Tag: Tradeweb

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Tradeweb launches EGB portfolio trading

Tradeweb has expanded its portfolio trading services to European Government Bonds (EGBs).

Tradeweb has facilitated electronic portfolio trading for corporate bonds since 2019. Responding to...

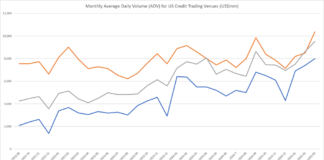

Surge of activity on fixed income trading platforms

MarketAxess has regained the lead in US credit fully electronic trading amid a surge of activity in March with Trace printing a record US$61.2...

MTS launches dealer to client ticket protocol

MTS has introduced a new Dealer-to-Client Ticket (DCT) protocol on its BondVision platform, aiming to streamline trade workflows and reduce operational friction for both...

Trumid upgrades US corporate bond predictive pricing tool

Trumid launches its enhanced Fair Value Model Price (FVMP) tool, which aims to deliver predictive pricing for around 22,000 US corporate bonds every 30...

Direct streaming on credit trading platforms

Sell-side bond trading counterparties price trades according to their clients’ profiles, based on tiering systems. That model directs the pricing of risk according to...

E-trading stumbles in US credit

E-trading in high yield (HY) US credit reduced year-on-year (YoY) in February, despite rising average daily trade sizes.

After taking almost a third of traded...

Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...

Bond CTP race heats up

Etrading Software launches a free-to-use in 2025 Consolidated Tape prototype, intensifying competition among prospective providers.

Etrading Software (ETS), a provider of technology-led trading software solutions...

Tradeweb takes electronic credit trading lead, for second time

Multi-asset market operator, Tradeweb, has recorded average daily volume (ADV) of US$8.6 billion in US credit during February, surpassing rivals MarketAxess (US$8.5 billion) and...