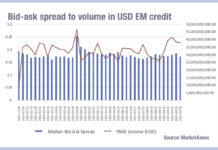

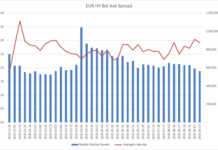

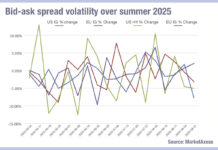

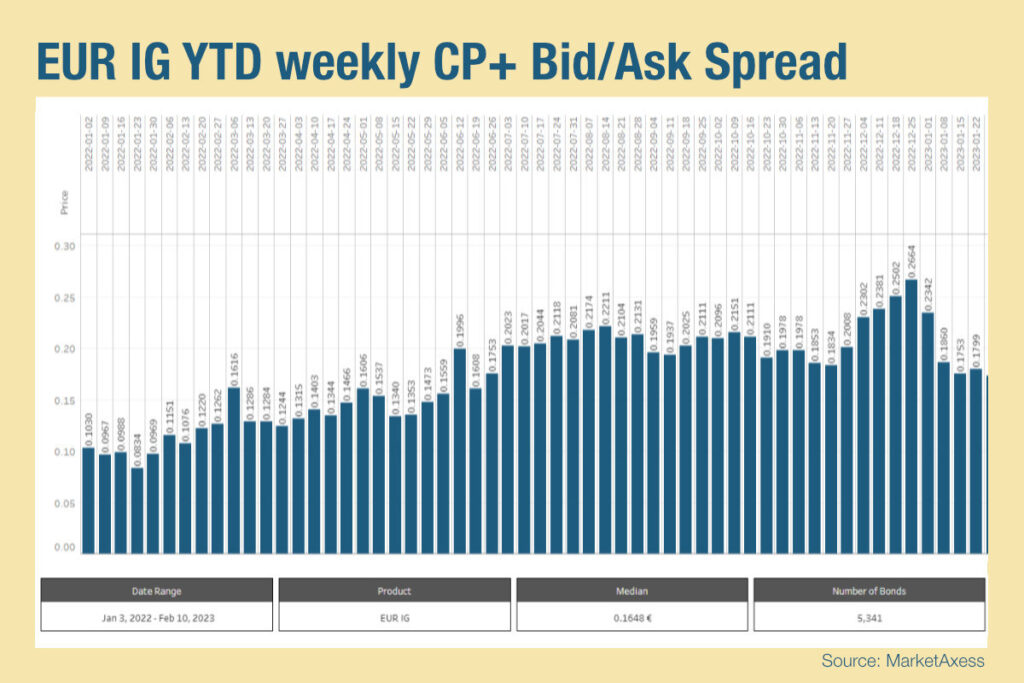

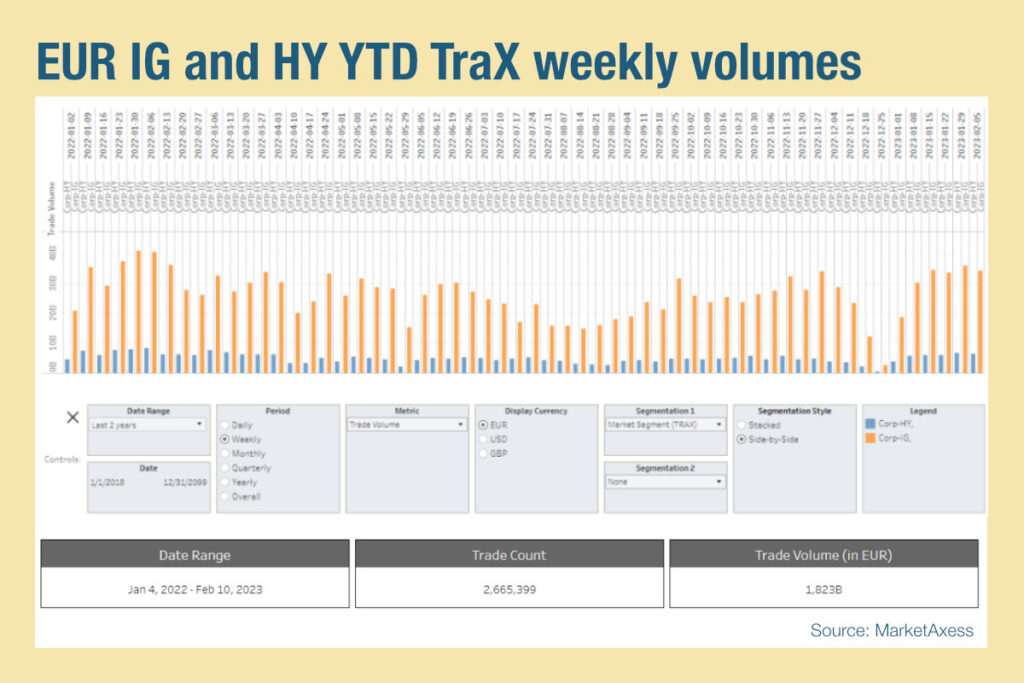

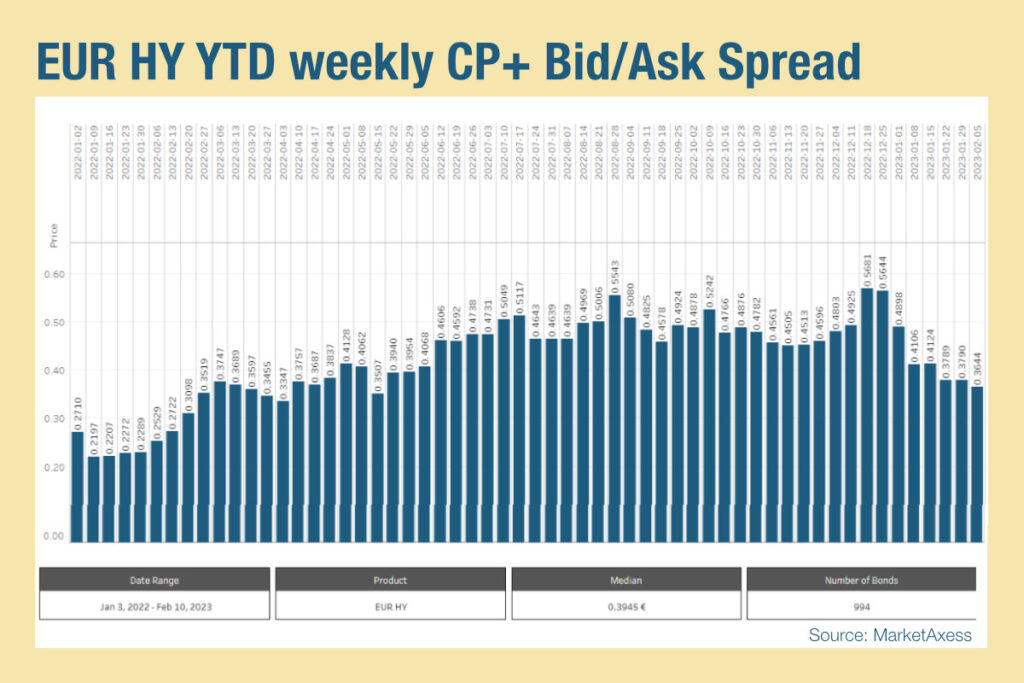

Good news for buy-side traders in European credit markets. Looking at MarketAxess Trax, which tracks trading across multiple markets and counterparties, bid-ask spreads are falling in both investment grade (IG) and high yield (HY) bonds, and volumes are staying steady after the drop off around year end.

At the start of 2022, trade count and trade volume had begun to diverge, meaning higher volumes were taking place but without a linear increase in the number of trades. That suggested these trades were taking place in larger blocks. While electronic block trading is greatly desired – and increasingly possible – block trading is still more commonplace via voice.

As we see volumes and trade count grow in tandem, there is a greater potential for electronic trading to be supported as medium and smaller-sized trades are more commonplace in electronic channels. The tightening of bid-ask spreads is also helpful as that suggests a greater capacity to offload risk by dealers. The pattern is similar in IG and HY markets and the consistency indicates greater sell-side support for client trading.

The knock on effect for electronic trading is positive. As volumes of trading increase, pricing information becomes available more readily and that supports pre-trade analysis. Consequently, lower touch trades can be executed more frequently via electronic channels and if that frees up time for higher touch trades these can be worked to greater effect. That can also lead to higher touch electronic execution – such as portfolio trading – which requires both buy- and sell-side desks to negotiate on the contents of the deal but typically enables a more efficient transfer of positions.

©Markets Media Europe 2023

©Markets Media Europe 2025