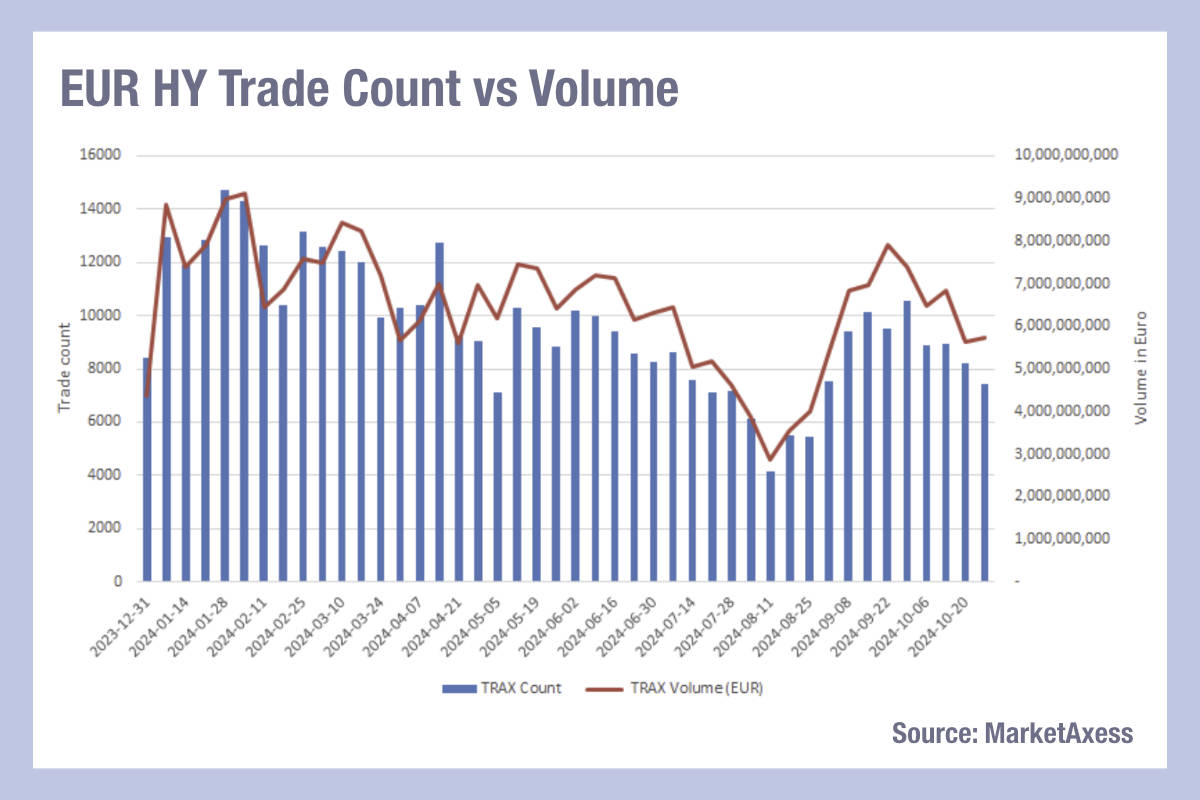

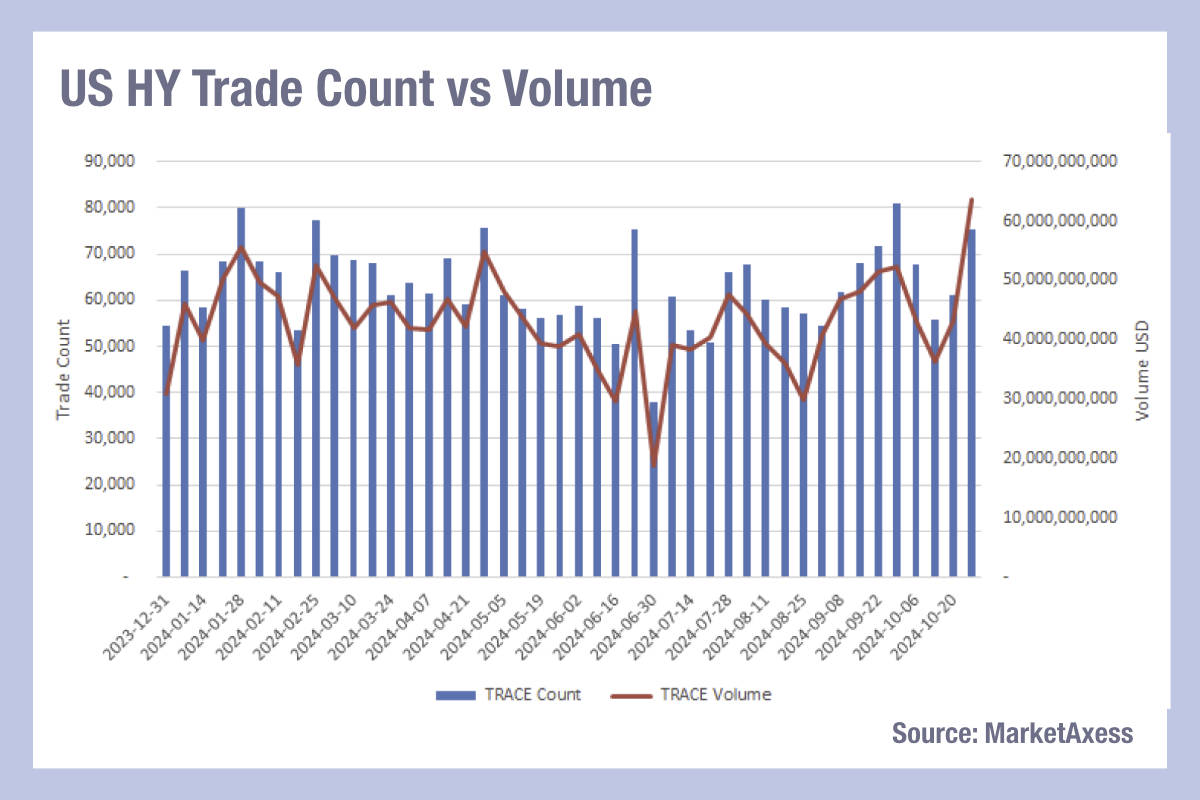

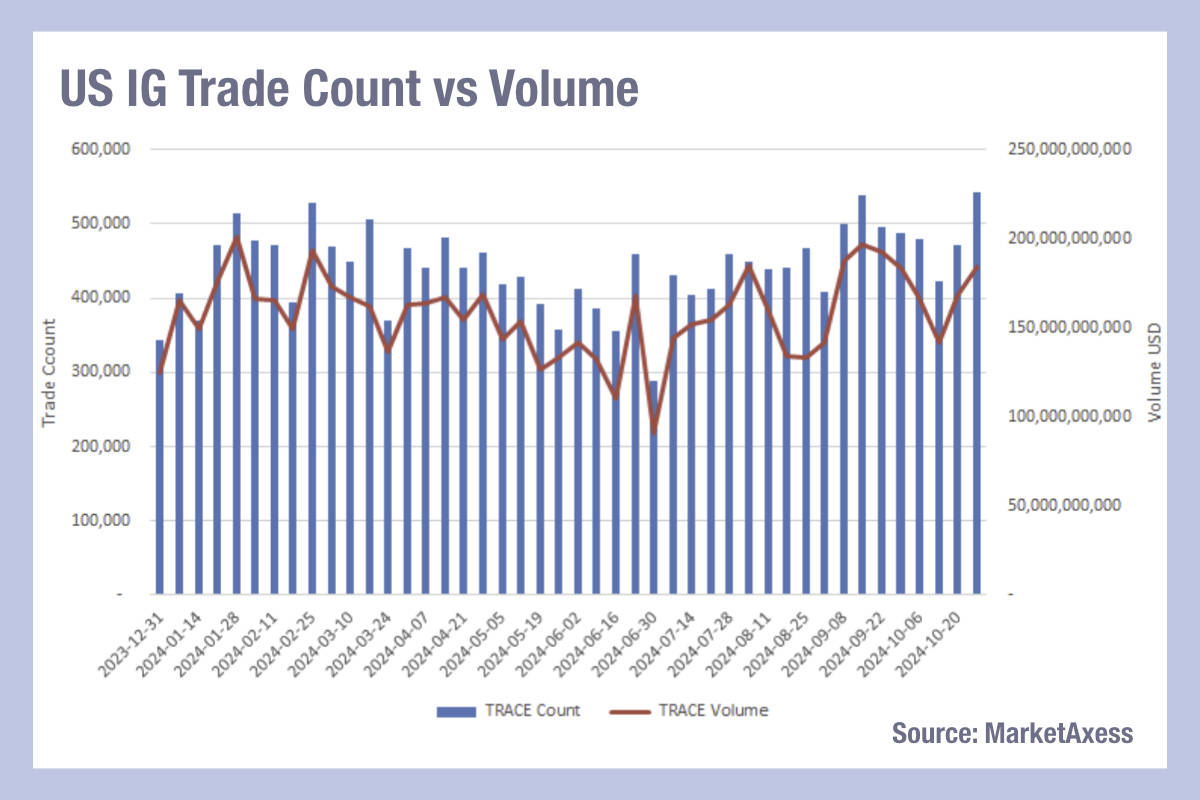

Looking at MarketAxess’s TraX and TRACE data, we can quite clearly see trading in Europe began to peak in mid-September after bouncing back from the summer lull.

Investment grade (IG) European credit volume plateaued at that point, all the way through October before declining steeply at the end of the month in volume, with trade count reflecting a less linear pattern, bouncing range-bound between an average of 6-7000 per week across the previous two months.

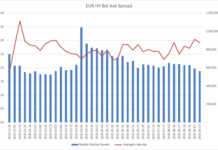

European high yield simply dropped after early September falling below the pre-summer period in trade count notably, and to a lesser extend in trade volume. This may reflect a greater number of larger risk trades being placed to position ahead of the 5 November election.

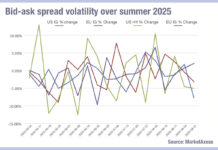

The US has seen a very different profile of activity. HY trading has been characterised by choppy volumes all year, and saw a limited decline in trading over the summer period. The greatest contrast over the past month has been the extended trading volumes which have reached the highest this year coming into the election, hitting US$63 billion in the week of 20 October, up from US$30 billion in the first week of the year. Trade count was in the top five weeks of the year.

For investment grade, which has been equally choppy, it is trade count that has hit record highs as the election neared, while trading volume was elevated but within the peaks found across the rest of the year.

With bid-ask spreads remaining low across all four markets, according to MarketAxess CP+ pricing data, it seems evident that the trades are not forced, which might be accompanied by a tightening or widening of spreads indicative of a big directional move, but are natural liquidity reflecting strong positioning around risk management.

©Markets Media Europe 2024

©Markets Media Europe 2025