There can be valuable benefits to using derivatives as part of a portfolio.

There can be valuable benefits to using derivatives as part of a portfolio.

Bringing derivatives into a fund’s mandate requires client appetite, portfolio management and trading capabilities, and the external relationships to access, price, trade and process them.

“The first considerations are around the types of derivatives I wish to trade and who I wish to trade them for,” notes Ricky Maloney, head of buy-side relationships at Eurex. “The portfolio manager (PM) needs to know which of his or her client mandates have expressed permissions to use derivatives in their Investment Management Agreements (IMAs).”

With client interest increasing, it is becoming more incumbent upon fund managers to have access to the infrastructure and relationships necessary to trade them effectively.

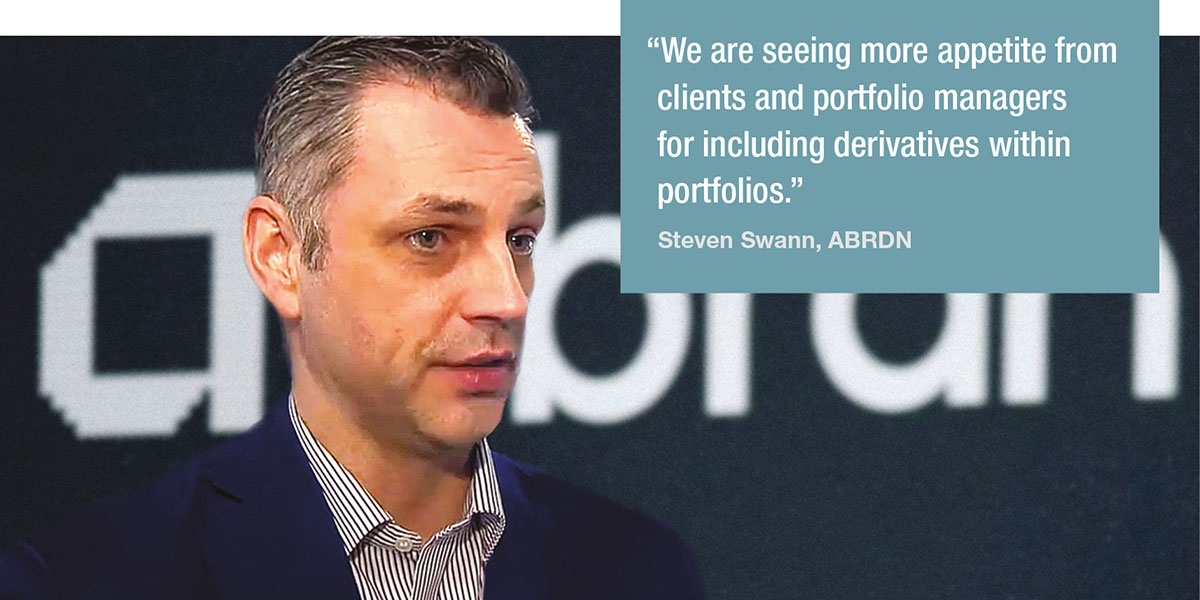

“We are seeing more appetite from clients and portfolio managers for including derivatives within portfolios; that can be for managing duration, liquidity and they are useful in particular instances for example, where a fund has very limited cash and can use derivatives to take positions in the market,” says Steven Swann, head of derivatives and investment solutions dealing at ABRDN.

“We are seeing more appetite from clients and portfolio managers for including derivatives within portfolios; that can be for managing duration, liquidity and they are useful in particular instances for example, where a fund has very limited cash and can use derivatives to take positions in the market,” says Steven Swann, head of derivatives and investment solutions dealing at ABRDN.

In addition to providing access to returns that are not accessible from cash bonds, having expertise in the use of derivatives trading adds a tactical element to the management of a portfolio in fixed income markets. Consequently, market makers are upping their involvement in the listed derivatives and exchange-traded fund space,

By creating optionality in how to access liquidity and manage aspects such as duration, a derivatives-enabled trader can provide a portfolio with more flexibility in managing cost and opportunity.

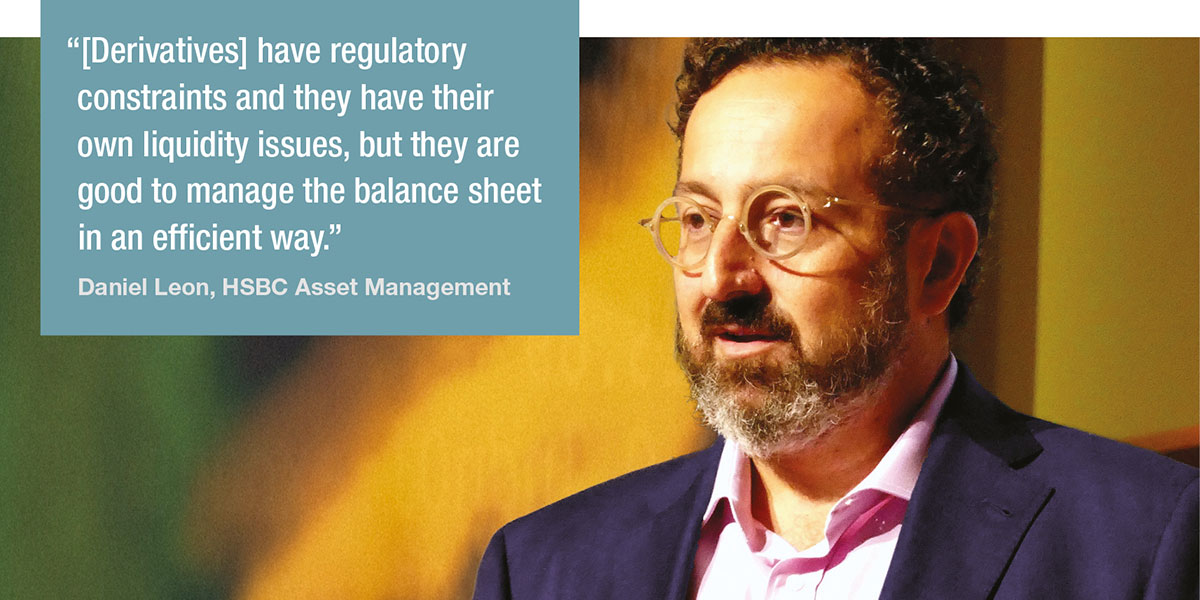

“[Derivatives] have regulatory constraints and they have their own liquidity issues, but they are good to manage the balance sheet in an efficient way,” says Daniel Leon, HSBC Asset Management. “If you want to take a duration bet in large size you can trade even US$1 or US$2 million of Tier 1 debt, in a very efficient way. That being said, again they will have their own pot of liquidity, so you need to avoid simplicity and if you are going to do some very technical forward swaps, or even some customised derivatives they need to be managed well to take that liquidity into account. But definitely they are a great tool.”

“[Derivatives] have regulatory constraints and they have their own liquidity issues, but they are good to manage the balance sheet in an efficient way,” says Daniel Leon, HSBC Asset Management. “If you want to take a duration bet in large size you can trade even US$1 or US$2 million of Tier 1 debt, in a very efficient way. That being said, again they will have their own pot of liquidity, so you need to avoid simplicity and if you are going to do some very technical forward swaps, or even some customised derivatives they need to be managed well to take that liquidity into account. But definitely they are a great tool.”

The appropriate instrument

The first consideration for including derivatives within investment portfolios is the value they can provide to the investor, based on the appropriate risk profile.

“Multi-asset portfolios tend to be the largest users of derivatives,” says Swann. “In fixed income, rates mandates may use derivative instruments to exploit dislocation in curves, but also manage duration and cash levels in funds. Typically credit mandates have more limited exposure, whilst equity only mandates focus predominately on cash instruments.”

The way in which they might be used is also crucial to deciding which would be most appropriate to select i.e. whether the derivative is being used for hedging purposes or for alpha generation through leverage.

Maloney says, “If they are used for hedging, which risks is the PM looking to address, inflation, interest rate? If alpha generation through leverage they need to accurately track any leverage allowances in the mandate or fund might have.”

Maloney says, “If they are used for hedging, which risks is the PM looking to address, inflation, interest rate? If alpha generation through leverage they need to accurately track any leverage allowances in the mandate or fund might have.”

Approval via the investment committee and then the product committee is likely to be needed, he observes, but it is also necessary to have the right infrastructure and systems to record and price the products appropriately.

Hardwiring and connecting

The technology necessary to trade derivatives encompasses risk and trading tools. Yet as buy-side trading desks have been cautious to engage with investment in trading tools for cash bonds, making an additional investment for derivatives trading is potentially a heavy lift. Despite this apparent barrier, system providers observe that the appetite of investors for derivatives trading is being expressed via investment managers.

Andy Mahoney, managing director at execution management system (EMS) provider, FlexTrade, says, “We see a massively increased demand for derivatives capabilities. Many clients are routing orders down a pipe to a broker and the broker is either performing a manual action to execute on a venue or placing it straight through if there are sufficient agreements in place.”

Andy Mahoney, managing director at execution management system (EMS) provider, FlexTrade, says, “We see a massively increased demand for derivatives capabilities. Many clients are routing orders down a pipe to a broker and the broker is either performing a manual action to execute on a venue or placing it straight through if there are sufficient agreements in place.”

Some of the limits on the technology side are via deficiencies in FIX connectivity which would allow those workflows to be incorporated, but on the buy-side desk these include order routing, algorithmic frameworks and automation capabilities.

“We can combine outright products, for use with our spread trader algo for calendar rolls or more complex packages, like crack spreads,” says Mahoney. “We have click to trade execution with the ability to layer the book, and request for quote (RFQ) capabilities for complex products.”

One of the intrinsic challenges the need for counterparty support for the trading of specific instruments. While buy-side firms can build these with sell-side firms on a bilateral basis, access to listed instruments creates complexities as they control access to exchanges. Providing information on liquidity which would support best execution requires a clear value to the sell-side.

“The sell-side has to see the commercial value in flowing that data through to the client,” Mahoney says.

Maloney says there are key questions for the investment manager to consider, in order to assess the potential of using it within the investment process.

“Has the product or contract been embedded into the system and tested end to end from execution to settlement / clearing. Does the firm use an outsourced middle / back office service provider? If so, can they support the product or is it a new instrument for them too. Same considerations for custodians, net asset value (NAV) calculators.”

Barriers to doing business

Even where an asset manager has the right mandate, with the willingness amongst counterparties to trade derivatives, and the right trading tools, there are market structural issues to bring into consideration.

“If a manager is not yet using derivatives there are a lot of considerations to be made before they are included,” says Swann. “The post-crisis regulatory changes, such as mandated clearing rules, took a long time to come into effect and those still need to be assessed, including the UMR rules; all of these considerations and costs have to be weighed up”.

Despite the 2009 G20 agreements on electronification and clearing, more recently, clear differences have developed between jurisdictions, including complexities added by Brexit.

“The absence of equivalence between UK and EU authorities has resulted in increased fragmentation of venues and liquidity, as market participants seek to meet their overlapping derivative trading obligations (DTO) by routing orders to a venue recognised by their relevant national competent authority (NCA),” says Swann.

This has an impact on the market into which buy-side firms can trade, he also notes.

“A secondary consequence of this situation is that firms have been faced with a reduced panel of counterparties, since for example, EU domiciled banks are unable to trade with UK domiciled firms under certain circumstances. The big winners in all of this have been the US Swap Execution Facilities (SEFs), which have seen sharp increases in market share due to those venues being recognised as mutually equivalent by both UK and EU jurisdictions.”

Maloney says that such restrictions will need to be built into any trading expectations, with the size of the panel of counterparties being a key point.

“In order to trade a firm will need a panel of counterparties, if trading bilaterally then agreements will need to be put into place,” he says. “The panel needs to be large enough to ensure the firm has sufficient balance sheet access. In the event the company wishes to trade on swap execution facility (SEF) or multilateral trading facility (MTF) etcetera, then execution agreements are required, counterparty mapping will need to be performed on those platforms.”

©Markets Media Europe 2021

©Markets Media Europe 2025