Tag: Tradeweb

Tradeweb sees August ADV jump 53.9%, MarketAxess up 39.6%

Trading platforms MarketAxess, Tradeweb and Trumid saw substantial increases in their average daily volumes for August compared to the same period last year. MarketAxess...

Getting the most out of derivatives in credit

Bond investing has become more exciting in the past two years than in the previous ten, with interest rates and central bank activity fire-fighting...

The Fixed Income Leaders Summit: Debating a decade of change

The focused event delivered a communication hub that has supported the buy and sell side as they navigated market transformation.

“In 2014, this event was...

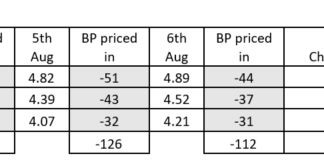

Tradeweb data reveals shock of rate cut expectations on swaps market

Analysis of Tradeweb data has show the level of surprise at potential central bank rate cuts over the past week in the interest rate...

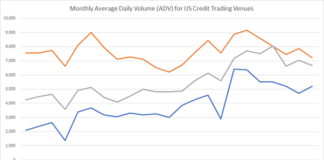

Dogfight in credit e-trading as platforms see double figure growth

Average daily volumes (ADV) for Tradeweb’s cash rates trading were US$455 billion for the month of July, the company reported, with overall government bond...

Tradeweb completes ICD acquisition

Tradeweb has completed its acquisition of investment technology provider Institutional Cash Distributors (ICD) in a US$785 million, all-cash transaction.

The deal was first announced in...

H1 growth at LSEG buoyed by Tradeweb success

LSEG once again led their capital markets results with Tradeweb’s successes in H1 2024. Total revenue of £880 million, up 13.4% year-on-year (YoY), was...

Markets run on mobile as Microsoft viral patch decimates systems

“Nothing’s working,” said one trader. “Everyone’s on their mobile device. Some banks are up, Bloomberg is up, but I can’t trade as I can’t...

IRS electronification: 20 years in the making

With the 20th anniversary of Tradeweb’s interest rate swaps (IRS) marketplace around the corner, the firm’s head of US institutional Rates, Bhas Nalabothula, looks...

Bond platforms see leap in June volumes year-on-year

Trading platforms recorded double digit growth in average daily volumes (ADV) in June 2024. Tradeweb saw its June 2024 fully electronic US credit ADV...