Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to MarketAxess data from its CP+ pricing tool and TraX, which tracks activity across markets.

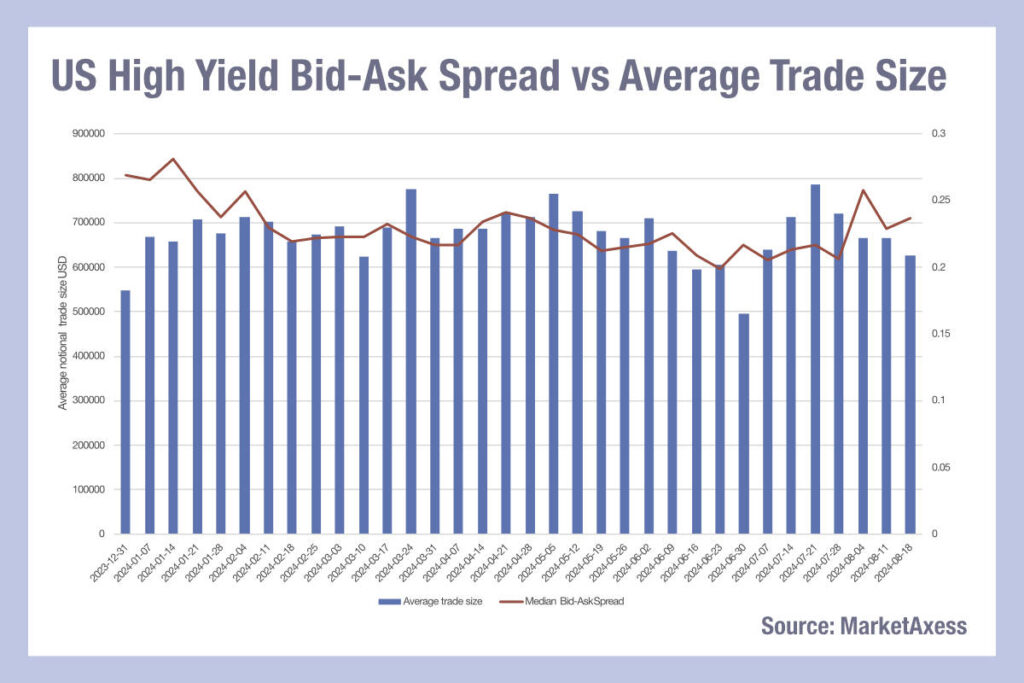

In the US, we have seen the median bid-ask spread decline – quickly, then slowly – heading into summer, before rising steeply in August. At the same time average trade sizes have fluctuated throughout the year, with no clear pattern.

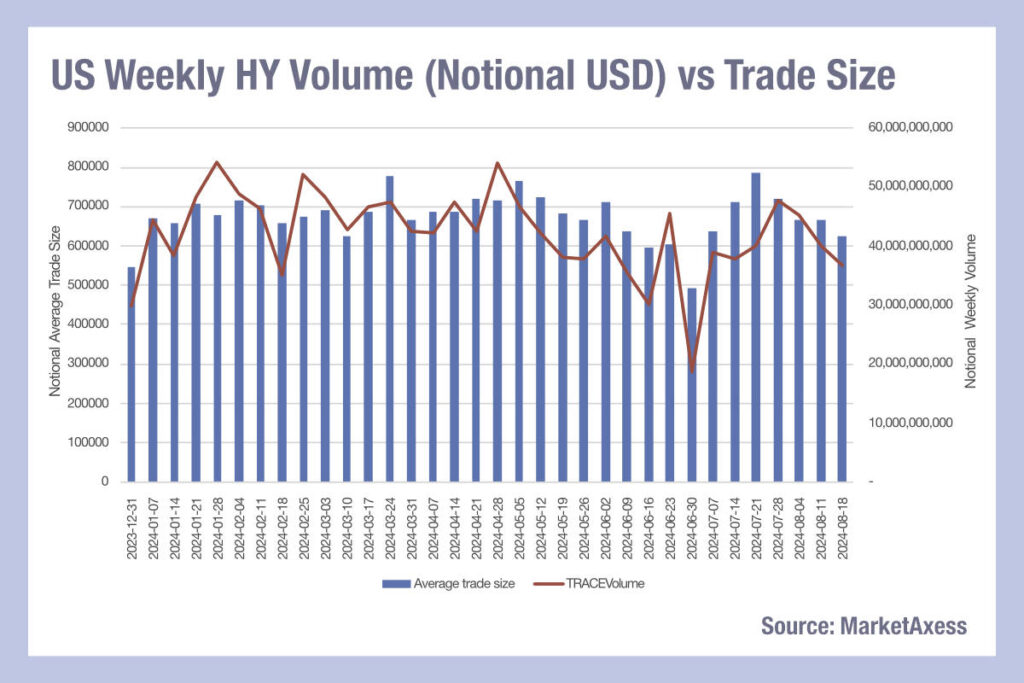

If we compare trade sizes with trading volumes in US high yield, we can see a far tighter correlation, suggesting perhaps that trading in a size to match overall trading volumes is being used to try and reduce market impact, while smaller bid-ask spreads are reflecting larger trade sizes, and therefore pricing is rewarding larger risk positions being placed with dealers.

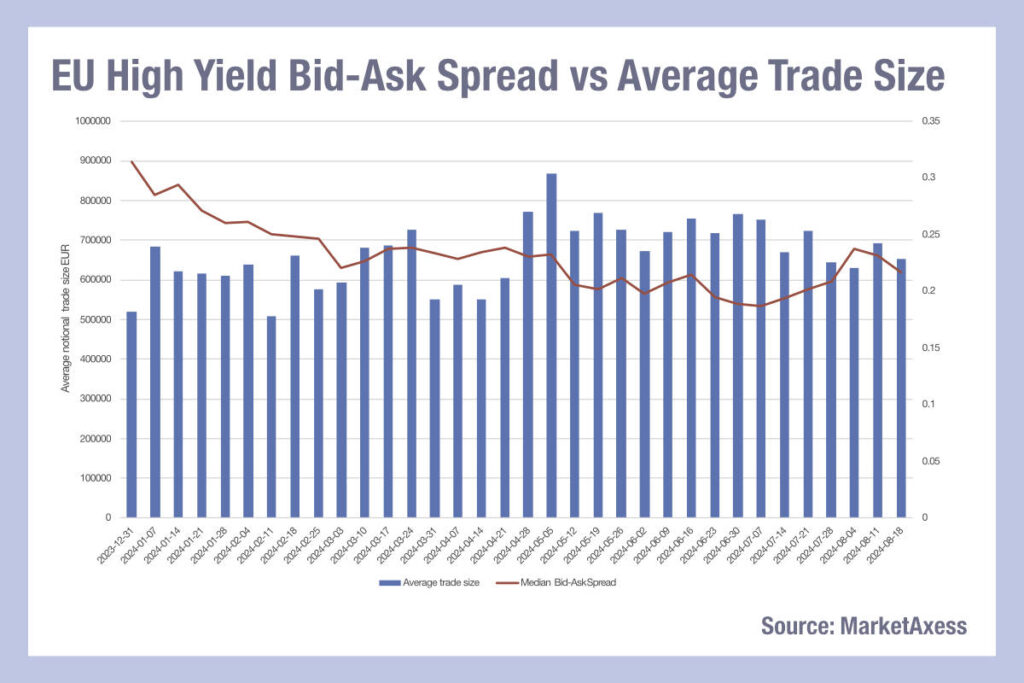

In European markets, median bid-ask spreads fell more steeply, with only a slight, temporary bump up in August, before reverting to trend. Average trade sizes have been increasing during the year, to mid-July 6, before declining slightly in mid-summer.

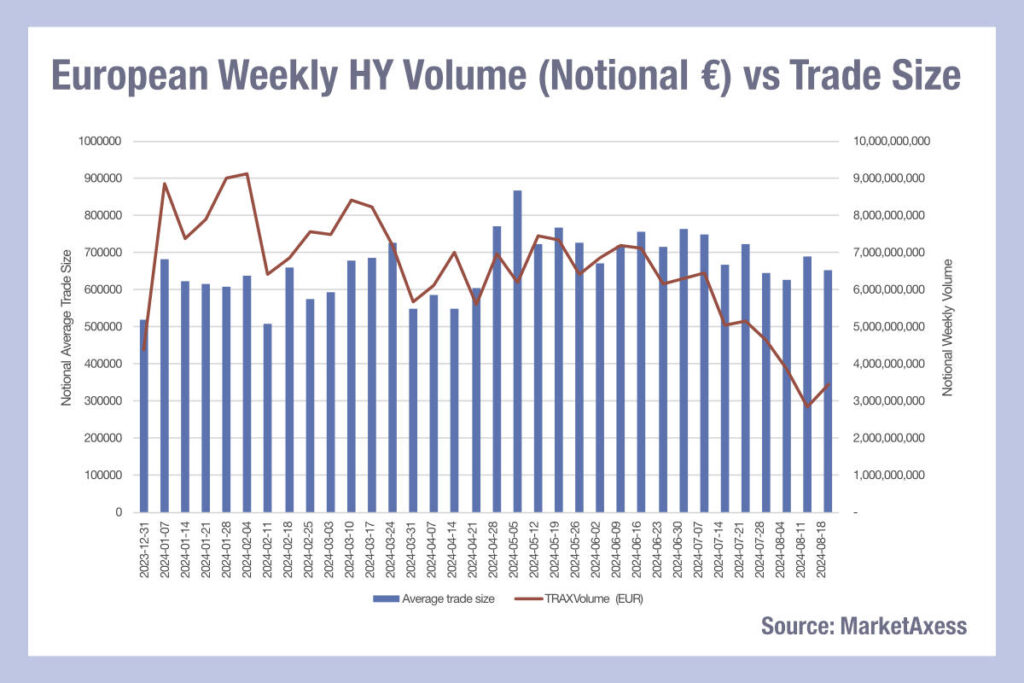

Here the correlation between the cost of liquidity and order sizes again appears to reflect rewarding of larger risk positions with tighter bid-ask spreads. However, where the pattern changes significantly is that volumes do not correlate with trade sizes, and therefore the severe decline in volume in midsummer does not impact liquidity costs to the same extent as it might in the US, potentially as a result of the lower transparency in the European market. That not only makes it harder to trade on an approximation of volume-weighted order sizes, but as sizes for trades are maintained despite falling volumes, dealers are able to support pricing.

©Markets Media Europe 2024

©Markets Media Europe 2025