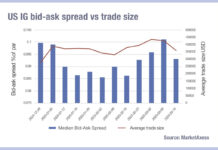

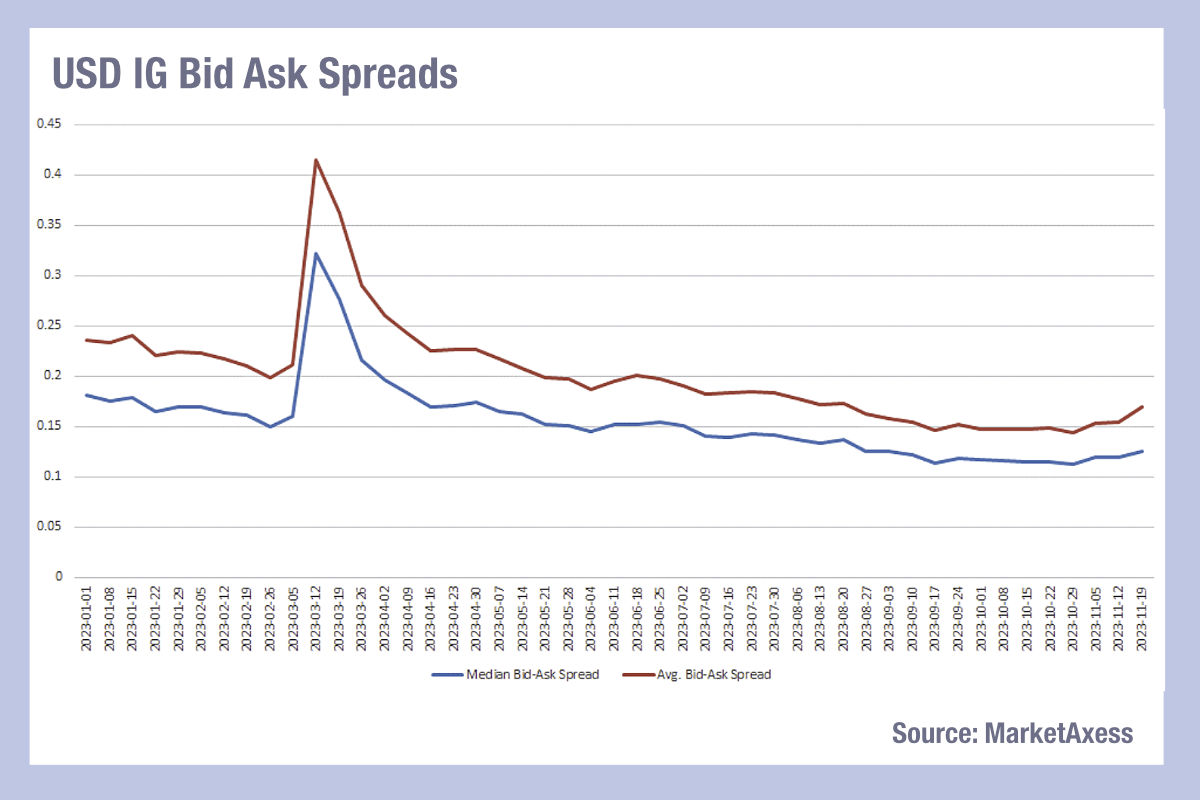

Bid ask spreads are widening in US investment grade credit, according to MarketAxess’s CP+ data, which may signal the traditional end-of-year withdrawal of dealer liquidity.

The drop off is triggered by banks attempting to adjust their risk capital weighting in order to get better results at the year end, when their vulnerability to shocks are tested. Buy-side traders are understandably pained by this pattern, which can also be reflected at quarter end when banks similarly seek to reduce their risk exposure.

A new paper by Coalition Greenwich assesses the extent to which this liquidity gap is exacerbated by the way that globally systemically important banks (GSIB) capital requirements are calculated, and the efforts made by the banks themselves to try and reduce that burden.

“The tactics banks use to reduce their capital needs have contributed to some unusual market disruptions in repo financing and other activities in recent years, especially in the fourth quarter,” writes Minal Chotai, co-head of Financial Resources, at Coalition Greenwich and the report author. “Proposed changes to the GSIB rules could have a lasting effect on how sell-side firms provide intermediation and financing services, which until now have mostly been affected by year-end pressures.” This can include engaging in les trading activity, or widening the bid-ask spread as we are beginning to see in the MarketAxess data.

In the existing regulatory framework, Chotai notes that US GSIBs are required to hold an added layer of capital because they are seen as ‘too big to fail’ and the “striking decline in the fourth quarter of each year (except 2020) is a direct result of this methodology, with regulators assessing the systemic importance of financial institutions based on year-end data.” By making their balance sheets look better temporarily at the end of the year – a practice known as window dressing – they attempt to lower their GSIB scores and reduce any capital costs.

A proposed change would see the measure take place across the year. However, Chotai argues that the new methodology in place, “banks that were benefiting from artificially low GSIB scores at year-end would likely incur higher capital surcharges. Those higher costs would then prompt banks to more closely manage their balance sheets, likely causing them to decrease their market activity and/or pass along the increases to clients.”

For traders seeking to remedy this activity, solution can be found through the solid application of data. Buy-side firms with granular broker review processes, based on benchmarking trading performance have made the case to their sell-side counterparts that the drop off in performance makes the case for using alternative brokers. Without a quantitative analysis of dealer performance this is hard to argue.

If the new proposal does take effect, the impact on liquidity provision could be more diffuse and harder to spot. Consequently, these rules could increase the need for traders to build a picture of each dealer activity to an even greater extent.

©Markets Media Europe 2023

©Markets Media Europe 2025