Tag: Trumid

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Surge of activity on fixed income trading platforms

MarketAxess has regained the lead in US credit fully electronic trading amid a surge of activity in March with Trace printing a record US$61.2...

Trumid upgrades US corporate bond predictive pricing tool

Trumid launches its enhanced Fair Value Model Price (FVMP) tool, which aims to deliver predictive pricing for around 22,000 US corporate bonds every 30...

Tradeweb takes electronic credit trading lead, for second time

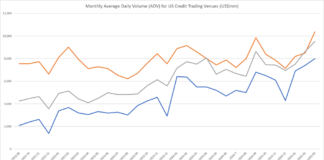

Multi-asset market operator, Tradeweb, has recorded average daily volume (ADV) of US$8.6 billion in US credit during February, surpassing rivals MarketAxess (US$8.5 billion) and...

MarketAxess trading volumes dip in static corporates market

US corporate bond markets have had an unexciting start to the year, remaining flat at US$50 billion in average daily notional volumes (ADNV).

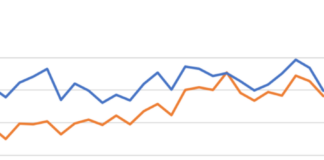

Market share...

Strong start of the year in electronic credit trading

Electronic credit markets started 2025 on a strong note, with January's total credit average daily volume (ADV) showing robust growth across platforms. Trumid reported...

Trumid zeroes in on data automation, appoints Ryan Gwin

Trumid has expanded its data and intelligence and automation divisions, appointing Ryan Gwin as head of data solutions. The divisions were established four years...

Tradeweb, Trumid close in on MarketAxess’ lunch

Electronic credit closed 2024 on a strong showing with December monthly volume growing 14.7% to US$18.3 billion year–on–year (YoY) while full-year trading volume totalled...

US credit e-trading race tightens, November volumes fall

US credit e-trading volumes dipped for both MarketAxess and Tradeweb in November, the gap between the two platforms narrowing towards the end of the...

Is electronic trading levelling out the year-end liquidity shortfall?

Concern about liquidity shortfalls at year end could be alleviated by electronic market makers say traders, and the data seems to back them up.

A...