Tag: Tradeweb

Record volumes but room to grow in portfolio trading

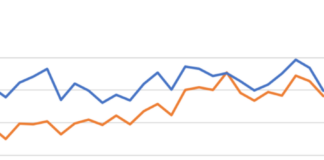

Portfolio trading made up 11.4% of TRACE volume in December, and was up more than two percentage points year-on-year across the market.

The upward trajectory...

Tradeweb accelerates government bond benchmark closing price publication

Tradeweb will now publish FTSE UK Gilt and European Government Bond Benchmark Closing Prices at 4:30 PM.

This change has been made in response to...

The cost of transparency and the value of information

Transparency can smell like information leakage by any other name, to butcher a Shakespeare quotation. Giving up information needs to happen at the latest...

Tradeweb, Trumid close in on MarketAxess’ lunch

Electronic credit closed 2024 on a strong showing with December monthly volume growing 14.7% to US$18.3 billion year–on–year (YoY) while full-year trading volume totalled...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Enrico Bruni and Troy Dixon to lead Tradeweb global markets

Enrico Bruni and Troy Dixon have been named co-heads of global markets at Tradeweb effective January 2025

Troy Dixon joins from Hollis Park Partners, a...

US credit e-trading race tightens, November volumes fall

US credit e-trading volumes dipped for both MarketAxess and Tradeweb in November, the gap between the two platforms narrowing towards the end of the...

Could a secondary market work in private credit?

There is very limited access to secondary trading in private credit. Given the direct exposure to creditors, this might present a liquidity bottleneck for...

Is electronic trading levelling out the year-end liquidity shortfall?

Concern about liquidity shortfalls at year end could be alleviated by electronic market makers say traders, and the data seems to back them up.

A...