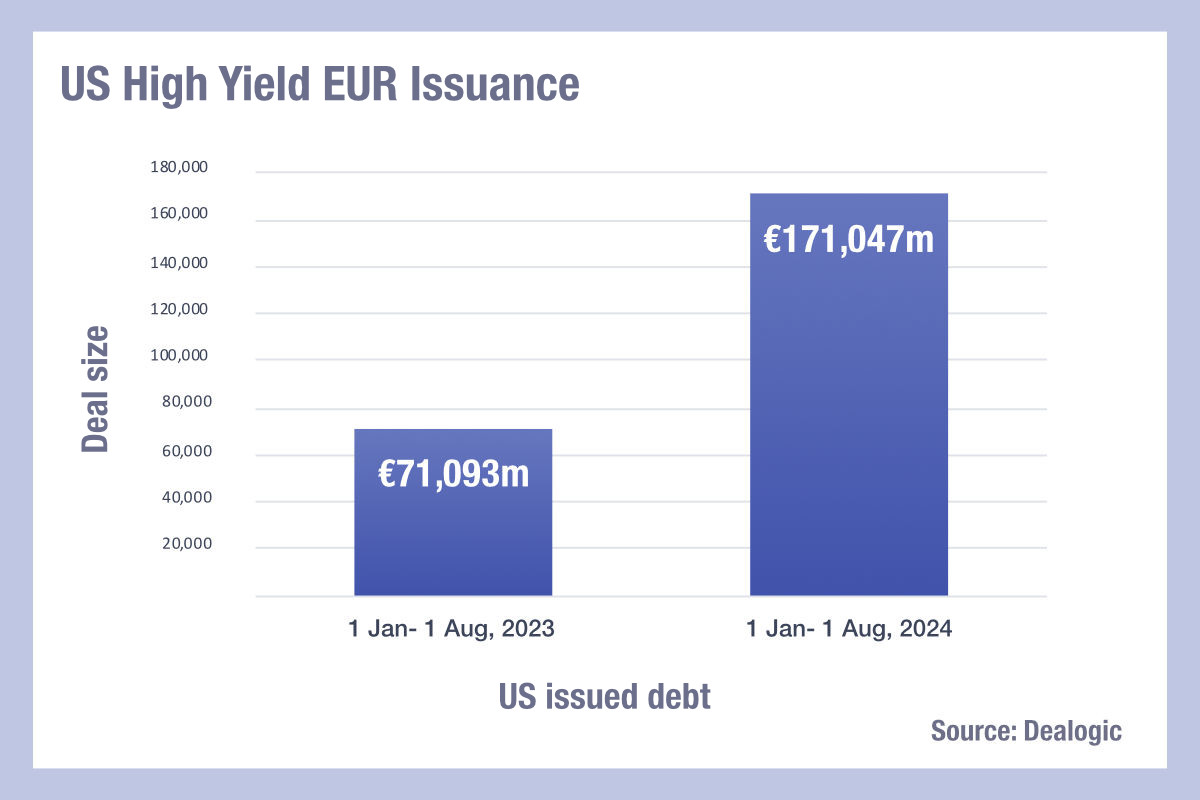

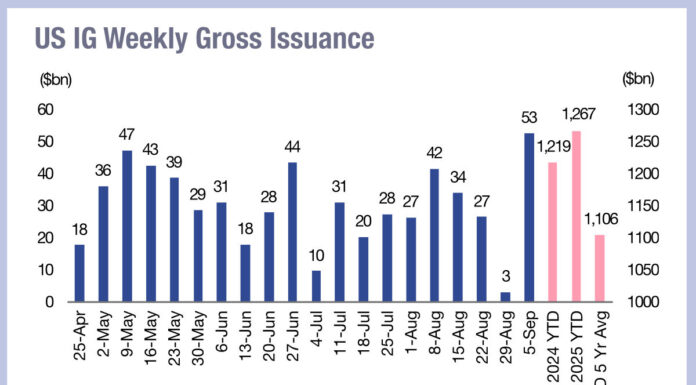

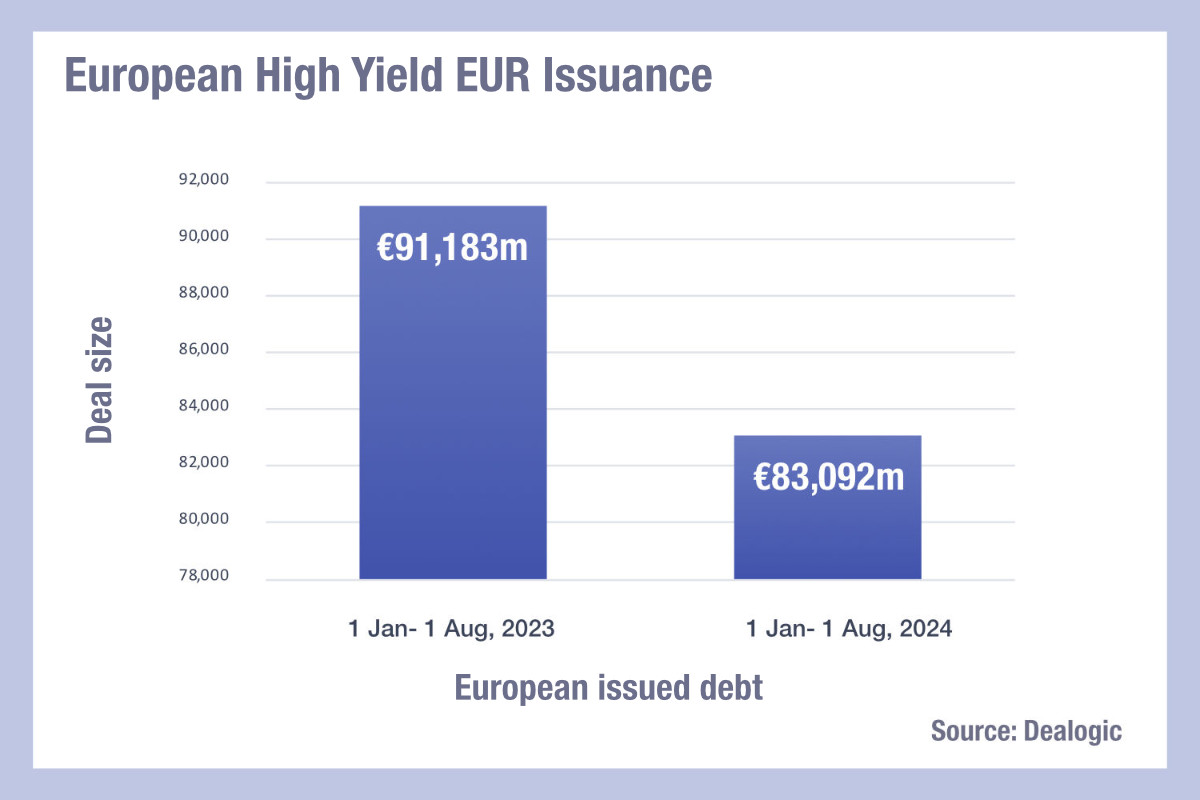

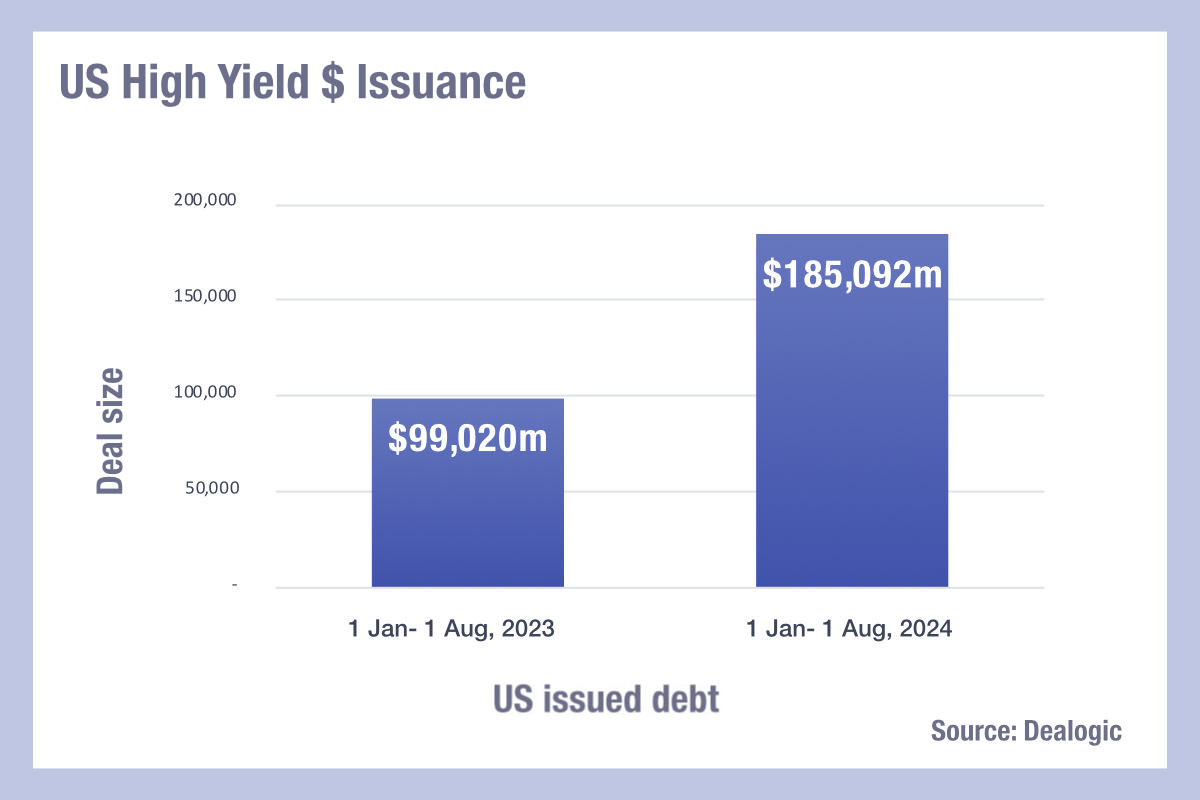

Issuance of USD versus Euro high yield debt shows a significant split, based on Dealogic data, with US markets in 2024 issuing more than double the volume of USD and Euro-denominated debt seen in 2023 in the first half of 2024, and European markets issuing less Euro-denominated debt in 2024 than in 2023, but with a marked USD-denominated issuance.

Recent analysis by Morgan Stanley’s fixed income team shows Europe’s rating adjusted yield for HY (50% Bs, 50% BBs) has fallen below that of the US, but a comparison of the asset swap spreads between US and European HY shows very little difference. The 1 year spread on US HY is 314 bps against 364 bps for European HY.

It is clear that the notional outstanding for European HY has declined since 2022, while the notional outstanding for European investment grade has continued upwards.

An obvious aspect of this is the success of using debt capital markets in the US to support smaller businesses, with lower reliance on bank loans. Not only are bonds less used in Europe but the expansion of private credit in the US is now allowing direct lending between borrowers and investor creditors.

As European markets see a decline in debt outstanding for businesses with lower credit ratings, it may be that overall corporate debt is being reduced as interest rates have risen, to manage credit risk.

By contrast the overall direct lending market is estimated to be around US$1.7 trillion globally – larger than the US HY market – and growing. Within the US, the number of private credit funds has been visibly growing based upon company announcements.

Europe lacks the business development company (BDC) model that is used to raise private credit for investment firms in the US, but has already managed considerable levels of private credit as M&G Investments noted last year.

“The European leveraged loan market alone is a $450 billion market, and is often omitted from estimates of the wider private credit market size,” it wrote. “Therefore in our view, the depth of the European private credit market is consistently underestimated, and we believe the true scope could be over US$800 billion.”

Whether Europe is seeing a net decline in lower rated credit exposure, or a migration out of lower-rated bonds into other debt structures, it is likely that liquidity in HY bond markets which clusters around new issues will be declining, and net inventory as well.

©Markets Media Europe 2024

©Markets Media Europe 2025