When a company has its credit rating adjusted, the impact on bond liquidity is not entirely predictable. In a changeable rate environment as seen in the current market, the chance of a re-rating increases, and awareness of the impact on pricing and liquidity is relatively more important.

We spoke with buy-side traders about the factors and practices that they need to be cognisant of to handle their own buying/selling activity most effectively.

“From a pure liquidity standpoint all else being equal, ratings downgrades, especially going from investment grade (IG) to high yield (HY), you would expect credit spreads to widen significantly putting downward pressure on bond pricing,” noted one trader.

The first point to note is that credit ratings are not black-and-white pictures of credit worthiness. There are ranges set by credit rating agencies (CRAs) within a specific level of investibility. The threshold at which investment grade debt investments falls to high yield, which is seen as a more speculative investment, corresponding with the Baa3 rating by agency Moody’s and BBB– ratings from its rival agencies S&P Global and Fitch. Funds themselves may also have measures. As a result, rating is not uniform.

There can be a wide variation in the credit spread of bonds which share a single credit rating, based upon different factors. These can be helpful indicators of the risk of a rerating. In their paper ‘Credit Spreads, Rating Downgrades, and Downside Performance: A Market-Informed Approach to Monitoring Credit Risk’, Wei Dai, Alan Hutchison, and Samuel Wang of Dimensional Fund Advisors, observed that firms with a wider spread were on average more likely to be subject to a downwards rerating.

“Compared to bond defaults, rating changes happen much more frequently and can vary in magnitude, ranging from one notch to multiple notches,” they wrote. “If we classify bonds based on whether their credit spreads are above or below the midpoint between the spread curve for their stated credit rating and the spread curve for the next-lower credit rating, the subsequent downgrade frequency is on average three to four times higher for bonds above the midpoint compared to those below.”

The liquidity that exists around a given bond – or set of bonds from a single issuer – reflects many factors including their credit rating. Broadly speaking, investment grade credit trades at higher volumes and with tighter bid-ask spreads than high yield credit, but like all fixed income activity it is episodic in nature. The tenor of bonds – shorter dated tend to trade at higher volumes – and their inclusion within an index have an effect.

Pricing and liquidity is also based upon both fundamental factors – such as the bond’s attractiveness based on prevailing interest rates – and market sentiment such as bull/bear market conditions, as well as credit quality and events.

When assessing how liquidity might be affected by a rerating, assuming all other things are equal/stable, two dynamics are key; the level and speed of information disclosure, and size of the change.

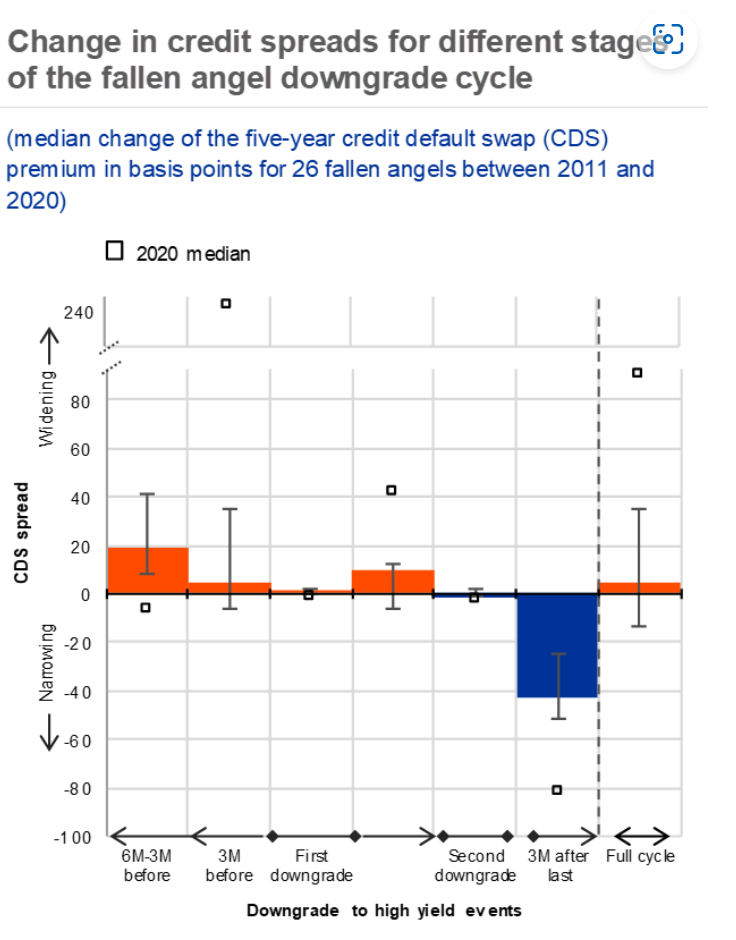

“Changes in credit risk perceptions typically precede an issuer’s downgrade, including when CRAs do not place an issuer on a negative outlook or watch list. CDS premia generally widen before a company is first downgraded to below investment grade by one of the CRAs, followed by only a small market reaction immediately afterwards,” wrote Marco Belloni, Tobias Helmersson, Mariusz Jarmuzek, Benjamin Mosk and Filip Nikolic of the European Central Bank in its 2020 Financial Stability Review.

One trader said, “It would all depend on how the market digests the downgrade and how severe the downgrade is from a notching perspective. If upgraded, you would see the credit spreads tightening, prices higher leading to a higher likelihood of calls, if callable, and reissuing with lower coupons thus saving on interest expenses.”

A good credit analyst should foresee any rating activity, while dealer pricing changes may well alert buy-side traders, so there should be no surprises barring unforeseeable events, for example sudden management changes. In many cases ratings change reflecting market sentiment but they are also put on review ahead of a change. As a result of this, the point at which changes to credit ratings get priced in by the market can be both gradual and well telegraphed. In this event, trading volume could change ahead of a rerating, dependent upon the level of certainty.

“I would say if you’re looking for signals, you’d be better off tracking credit spreads vs liquidity – amount outstanding – due to the street pricing in additional risk,” notes the trader.

A major change to liquidity will be felt if a corporate bond goes from investment grade to high yield or vice versa – the fallen angel or rising star – and as a result either leaves or joins an index. Many funds are benchmarked to or track indices, making them forced buyers or sellers based upon inclusion/exclusion. However, that also depends on the firm’s guidelines for investment.

A fund can use buffer rules – for example allowing the holding of 5% above or below the rating of the fund’s mandate – precisely in order to avoid forced trading action at a point when pricing would work against its investment goals. This is as true of some passive funds as it is for active managers; on page 32 of the iShares prospectus handbook it notes that while holdings should “comply with the credit rating requirements of the Fund’s Benchmark Index, which is investment grade” in the event of a downgrade it suggests selling, “When … it is possible and practicable in the Investment Manager’s view to liquidate the position.”

When dislocations occur, if there is any lack of transparency or surprising activity levels, both investors and market makers can panic, making liquidity conditions very challenging and/or directional. At that point trading can become very technical.

Often a ‘v’ or ‘ᴧ’ pattern of spread performance can occur with the apex at or around the actual rerating, which one trader noted is “a classic buy/sell on the rumour, reverse on the fact”.

The ECB also observed, “A partial recovery is seen after an issuer loses its last investment-grade rating, suggesting that a fallen angel’s securities are undervalued at this point. Fallen angels since February 2020 follow this pattern, but with a swifter and stronger increase in the credit premium before the first downgrade, as seen most notably in the severely affected airline industry. This analysis is, however, based on historical data, and may not be representative of extreme systemic scenarios with many concurrent downgrades.”

Both portfolio managers and traders need to take a sensible approach to the positions they hold, in order to get the best outcome for the end investor.

“If it’s a position that’s going to mature in a year, why be a forced seller?” asks one trader. “Just hold it until it matures. Sometimes things get overdone and then they come back so why panic sell? It can be better to see how the story develops because it’s not just about the rating, sometimes it’s about the price.”

©Markets Media Europe 2023

©Markets Media Europe 2025