Tag: S&P

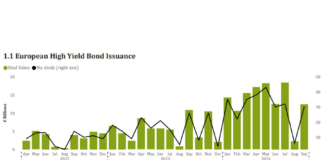

The Book: European HY issuance proceeds spike in Q3

European HY bond issuance year-to-date has generated €121.3 billion in proceeds, the second highest results in AFME’s records. The figure fell just below 2021’s...

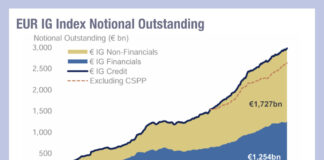

Ongoing effect of CSPP on European credit markets

Europe has seen considerable growth in credit issuance this year relative to 2023, with last week finding a 116% year-on-year increase in non-financial high...

S&P Global completes sale of Fincentric

S&P Global has completed the sale of its Fincentric business to Stellex Capital Management, a global private equity firm. The transaction does not have...

High yield bond issuance relative to liquidity

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

Connecting the primary and secondary credit workflows

With issuance at near record highs in the first week of the year, credit market traders are keen to make more effective use of...

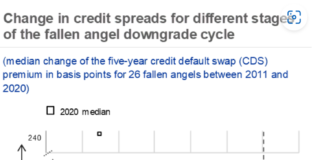

The changing liquidity picture for fallen angels and rising stars

When a company has its credit rating adjusted, the impact on bond liquidity is not entirely predictable. In a changeable rate environment as seen...

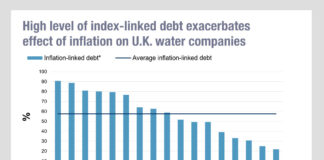

Examining the (Thames) Water fall

In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow...

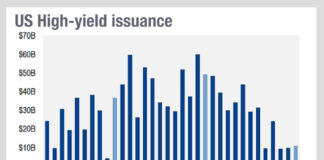

Primary markets: Give me some credit: Outlook for bond issuance in...

New issues provide liquidity and price points for bond traders; we assess the prospects for the year ahead.

As the cost of borrowing continues to...

Schleifer: “Explosive growth” for desktop interoperability as Finsemble goes solo

Cosaic is spinning off its desktop interoperability platform, Finsemble, following the sale of its Chart IQ to S&P Global, as a new company. The...

How does the collapse of refinancing affect bond trading?

It costs more to borrow money in the US right now, than it has for a long time. Even more so for companies in...