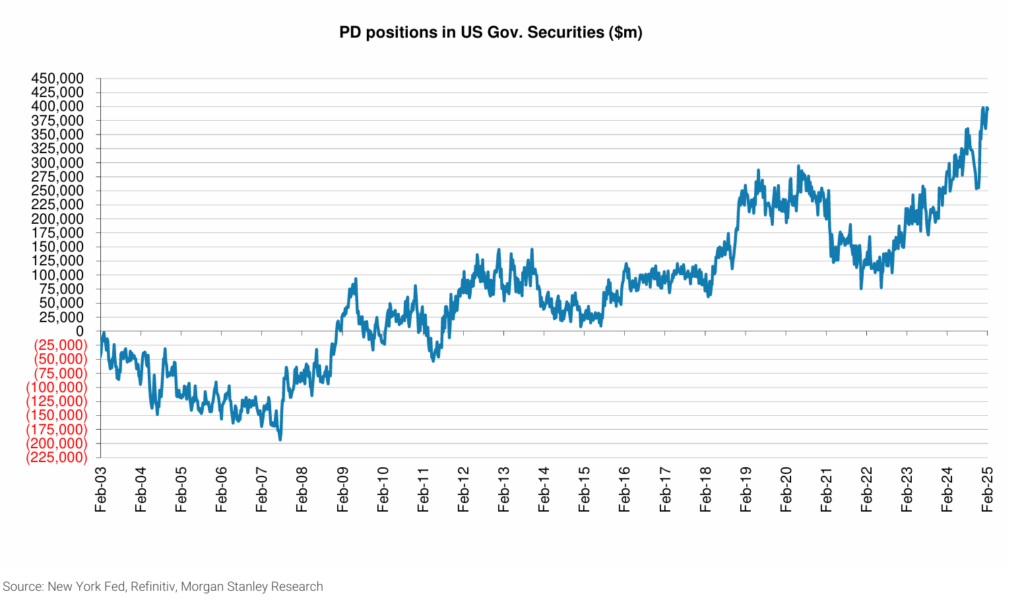

Primary dealer positions of US Treasury holdings are expanding rapidly, but concern around restrictions on capacity are misplaced according to analysis.

A new paper by Morgan Stanley analysts has outlined that primary dealers in the US, who are responsible for distributing US treasuries into the market, face a number of barriers to increasing the number of asset they hold for trading purposes, after authorities recently stepped in to try and increase market liquidity.

“In separate congressional testimony and a speech, Fed Chairman Powell and Governor Bowman recently expressed support for modifying the supplementary leverage ratio (SLR), with the goal of improving liquidity in the Treasury markets,” noted the report authors, including equity analyst, Betsy Graseck. “We interpret this as excluding Treasuries from the SLR denominator, with SLR currently calculated as Tier 1 Capital divided by total leverage exposure, or total on-balance-sheet assets plus certain off-balance-sheet exposures.”

However, the effect of this was expected to be muted, the team observed, as the big call to invest more in a bank’s US Treasury trading would be balanced against other areas, and the costs of capital would still be weighed against including the surcharge for global systemically important banks (GSIB), Tier 1 Leverage and unrealised losses or profits from accumulated other comprehensive income (AOCI).

“Banks must balance incremental assets with implications to their GSIB surcharge, which increases as banks grow assets, and Tier 1 Leverage, which is calculated using GAAP assets. US Treasuries, when purchased outright, also come with duration risk to AOCI, which flows through regulatory capital at GSIBs. In addition, haircuts applied to Treasuries through prime brokers impact risk weighted assets (RWAs). In other words, for every dollar of asset added, banks must still factor the total and relative profitability of the trade inclusive of follow on ramifications of incremental capital required.”

This echoes analysis by the Federal Reserve in Q4 2024 which found that as of June 2024 the six largest primary dealers had considerable headroom in their market activities at existing capital levels.

“Hypothetically, if those dealers were to use the entire headroom to expand their Treasury intermediation – including long positions and financing – they would be able to expand those activities by 316 percent from recent levels. Among all primary dealers, the total capacity to expand Treasury intermediation is likely even greater since several smaller dealers are not subject to the SLR.”

©Markets Media Europe 2025