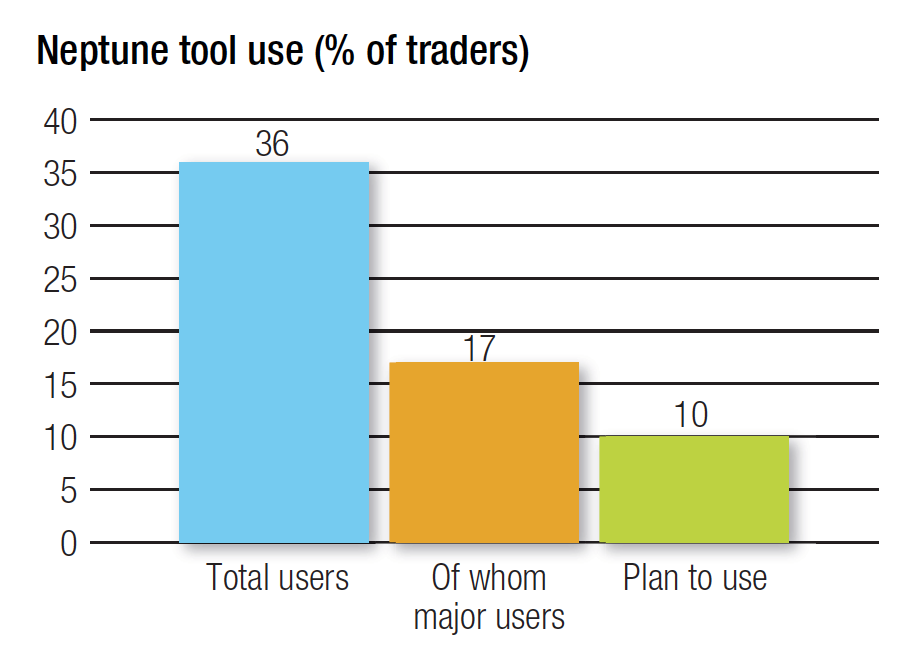

Neptune has expanded its user base to 36% of buy-side traders in 2021 up from 29% in 2020, a considerable increase and one that reflects its steady strategy.

Neptune has expanded its user base to 36% of buy-side traders in 2021 up from 29% in 2020, a considerable increase and one that reflects its steady strategy.

Over the last two and a half years the growth rate of clients coming from the US has been greater than in Europe, which is where the firm’s focus had initially been. Nevertheless, UK and continental Europe is still expanding says Byron Cooper-Fogarty, interim CEO at the firm.

“With John Robinson and Bob Burns joining in November 2020, both with excellent buy-side networks, and Ashley Armanno joining to expand our sell-side business we have good prospects for growth looking ahead notably in the US, with regional broker-dealers who are a target,” he explains. “Having boots on the ground to cement those relationships will give us a sure footing for continued growth. Neptune have also added staff in London, including Neelam Parikh, formerly at JP Morgan.”

As a delivery mechanism for axes and pricing, Neptune stands out as a data utility in the marketplace, one of the only success stories not tied to a trading venue. With dealers trying to deliver direct trading capabilities where possible, Neptune’s standardised data delivery model lets them engage with buy-side trading desks without the intermediation of a trading platform.

However, that has meant that Neptune has had to ensure its feed can be consumed by investment firms as easily as possible.

“Connectivity with order management system (OMS) and execution management system (EMS) vendors over the past 18-24 months has continued,” says Cooper-Fogarty. “Charles River was a major announcement for us last year and connectivity with buy-side investment tools remains a major priority.”

By concentrating on its core products and a strong delivery model, Neptune has seen a widening set of consumers realise the value of the information it offers, within existing clients as well as with the growing group of firms which are utilising it.

“People taking data through a direct application programming interface (API) now makes up a third of our clients and the trading teams getting the most out of our data are taking it in through multiple channels, including Charles River on the OMS side, and in the EMS space via Flextrade or TradingScreen,” he says.

Having made solid inroads on both sides of the Atlantic, the business is also looking at the best ways to reach the Asia Pacific region.

“We are keen to do more in Asia across both sides of the street; emerging markets as a product set is a big focus for us,” says Cooper-Fogarty. “We’re carrying significant amounts of liquidity but there are still gaps which remain and we’ve got a working group of buy-side firms identifying where those gaps are and how they can be addressed. That will help us to onboard the Asian subsidiaries of firms that are part of the network elsewhere.”

The importance of liquidity in investment decision-making in the fixed income markets is also leading to the widening interest in Neptune’s value across business lines.

“Portfolio managers are getting far more access to the data, and that allows them to make more intelligent decisions about which bonds to buy and sell,” he says. “We will continue to provide a link between axes and execution in a low cost environment that benefits buy- and sell-side clients.”

©Markets Media Europe 2021

TOP OF PAGE